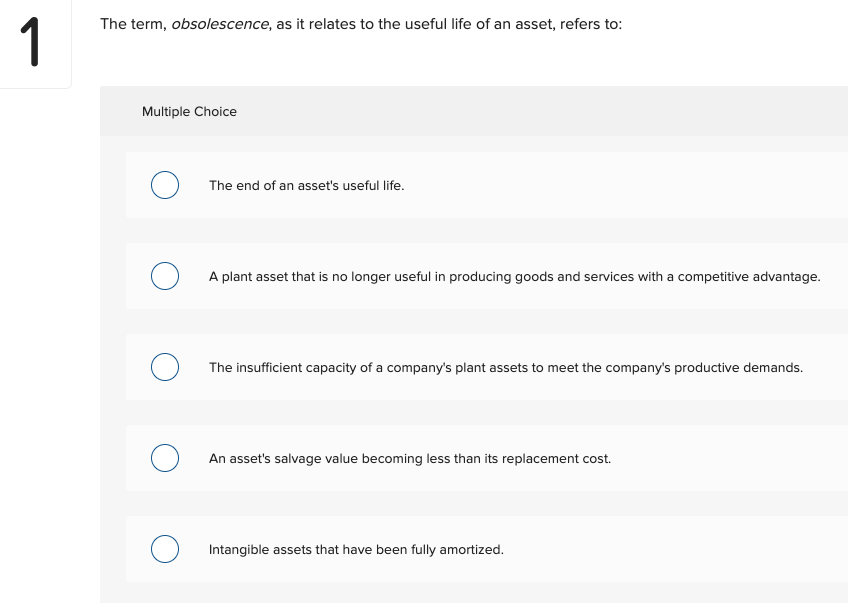

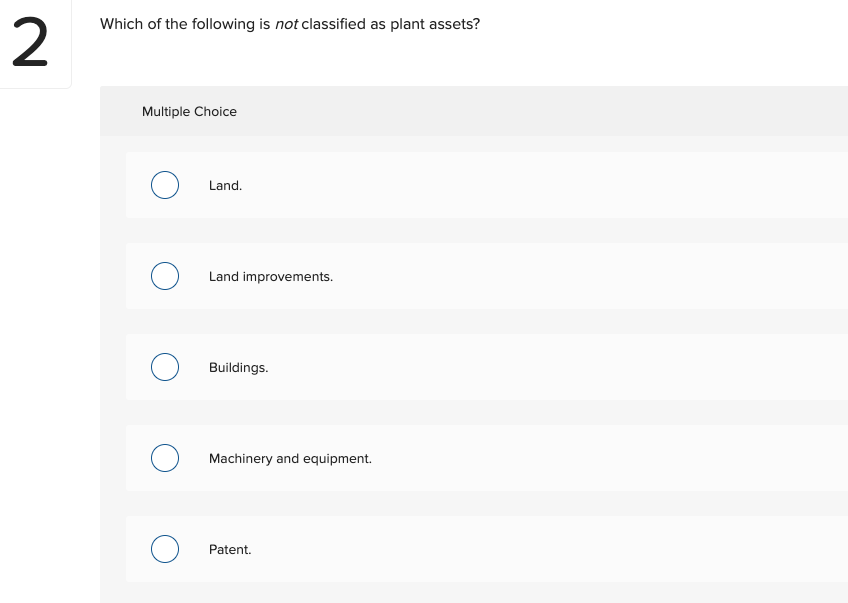

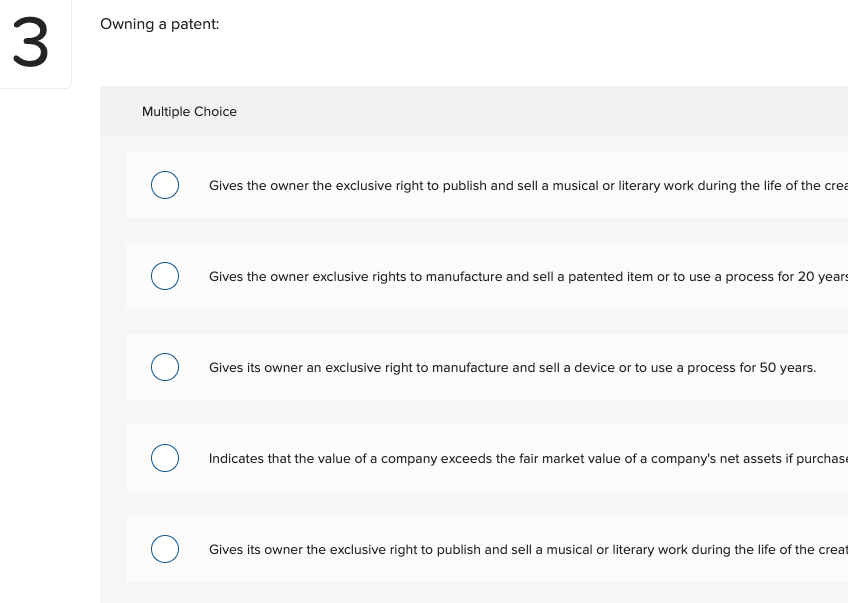

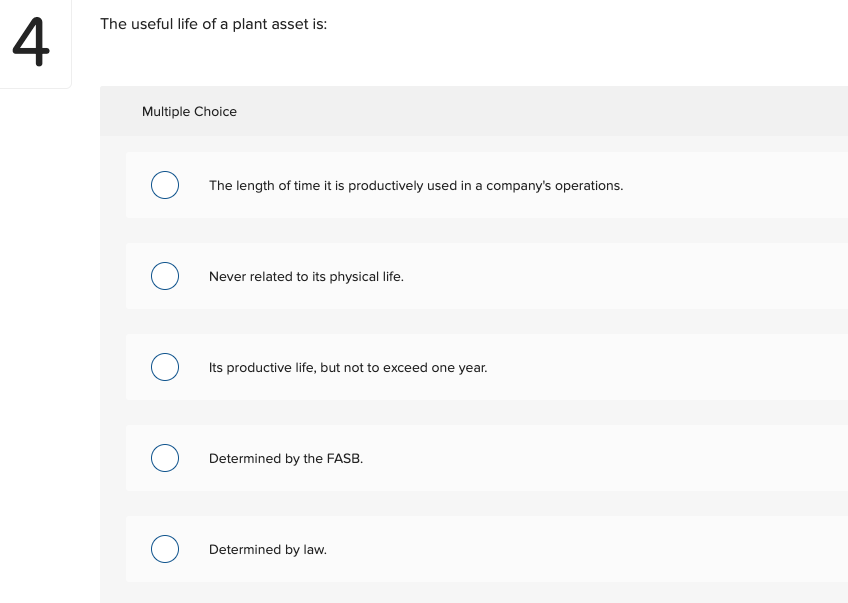

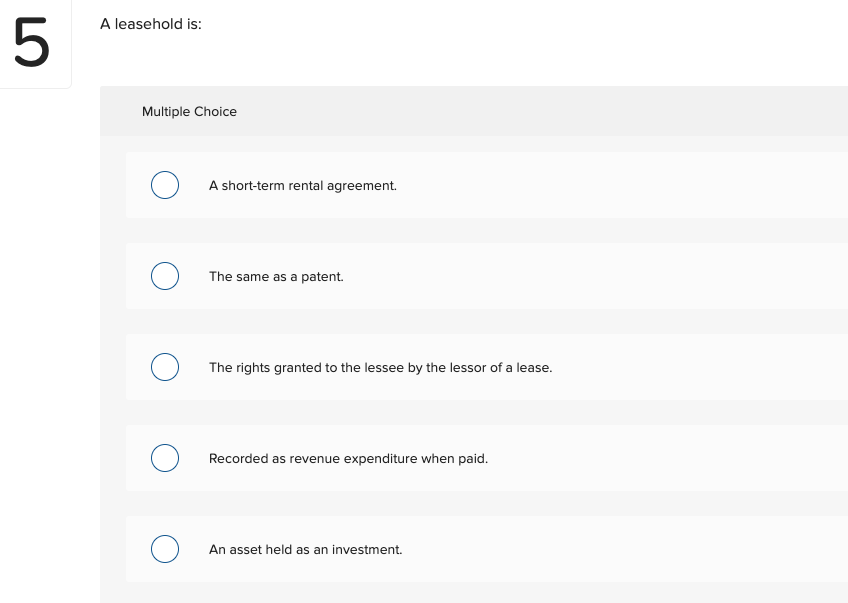

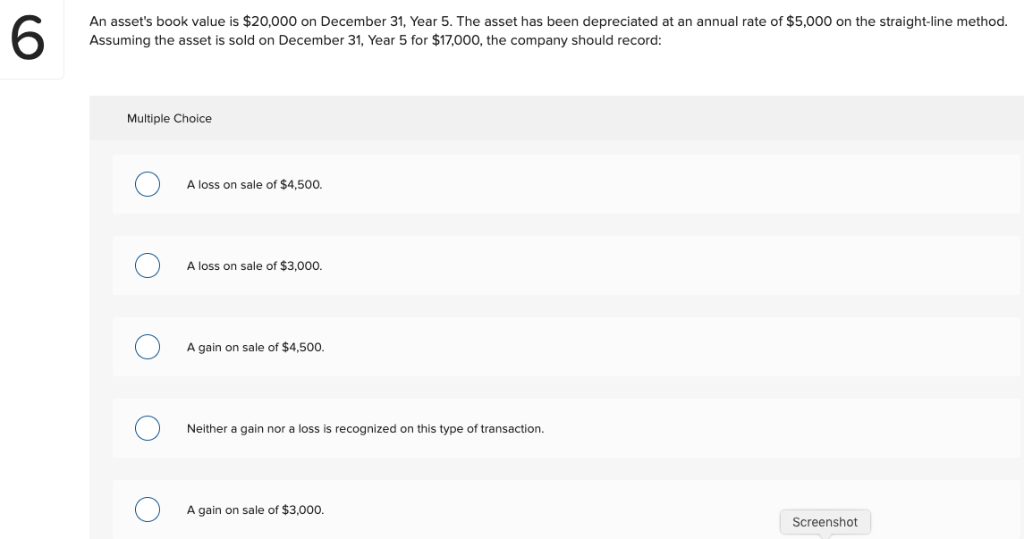

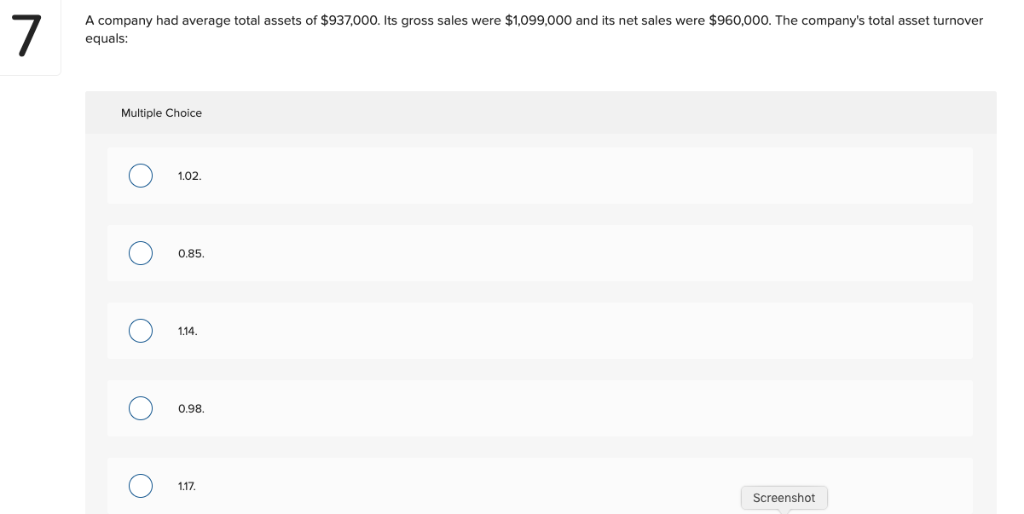

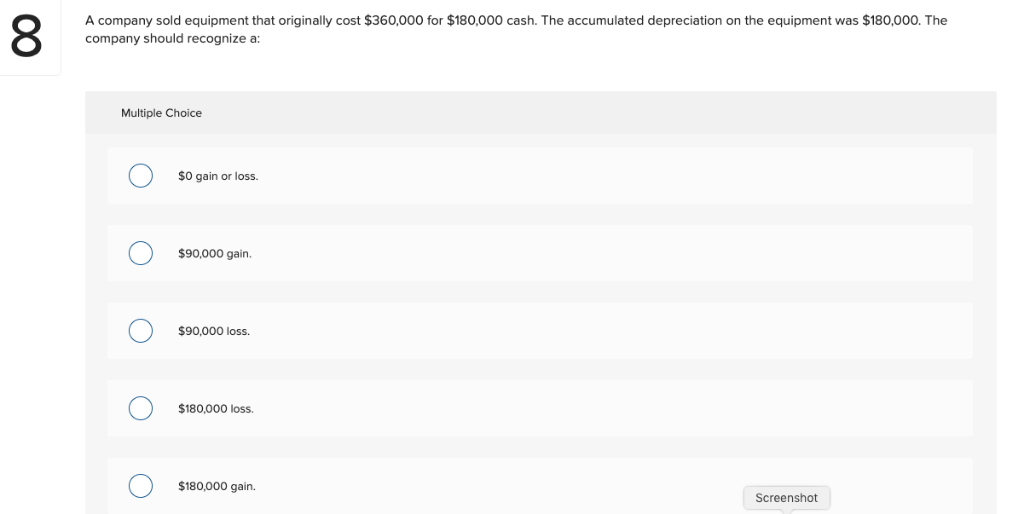

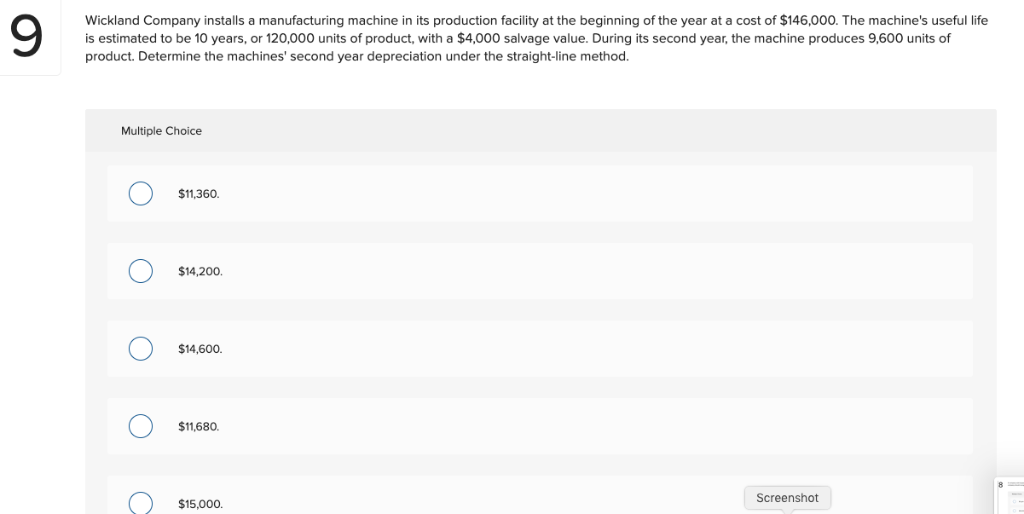

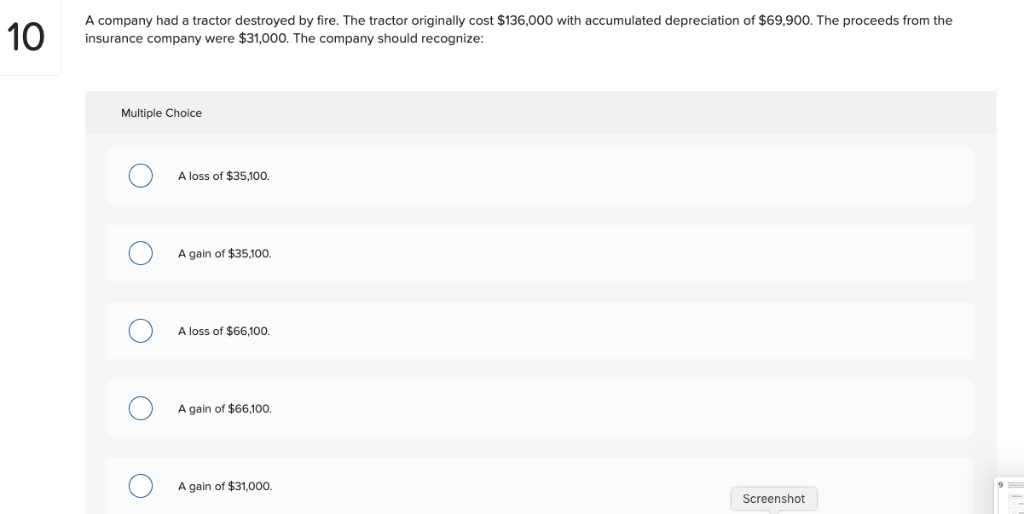

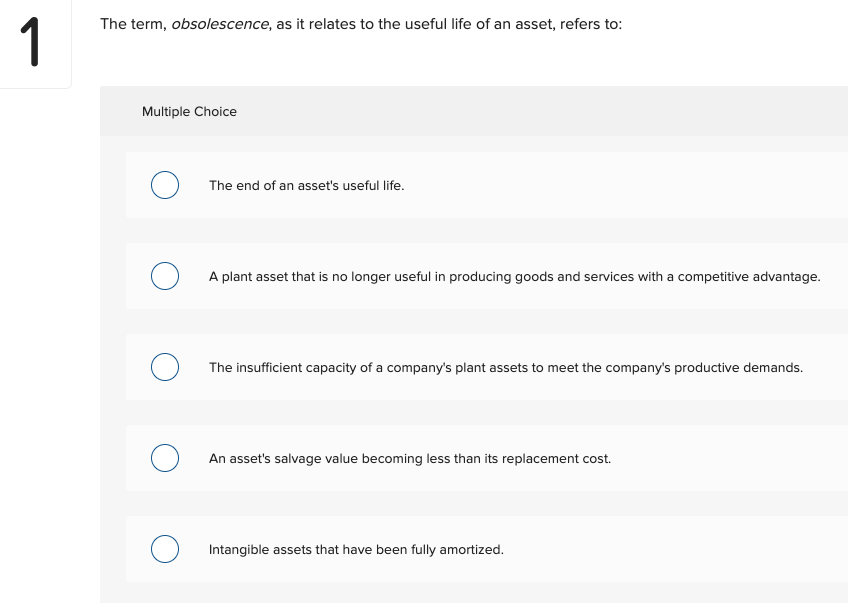

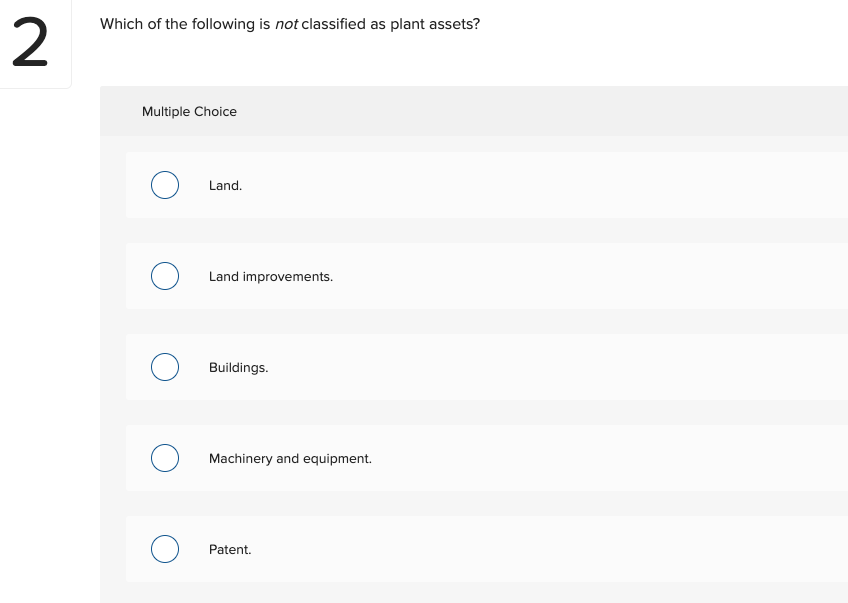

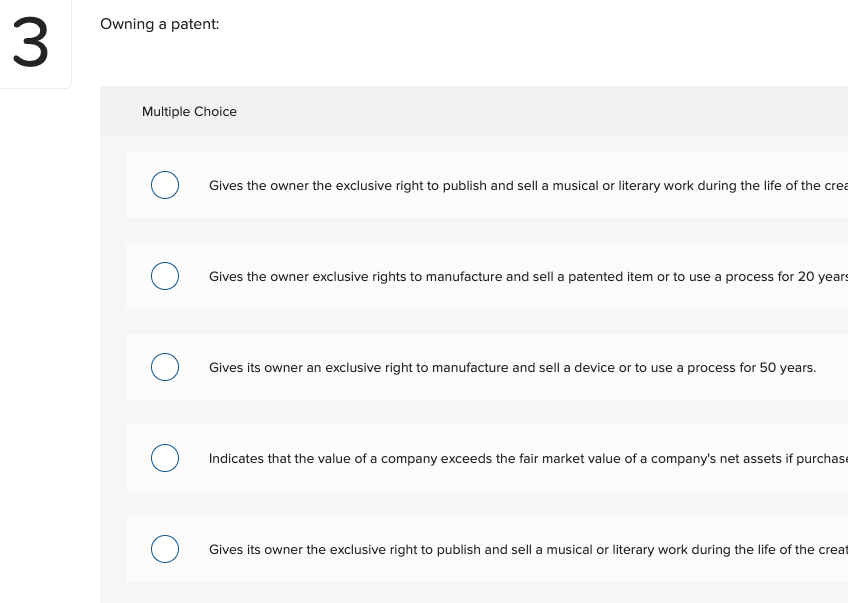

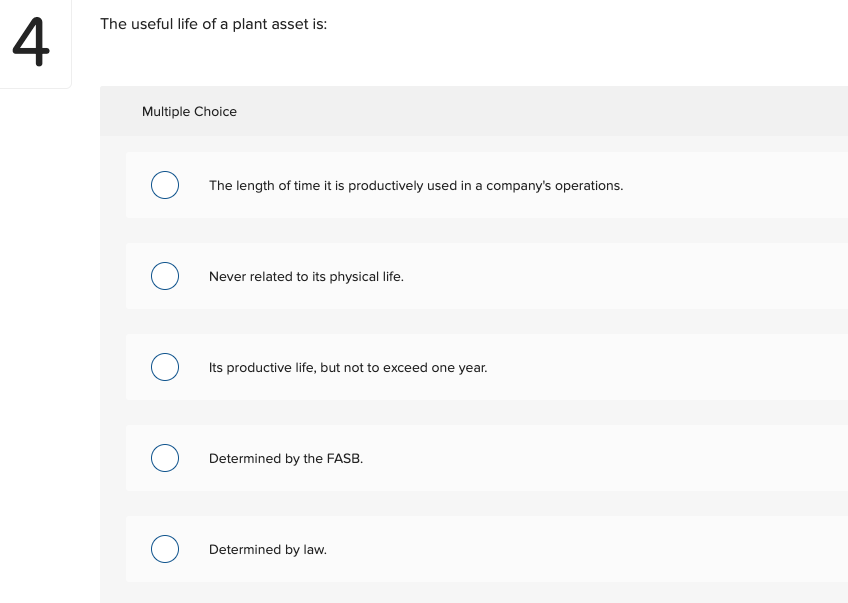

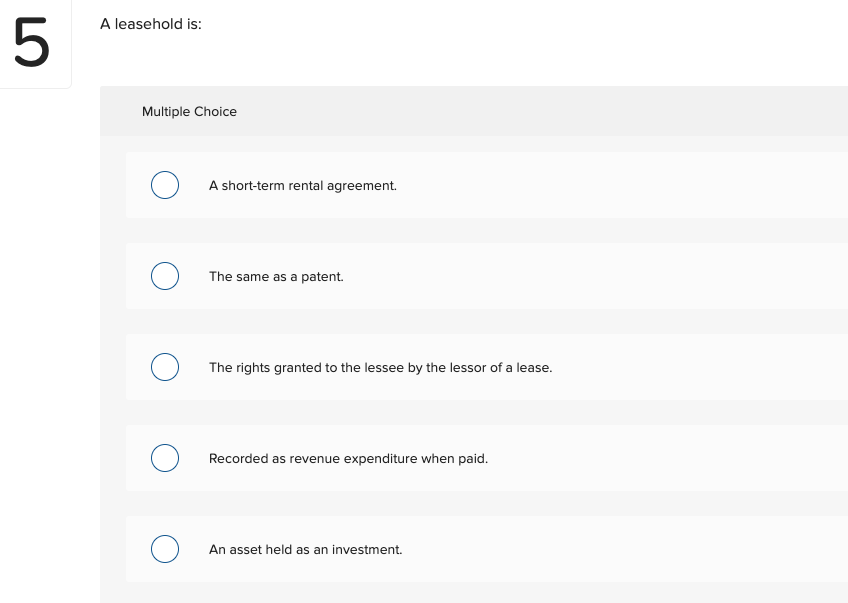

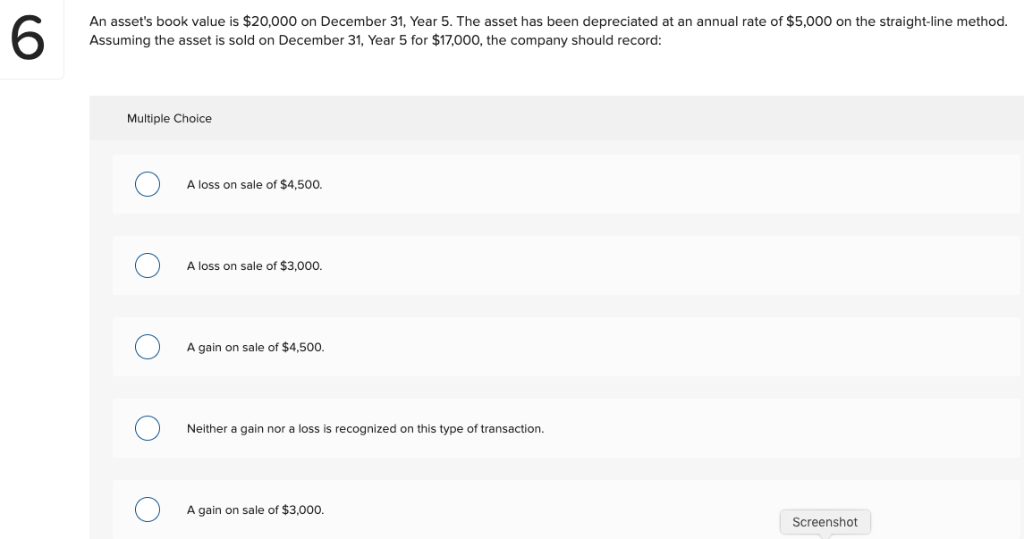

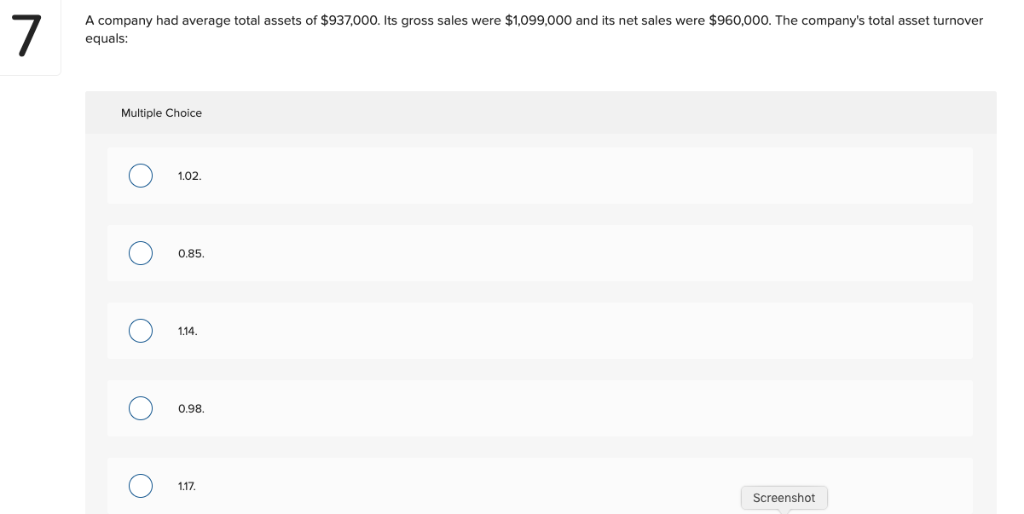

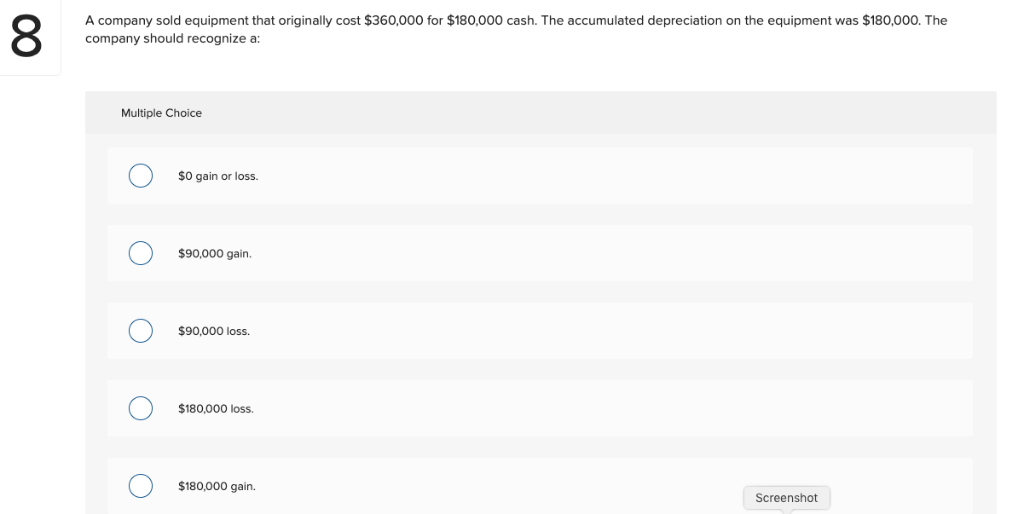

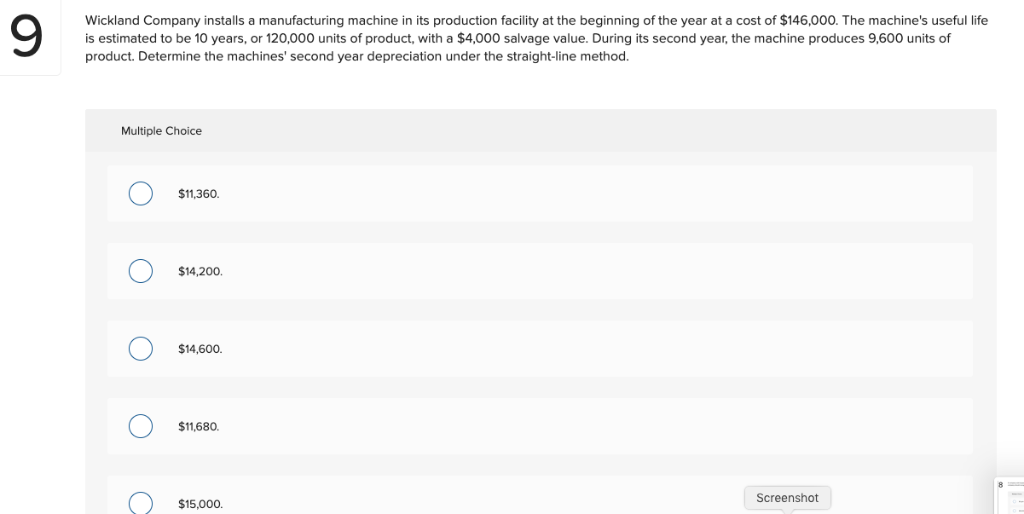

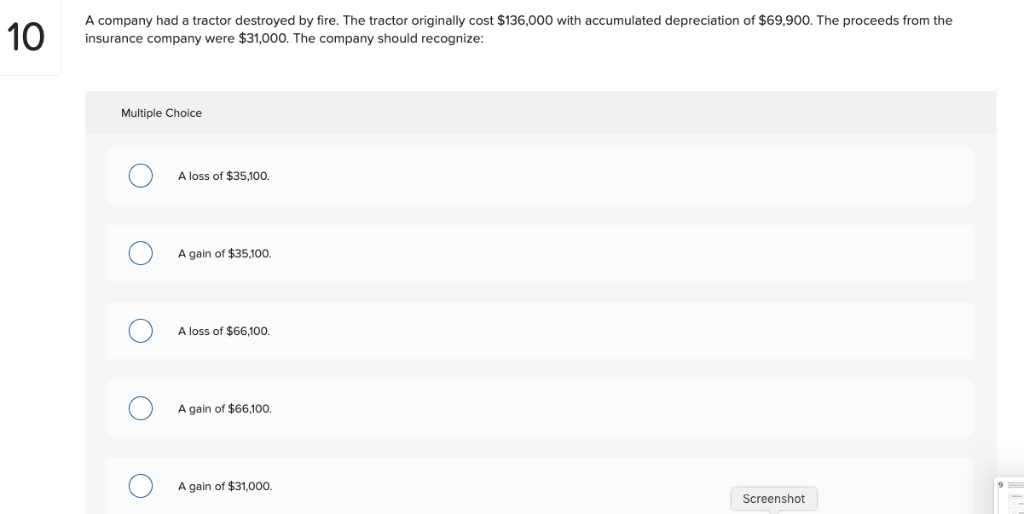

1 The term, obsolescence, as it relates to the useful life of an asset, refers to: Multiple Choice The end of an asset's useful life. A plant asset that is no longer useful in producing goods and services with a competitive advantage. The insufficient capacity of a company's plant assets to meet the company's productive demands. An asset's salvage value becoming less than its replacement cost. Intangible assets that have been fully amortized. 2 Which of the following is not classified as plant assets? Multiple Choice Land. Land improvements Buildings Machinery and equipment. Patent Owning a patent Multiple Choice Gives the owner the exclusive right to publish and sell a musical or literary work during the life of the crea Gives the owner exclusive rights to manufacture and sell a patented item or to use a process for 20 years Gives its owner an exclusive right to manufacture and sell a device or to use a process for 50 years. Indicates that the value of a company exceeds the fair market value of a company's net assets if purchase Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creat 4 The useful life of a plant asset is: Multiple Choice The length of time it is productively used in a company's operations. Never related to its physical life. Its productive life, but not to exceed one year. Determined by the FASB Determined by law. A leasehold is: 5 Multiple Choice A short-term rental agreement The same as a patent The rights granted to the lessee by the lessor of a lease Recorded as revenue expenditure when paid. An asset held as an investment. An asset's book value is $20,000 on December 31, Year 5. The asset has been depreciated at an annual rate of $5,000 on the straight-line method. Assuming the asset is sold on December 31, Year 5 for $17,000, the company should record: Multiple Choice A loss on sale of $4,500. A loss on sale of $3,000. A gain on sale of $4,500 Neither a gain nor a loss is recognized on this type of transaction. A gain on sale of $3.000. Screenshot 7 A company had average total assets of $937,000. Its gross sales were $1,099,000 and its net sales were $960,000. The company's total asset turnover equals: Multiple Choice 1.02 0.85 114 0.98. 117 Screenshot A company sold equipment that originally cost $360,000 for $180,000 cash. The accumulated depreciation on the equipment was $180,000. The company should recognize a Multiple Choice $0 gain loss. $90,000 gain $90,000 loss. $180,000 loss. $180,000 gain. Screenshot Wickland Company installs a manufacturing machine in its production facility at the beginning of the year at a cost of $146,000. The machine's useful life is estimated to be 10 years, or 120,000 units of product, with a $4,000 salvage value. During its second year, the machine produces 9,600 units of product. Determine the machines' second year depreciation under the straight-line method. Multiple Choice $11,360. $14,200 $14.600. $11,680. Screenshot $15.000. A company had a tractor destroyed by fire. The tractor originally cost $136,000 with accumulated depreciation of $69,900. The proceeds from the insurance company were $31,000. The company should recognize: 10 Multiple Choice A loss of $35,100. A gain of $35.100 A loss of $66,100. A gain of $66,100. A gain of $31,000. Screenshot