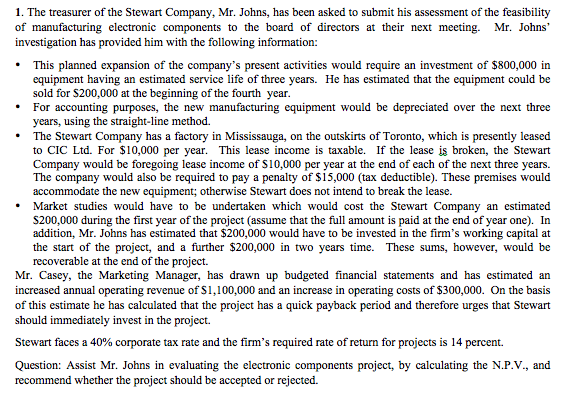

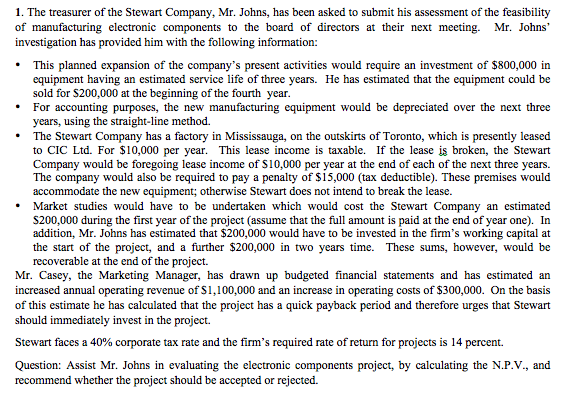

1. The treasurer of the Stewart Company, Mr. Johns, has been asked to submit his assessment of the feasibility of manufacturing electronic components to the board of directors at their next meeting. Mr. Johns' investigation has provided him with the following information: This planned expansion of the company's present activities would require an investment of $800,000 in equipment having an estimated service life of three years. He has estimated that the equipment could be sold for S200,000 at the beginning of the fourth year For accounting purposes, the new manufacturing equipment would be depreciated over the next three years, using the straight-line method. The Stewart Company has a factory in Mississauga, on the outskirts of Toronto, which is presently leased to CIC Ltd. For $10,000 per year. This lease income is taxable. If the lease is broken, the Stewart Company would be foregoing lease income of S10,000 per year at the end of each of the next three years The company would also be required to pay a penalty of $15,000 (tax deductible). These premises would accommodate the new equipment; otherwise Stewart does not intend to break the lease Market studies would have to be undertaken which would cost the Stewart Company an estimated S200,000 during the first year of the project (assume that the full amount is paid at the end of year one). In addition, Mr. Johns has estimated that $200,000 would have to be invested in the firm's working capital at the start of the project, and a further $200,000 in two years time. These sums, however, would be recoverable at the end of the project. Mr. Casey, the Marketing Manager, has drawn up budgeted financial statements and has estimated an increased annual operating revenue of S1,100,000 and an increase in operating costs of 5300,000. On the basis of this estimate he has calculated that the project has a quick payback period and therefore urges that Stewart should immediately invest in the project. Stewart faces a 40% corporate tax rate and the firm's required rate of return for projects is 14 percent. Question: Assist Mr. Johns in evaluating the electronic components project, by calculating the N.P.V., and recommend whether the project should be accepted or rejected