Answered step by step

Verified Expert Solution

Question

1 Approved Answer

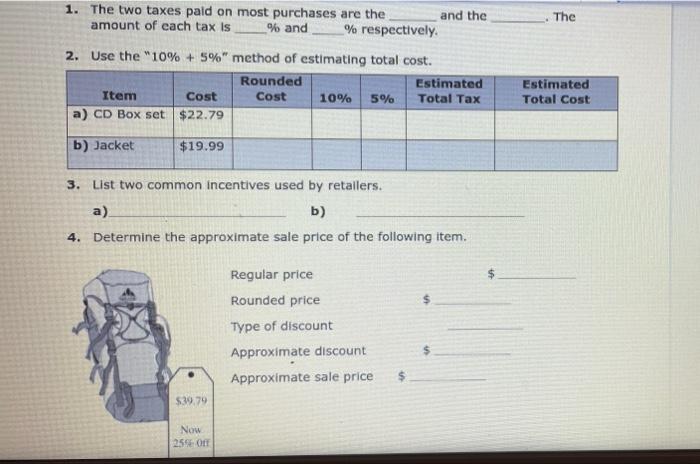

1. The two taxes paid on most purchases are the amount of each tax is % and and the % respectively. 2. Use the

1. The two taxes paid on most purchases are the amount of each tax is % and and the % respectively. 2. Use the "10% + 5%" method of estimating total cost. Estimated Rounded Cost Item Cost 10% 5% Total Tax a) CD Box set $22.79 b) Jacket $19.99 3. List two common Incentives used by retailers. a) b) 4. Determine the approximate sale price of the following item. Regular price Rounded price Type of discount Approximate discount Approximate sale price $39.79 Now 25% Off The Estimated Total Cost 1. The two taxes paid on most purchases are the amount of each tax is % and and the % respectively. 2. Use the "10% + 5%" method of estimating total cost. Estimated Rounded Cost Item Cost 10% 5% Total Tax a) CD Box set $22.79 b) Jacket $19.99 3. List two common Incentives used by retailers. a) b) 4. Determine the approximate sale price of the following item. Regular price Rounded price Type of discount Approximate discount Approximate sale price $39.79 Now 25% Off The Estimated Total Cost 1. The two taxes paid on most purchases are the amount of each tax is % and and the % respectively. 2. Use the "10% + 5%" method of estimating total cost. Estimated Rounded Cost Item Cost 10% 5% Total Tax a) CD Box set $22.79 b) Jacket $19.99 3. List two common Incentives used by retailers. a) b) 4. Determine the approximate sale price of the following item. Regular price Rounded price Type of discount Approximate discount Approximate sale price $39.79 Now 25% Off The Estimated Total Cost

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation 1 Direct tax and indirect tax 47 54 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started