Question

1. The unrealized gain (loss) from the change in fair value of investment properties for 2020 is 2. The balance of investment property at December

1. The unrealized gain (loss) from the change in fair value of investment properties for 2020 is

2. The balance of investment property at December 31, 2020 is

3. Assuming the company is using the cost model in accounting for investment properties, the balance of investment property on December 31, 2020 is

4. Assuming that on December 31, 2021, Property 5 is now used by the subsidiary in production instead of being leased out to another party. The fair value of the property at this date is P5,500,000. How much should be the gain or loss on reclassification?

5. Assuming that on December 31, 2021, Property 4 will now be used by Claude Company to lease out space to various tenants instead of operating it as a hotel. The fair value of the building at this date is P47,000,000. How much should be credited to revaluation surplus?

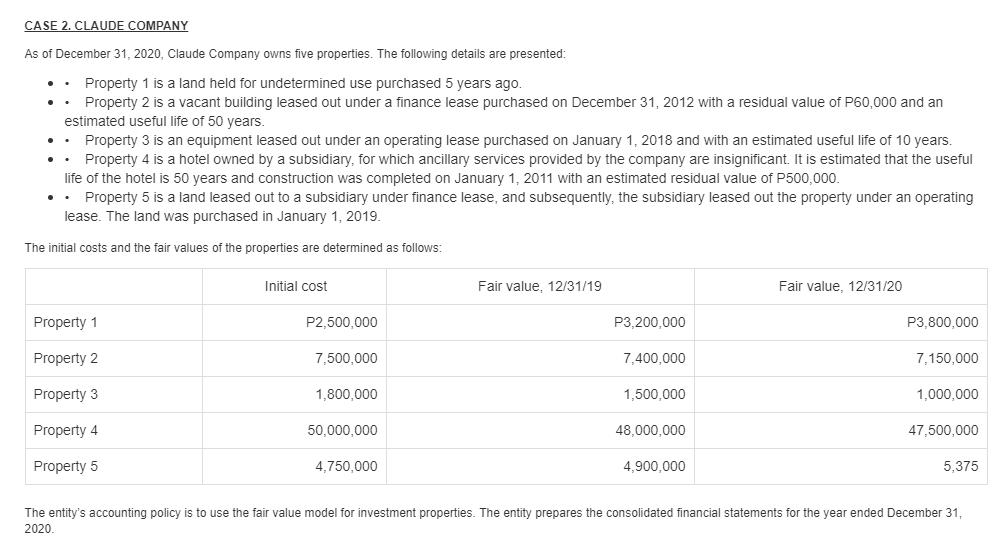

CASE 2. CLAUDE COMPANY As of December 31, 2020, Claude Company owns five properties. The following details are presented: . . Property 1 is a land held for undetermined use purchased 5 years ago. Property 2 is a vacant building leased out under a finance lease purchased on December 31, 2012 with a residual value of P60,000 and an estimated useful life of 50 years. .. Property 3 is an equipment leased out under an operating lease purchased on January 1, 2018 and with an estimated useful life of 10 years. Property 4 is a hotel owned by a subsidiary, for which ancillary services provided by the company are insignificant. It is estimated that the useful life of the hotel is 50 years and construction was completed on January 1, 2011 with an estimated residual value of P500,000. Property 5 is a land leased out to a subsidiary under finance lease, and subsequently, the subsidiary leased out the property under an operating lease. The land was purchased in January 1, 2019. The initial costs and the fair values of the properties are determined as follows: Initial cost Fair value, 12/31/19 Fair value, 12/31/20 Property 1 P2,500,000 P3,200,000 P3,800,000 Property 2 7,500,000 7,400,000 7,150,000 Property 3 1,800,000 1,500,000 1,000,000 Property 4 50,000,000 48,000,000 47,500,000 5,375 Property 5 4,750,000 4,900,000 The entity's accounting policy is to use the fair value model for investment properties. The entity prepares the consolidated financial statements for the year ended December 31, 2020

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Unrealized gain on investment property P10000000 P8000000 P2000000 2 Investment property at Decemb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started