Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The following are selected details of Expression Limited's capital structure as at January- 1, 2020: 2 200,000-ordinary-shares-issued-and-outstanding. 100,000 cumulative preference shares A that

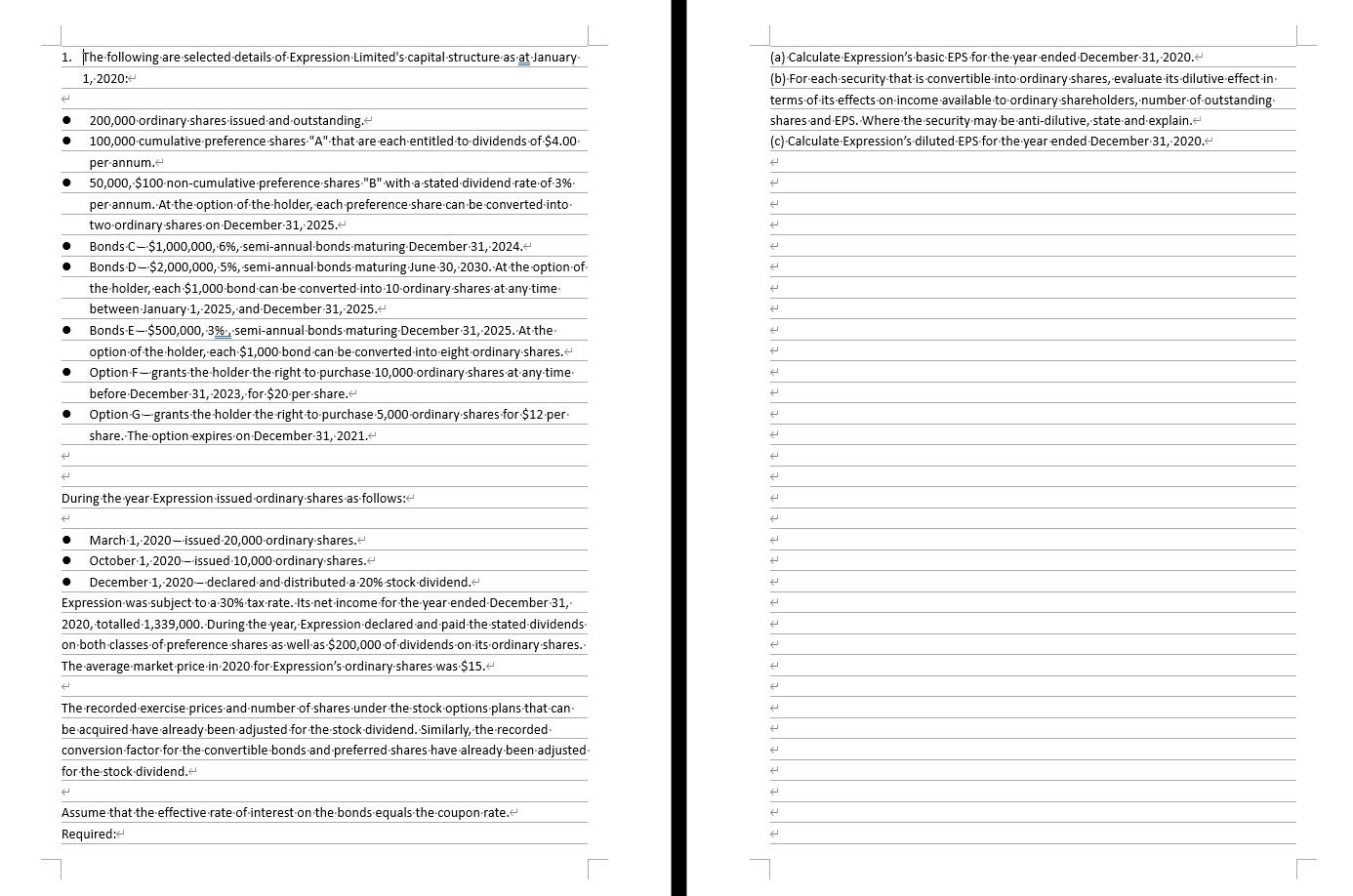

1. The following are selected details of Expression Limited's capital structure as at January- 1, 2020: 2 200,000-ordinary-shares-issued-and-outstanding. 100,000 cumulative preference shares "A" that are each entitled to dividends of $4.00- per annum. 50,000, $100-non-cumulative preference shares "B" with a stated dividend-rate-of-3%- per annum. At the option of the holder, each preference share can be converted into two-ordinary shares on December 31, 2025. Bonds C-$1,000,000, 6%, semi-annual bonds maturing December 31, 2024. Bonds D-$2,000,000, -5%, semi-annual-bonds maturing June 30, 2030. At the option-of- the holder, each $1,000-bond can be converted into 10-ordinary shares at any time. between January 1, 2025, and December 31, 2025. Bonds E-$500,000, -3%, semi-annual bonds maturing December 31, 2025. At-the- option of the holder, each $1,000-bond-can-be-converted-into-eight-ordinary-shares. Option-F-grants the holder the right to purchase 10,000 ordinary shares at any time. before December 31, 2023, for $20-per-share. < Option G-grants the holder the right to purchase 5,000 ordinary-shares for $12-per- share. The option expires on December 31, 2021. e ( During the year Expression issued ordinary-shares as follows: e March 1, 2020-issued 20,000 ordinary-shares. < October 1, 2020-issued 10,000 ordinary-shares. December 1, 2020-declared and distributed-a-20%-stock-dividend. Expression was subject to a 30%-tax rate. Its net income for the year ended December 31, 2020, totalled 1,339,000. During the year, Expression declared and paid the stated dividends. on both classes of preference shares as well as $200,000 of dividends on its ordinary-shares.. The average market price in 2020-for-Expression's ordinary-shares-was $15. H The recorded exercise prices and number of shares under the stock options plans-that-can- be acquired have already been adjusted for the stock dividend. Similarly, the recorded. conversion factor for the convertible bonds and preferred shares have already been adjusted for the stock dividend. e Assume that the effective rate of interest on the bonds equals the coupon-rate. < Required: (a) Calculate Expression's basic EPS for the year-ended December 31, 2020. (b)-For-each-security that is convertible-into-ordinary-shares, evaluate its dilutive effect-in- terms of its effects on income available to ordinary-shareholders, number of outstanding. shares and EPS. Where the security may be anti-dilutive, state and explain. (c) Calculate Expression's diluted EPS for the year ended December 31, 2020. e H 4 4 4 E ( t H 4 H H e 4 # H 4 P 2 H H H 2 ( e L

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Weightedaverage number of shares outstanding 1Jan21 Shares Issued and outstanding 200000 1Mar21 Stoc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started