Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. There are two assets and three states of the economy. What are the expected returns and standard deviations for these two stocks? State of

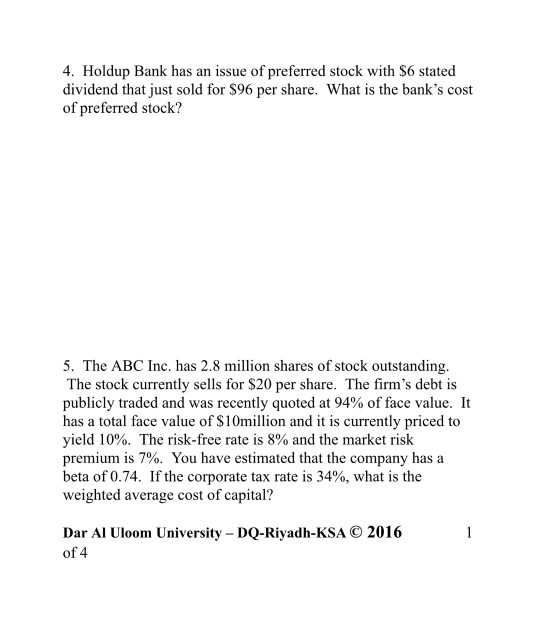

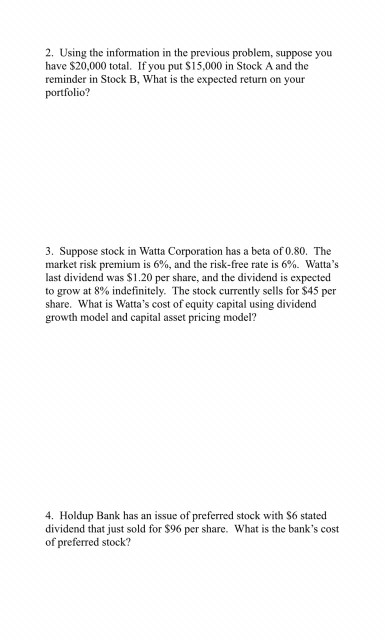

1. There are two assets and three states of the economy. What are the expected returns and standard deviations for these two stocks? State of ecoeomy Prohabilaty of state of Rate of retum if state occurs cconomy Stock A Stock E Recession Noemal Boom 0.15 0.20 0.60 0.20 0.20 0.30 040 4. Holdup Bank has an issue of preferred stock with S6 stated dividend that just sold for S96 per share. What is the bank's cost of preferred stock? 5. The ABC Inc. has 2.8 million shares of stock outstanding The stock currently sells for $20 per share. The firm's debt is publicly traded and was recently quoted at 94% of face value. It has a total face value of S10million and it is currently priced to yield 10%. The risk-free rate is 8% and the market risk premium is 7%. You have estimated that the company has a beta of 0.74. If the corporate tax rate is 34%, what is the weighted average cost of capital? 2016 Dar Al Uloom University DQ-Riyadh-KSA O of 4 2. Using the information in the previous problem, suppose you have $20,000 total. If you put S15,000 in Stock A and the reminder in Stock B, What is the expected return on your portfolio? 3. Suppose stock in Watta Corporation has a beta of 0.80. The market risk premium is 6%, and the risk-free rate is 6%. Watta's last dividend was $1.20 per share, and the dividend is expected to grow at 8% indefinitely. The stock currently sells for $45 per share. What is Watta's cost of equity capital using dividend growth model and capital asset pricing model? 4. Holdup Bank has an issue of preferred stock with S6 stated dividend that just sold for $96 per share. What is the bank's cost of preferred stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started