Question

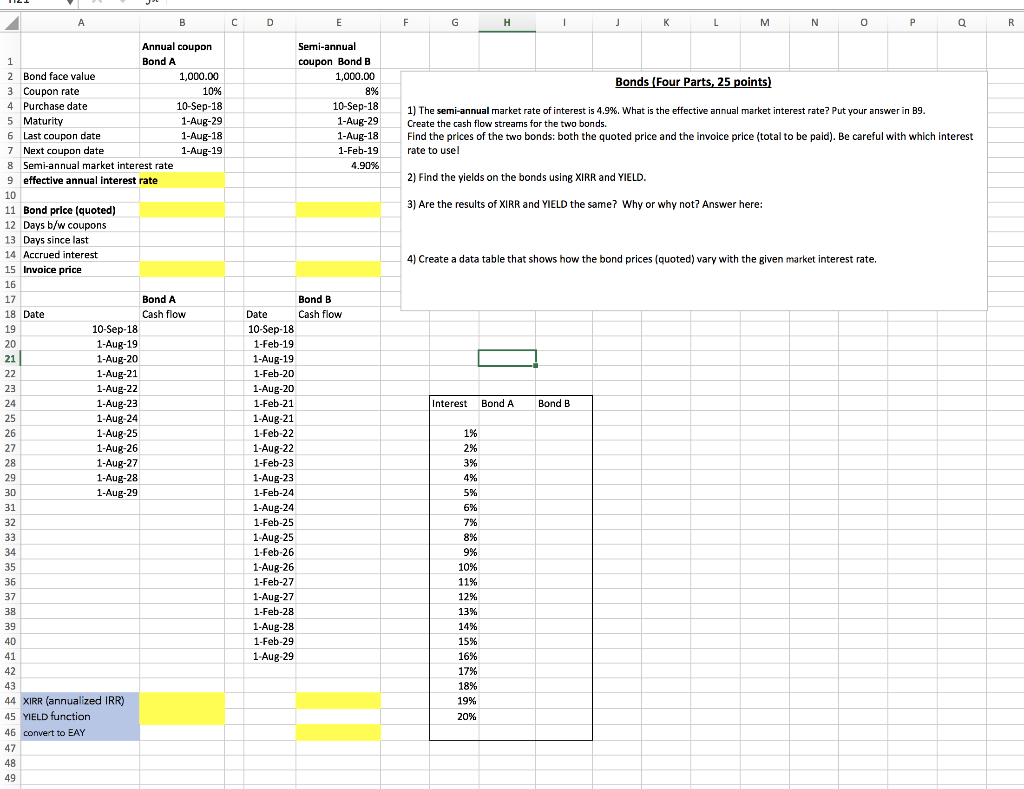

1) Thesemi-annualmarket rate of interest is 4.9%. What is the effective annual market interest rate? Put your answer in B9. Create the cash flow streams

1) Thesemi-annualmarket rate of interest is 4.9%. What is the effective annual market interest rate? Put your answer in B9.

Create the cash flow streams for the two bonds.

Find the prices of the twobonds: both the quoted price and the invoice price (total to be paid). Be careful with which interest rate to use!

2) Find the yields on the bonds using XIRR and YIELD.

3) Are the results of XIRR and YIELD the same? Why or why not? Answer here:

4) Create a data table that shows how the bond prices (quoted) vary with the givenmarket interest rate.

F G H I J K L M N O P Q R Bonds (Four Parts, 25 points) Annual coupon Bond A 2 Bond face value 1,000.00 3 Coupon rate 10% 4 Purchase date 10-Sep-18 5 Maturity 1-Aug-29 6 Last coupon date 1-Aug-18 7 Next coupon date 1-Aug-19 8 Semi-annual market interest rate 9 effective annual interest rate Semi-annual coupon Bond B 1,000.00 8% 10-Sep-18 1-Aug-29 1-Aug-18 1-Feb-19 4.9096 1) The semi-annual market rate of interest is 4.9%. What is the effective annual market interest rate? Put your answer in B9. Create the cash flow streams for the two bonds. Find the prices of the two bonds: both the quoted price and the invoice price (total to be paid). Be careful with which interest rate to use! 2) Find the yields on the bonds using XIRR and YIELD. 10 3) Are the results of XIRR and YIELD the same? Why or why not? Answer here: 11 Bond price (quoted) 12 Days b/w coupons 13 Days since last 14 Accrued interest 15 Invoice price 4) Create a data table that shows how the bond prices (quoted) vary with the given market interest rate. 18 Date Bond A Cash flow 10-Sep-18 1-Aug-19 1-Aug-20 1-Aug-21 1-Aug-22 1-Aug-23 1-Aug-24 1-Aug-25 1-Aug-26 1-Aug-27 1-Aug-28 1-Aug-29 Interest Bond A Bond B 1% 2% 3% Bond B Date Cash flow 10-Sep-18 1-Feb-19 1-Aug-19 1-Feb-20 1-Aug-20 1-Feb-21 1-Aug-21 1-Feb-22 1-Aug-22 1-Feb-23 1-Aug-23 1-Feb-24 1-Aug-24 1-Feb-25 1-Aug-25 1-Feb-26 1-Aug-26 1-Feb-27 1-Aug-27 1-Feb-28 1-Aug-28 1-Feb-29 1-Aug-29 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 43 44 XIRR (annualized IRR) 45 YIELD function 46 convert to EAY 47 F G H I J K L M N O P Q R Bonds (Four Parts, 25 points) Annual coupon Bond A 2 Bond face value 1,000.00 3 Coupon rate 10% 4 Purchase date 10-Sep-18 5 Maturity 1-Aug-29 6 Last coupon date 1-Aug-18 7 Next coupon date 1-Aug-19 8 Semi-annual market interest rate 9 effective annual interest rate Semi-annual coupon Bond B 1,000.00 8% 10-Sep-18 1-Aug-29 1-Aug-18 1-Feb-19 4.9096 1) The semi-annual market rate of interest is 4.9%. What is the effective annual market interest rate? Put your answer in B9. Create the cash flow streams for the two bonds. Find the prices of the two bonds: both the quoted price and the invoice price (total to be paid). Be careful with which interest rate to use! 2) Find the yields on the bonds using XIRR and YIELD. 10 3) Are the results of XIRR and YIELD the same? Why or why not? Answer here: 11 Bond price (quoted) 12 Days b/w coupons 13 Days since last 14 Accrued interest 15 Invoice price 4) Create a data table that shows how the bond prices (quoted) vary with the given market interest rate. 18 Date Bond A Cash flow 10-Sep-18 1-Aug-19 1-Aug-20 1-Aug-21 1-Aug-22 1-Aug-23 1-Aug-24 1-Aug-25 1-Aug-26 1-Aug-27 1-Aug-28 1-Aug-29 Interest Bond A Bond B 1% 2% 3% Bond B Date Cash flow 10-Sep-18 1-Feb-19 1-Aug-19 1-Feb-20 1-Aug-20 1-Feb-21 1-Aug-21 1-Feb-22 1-Aug-22 1-Feb-23 1-Aug-23 1-Feb-24 1-Aug-24 1-Feb-25 1-Aug-25 1-Feb-26 1-Aug-26 1-Feb-27 1-Aug-27 1-Feb-28 1-Aug-28 1-Feb-29 1-Aug-29 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 43 44 XIRR (annualized IRR) 45 YIELD function 46 convert to EAY 47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started