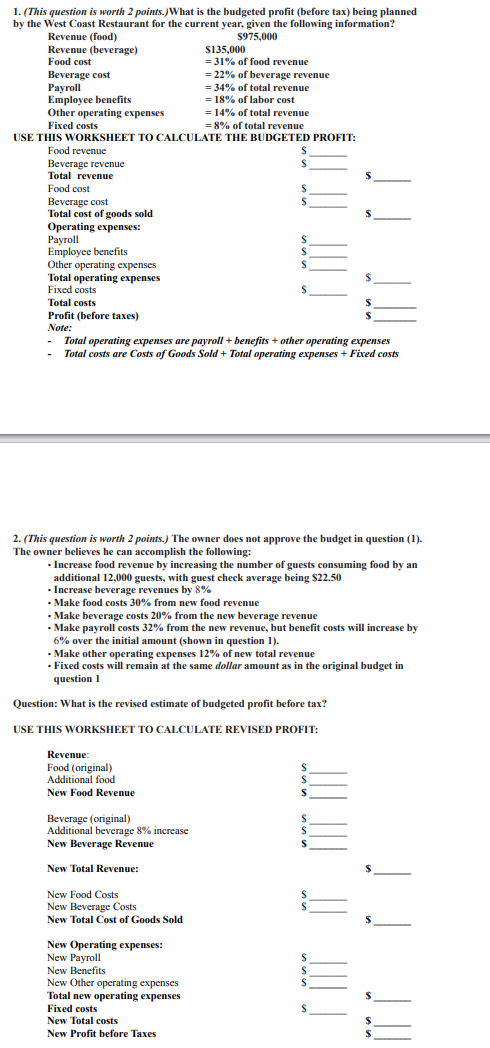

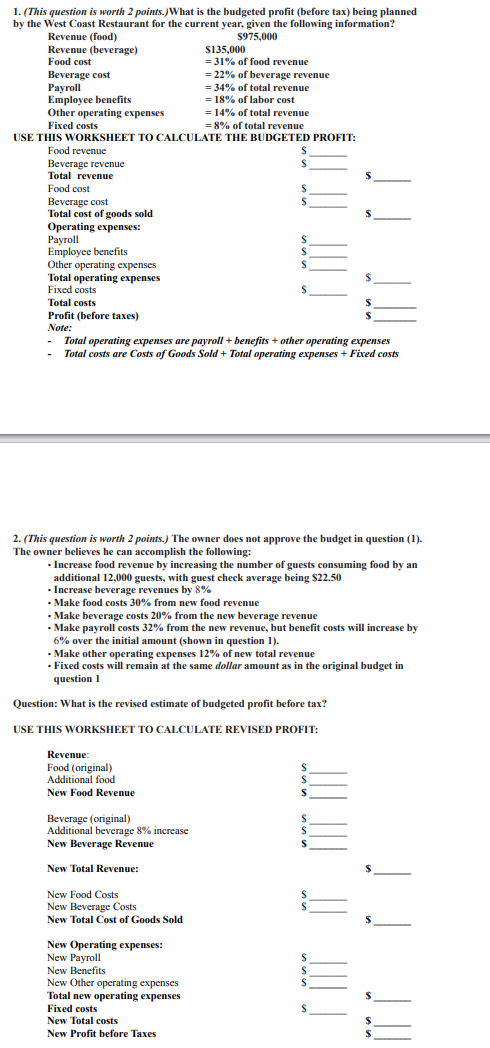

1. (This question is worth 2 points.) What is the budgeted profit (before tax) being planned by the West Coast Restaurant for the current year, given the following information? Revenue (food) $975,000 Revenue (beverage) $135,000 Food cost = 31% of food revenue Beverage cost = 22% of beverage revenue Payroll = 34% of total revenue Employee benefits = 18% of labor cost Other operating expenses = 14% of total revenue Fixed costs = 8% of total revenue USE THIS WORKSHEET TO CALCULATE THE BUDGETED PROFIT: Food revenue Beverage revenue Total revenue Food cost Beverage cost S Total cost of goods sold Operating expenses: Payroll Employee benefits Other operating expenses S Total operating expenses Fixed costs Total costs Profit (before taxes) Note: - Total operating expenses are payroll + benefits + other operating expenses - Total costs are Costs of Goods Sold + Total operating expenses + Fixed costs 2. (This question is worth 2 points.) The owner does not approve the budget in question (1). The owner believes he can accomplish the following: - Increase food revenue by increasing the number of guests consuming food by an additional 12,000 guests, with guest check average being $22.50 - Increase beverage revenues by 8% - Make food costs 30% from new food revenue Make beverage costs 20% from the new beverage revenue . Make payroll costs 32% from the new revenue, but benefit costs will increase by 6% over the initial amount (shown in question 1). - Make other operating expenses 12% of new total revenue Fixed costs will remain at the same dollar amount as in the original budget in question 1 Question: What is the revised estimate of budgeted profit before tax? USE THIS WORKSHEET TO CALCULATE REVISED PROFIT: : Revenue Food (original Additional food New Food Revenue s Beverage (original) Additional beverage 8% increase New Beverage Revenue S New Total Revenue: New Food Costs New Beverage Costs New Total Cost of Goods Sold S S New Operating expenses: New Payroll New Benefits New Other operating expenses Total new operating expenses Fixed costs New Total costs New Profit before Taxes 3. Short answer question. One of the items on the menu in the Downtown Restaurant is chopped steak. Each cook has his or her own idea about what a chopped steak is, and each prepares it differently. Using the four steps in the control process as the basis for your response, explain how a new manager might eliminate this problem. (You can answer in bullet format, explaining all 4 steps in short.) Your answer: 4. Short answer question. How can budgets be used as control devices in food and beverage operations? (The answer may be as short as 1 or 2 sentences.) Your answer: 5. Short answer question. What is the purpose of cost control? (The answer may be as short as 1 or 2 sentences.) Your answer: 6. Multiple choice question; highlight one answer below. Requiring records and reports is a: a. quantity standard. b. quality standard. c. neither (a.) nor (b.) is correct. 7. True or false: two principal causes of excessive costs are inefficiency and waste. 8. True or false: Portion size is one example of a common quality standard. 9. As the manager of an upscale restaurant, you need to use control techniques because one of your servers refuses to follow the service standards and techniques established by the restaurants management. What possible actions you might take to bring the employee's performance into line with established standards? (A short paragraph answer, choosing from the 8 control techniques described in Chapter 2) Your answer: 1. (This question is worth 2 points.) What is the budgeted profit (before tax) being planned by the West Coast Restaurant for the current year, given the following information? Revenue (food) $975,000 Revenue (beverage) $135,000 Food cost = 31% of food revenue Beverage cost = 22% of beverage revenue Payroll = 34% of total revenue Employee benefits = 18% of labor cost Other operating expenses = 14% of total revenue Fixed costs = 8% of total revenue USE THIS WORKSHEET TO CALCULATE THE BUDGETED PROFIT: Food revenue Beverage revenue Total revenue Food cost Beverage cost S Total cost of goods sold Operating expenses: Payroll Employee benefits Other operating expenses S Total operating expenses Fixed costs Total costs Profit (before taxes) Note: - Total operating expenses are payroll + benefits + other operating expenses - Total costs are Costs of Goods Sold + Total operating expenses + Fixed costs 2. (This question is worth 2 points.) The owner does not approve the budget in question (1). The owner believes he can accomplish the following: - Increase food revenue by increasing the number of guests consuming food by an additional 12,000 guests, with guest check average being $22.50 - Increase beverage revenues by 8% - Make food costs 30% from new food revenue Make beverage costs 20% from the new beverage revenue . Make payroll costs 32% from the new revenue, but benefit costs will increase by 6% over the initial amount (shown in question 1). - Make other operating expenses 12% of new total revenue Fixed costs will remain at the same dollar amount as in the original budget in question 1 Question: What is the revised estimate of budgeted profit before tax? USE THIS WORKSHEET TO CALCULATE REVISED PROFIT: : Revenue Food (original Additional food New Food Revenue s Beverage (original) Additional beverage 8% increase New Beverage Revenue S New Total Revenue: New Food Costs New Beverage Costs New Total Cost of Goods Sold S S New Operating expenses: New Payroll New Benefits New Other operating expenses Total new operating expenses Fixed costs New Total costs New Profit before Taxes 3. Short answer question. One of the items on the menu in the Downtown Restaurant is chopped steak. Each cook has his or her own idea about what a chopped steak is, and each prepares it differently. Using the four steps in the control process as the basis for your response, explain how a new manager might eliminate this problem. (You can answer in bullet format, explaining all 4 steps in short.) Your answer: 4. Short answer question. How can budgets be used as control devices in food and beverage operations? (The answer may be as short as 1 or 2 sentences.) Your answer: 5. Short answer question. What is the purpose of cost control? (The answer may be as short as 1 or 2 sentences.) Your answer: 6. Multiple choice question; highlight one answer below. Requiring records and reports is a: a. quantity standard. b. quality standard. c. neither (a.) nor (b.) is correct. 7. True or false: two principal causes of excessive costs are inefficiency and waste. 8. True or false: Portion size is one example of a common quality standard. 9. As the manager of an upscale restaurant, you need to use control techniques because one of your servers refuses to follow the service standards and techniques established by the restaurants management. What possible actions you might take to bring the employee's performance into line with established standards? (A short paragraph answer, choosing from the 8 control techniques described in Chapter 2) Your