Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Thompsons Inc. just finished their fiscal year and are preparing the P&L. They had sales of $1M. The direct material cost was based

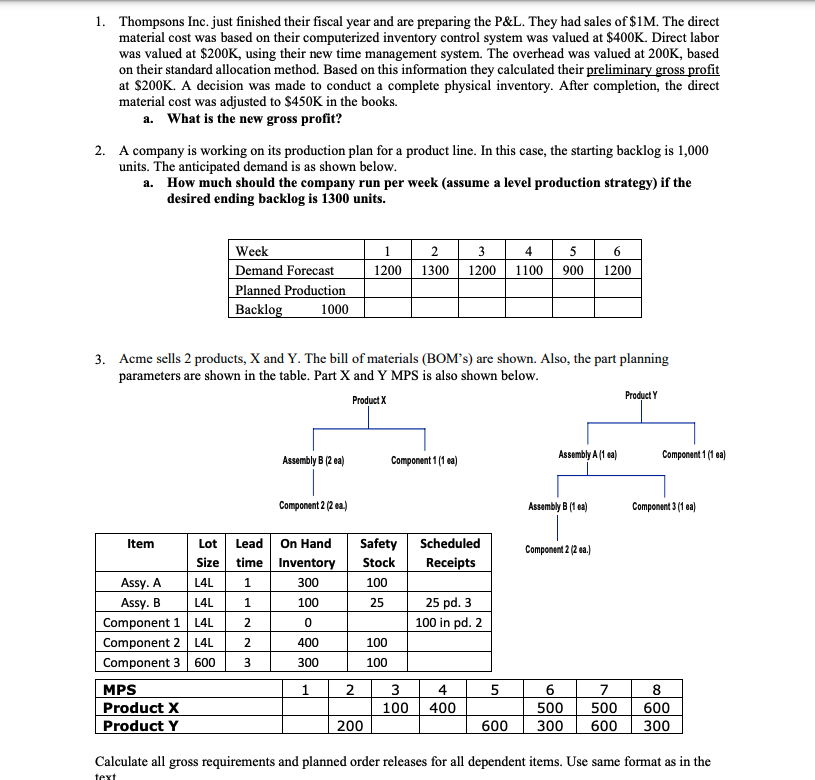

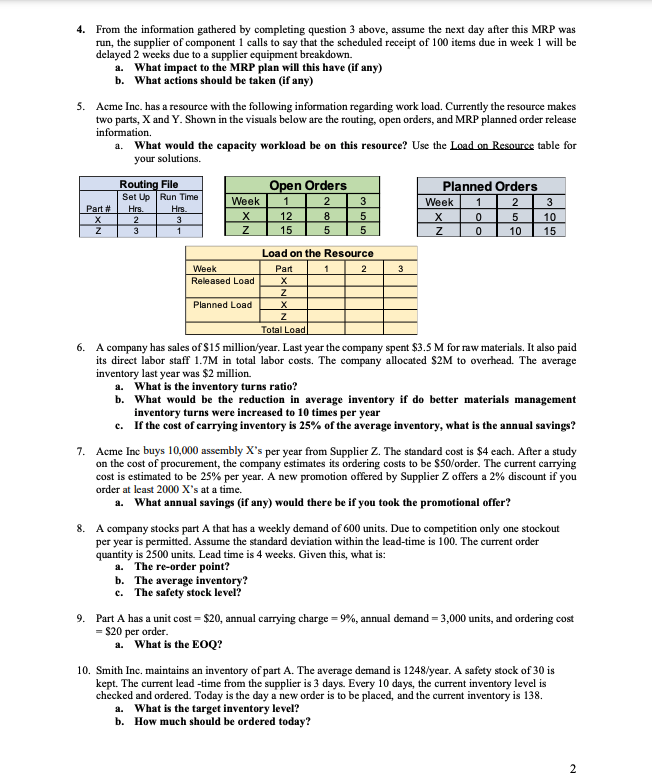

1. Thompsons Inc. just finished their fiscal year and are preparing the P&L. They had sales of $1M. The direct material cost was based on their computerized inventory control system was valued at $400K. Direct labor was valued at $200K, using their new time management system. The overhead was valued at 200K, based on their standard allocation method. Based on this information they calculated their preliminary gross profit at $200K. A decision was made to conduct a complete physical inventory. After completion, the direct material cost was adjusted to $450K in the books. a. What is the new gross profit? 2. A company is working on its production plan for a product line. In this case, the starting backlog is 1,000 units. The anticipated demand is as shown below. a. How much should the company run per week (assume a level production strategy) if the desired ending backlog is 1300 units. Week 1 2 3 4 5 6 Demand Forecast Planned Production Backlog 1200 1300 1200 1100 900 1200 1000 3. Acme sells 2 products, X and Y. The bill of materials (BOM's) are shown. Also, the part planning parameters are shown in the table. Part X and Y MPS is also shown below. Product X Assembly B (2 ea) Component 1 (1 ea) Product Y Assembly A (1 ea) Component 1 (1 ea) Component 2 (2 ea.) Assembly B (1 ea) Component 3 (1 ea) Item Lot Lead Size time On Hand Inventory Safety Stock Scheduled Receipts Component 2 (2 ea.) Assy. A L4L 1 300 100 Assy. B L4L 1 100 25 Component 1 L4L Component 2 L4L Component 3 600 223 0 25 pd. 3 100 in pd. 2 400 100 300 100 MPS Product X Product Y 1 2 3 4 5 6 7 8 100 400 500 500 600 200 600 300 600 300 Calculate all gross requirements and planned order releases for all dependent items. Use same format as in the text 4. From the information gathered by completing question 3 above, assume the next day after this MRP was run, the supplier of component 1 calls to say that the scheduled receipt of 100 items due in week 1 will be delayed 2 weeks due to a supplier equipment breakdown. a. What impact to the MRP plan will this have (if any) b. What actions should be taken (if any) 5. Acme Inc. has a resource with the following information regarding work load. Currently the resource makes two parts, X and Y. Shown in the visuals below are the routing, open orders, and MRP planned order release information. a. What would the capacity workload be on this resource? Use the Load on Resource table for your solutions. Routing File Open Orders Planned Orders Set Up Run Time Week 1 2 3 Week 1 2 3 Part # Hrs. Hrs. 12 8 5 X 0 5 X 2 3 10 Z 3 1 Z 15 5 5 Z 0 10 15 Load on the Resource Week Part 1 Released Load X Z Planned Load X Z 2 3 Total Load 6. A company has sales of $15 million/year. Last year the company spent $3.5 M for raw materials. It also paid its direct labor staff 1.7M in total labor costs. The company allocated S2M to overhead. The average inventory last year was $2 million. a. What is the inventory turns ratio? b. What would be the reduction in average inventory if do better materials management inventory turns were increased to 10 times per year c. If the cost of carrying inventory is 25% of the average inventory, what is the annual savings? 7. Acme Inc buys 10,000 assembly X's per year from Supplier Z. The standard cost is $4 each. After a study on the cost of procurement, the company estimates its ordering costs to be $50/order. The current carrying cost is estimated to be 25% per year. A new promotion offered by Supplier Z offers a 2% discount if you order at least 2000 X's at a time. a. What annual savings (if any) would there be if you took the promotional offer? 8. A company stocks part A that has a weekly demand of 600 units. Due to competition only one stockout per year is permitted. Assume the standard deviation within the lead-time is 100. The current order quantity is 2500 units. Lead time is 4 weeks. Given this, what is: a. The re-order point? b. The average inventory? c. The safety stock level? 9. Part A has a unit cost = $20, annual carrying charge = 9%, annual demand = 3,000 units, and ordering cost = $20 per order. a. What is the EOQ? 10. Smith Inc. maintains an inventory of part A. The average demand is 1248/year. A safety stock of 30 is kept. The current lead-time from the supplier is 3 days. Every 10 days, the current inventory level is checked and ordered. Today is the day a new order is to be placed, and the current inventory is 138. a. What is the target inventory level? b. How much should be ordered today? 2

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets go through all the questions stepbystep 1 Thompsons Inc just finished their fiscal year and are preparing the PL They had sales of 1M The direct material cost based on their computerized inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started