Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. To incentivize our employees, we are considering issuing them employee equity. The average employee would be issued stock options to purchase 800 shares

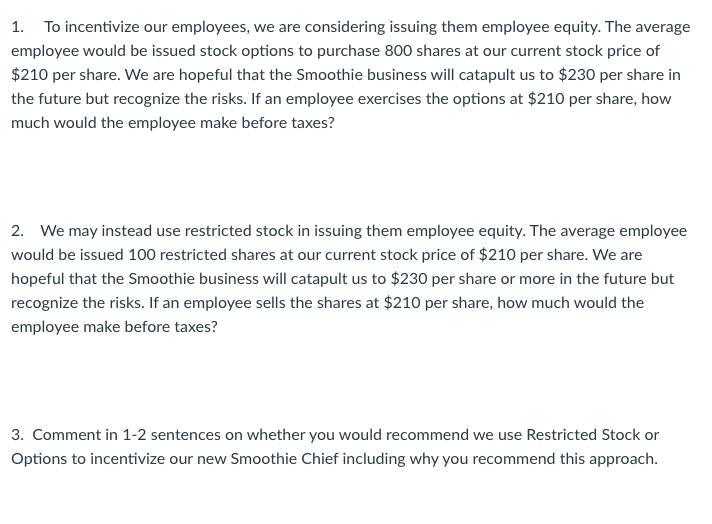

1. To incentivize our employees, we are considering issuing them employee equity. The average employee would be issued stock options to purchase 800 shares at our current stock price of $210 per share. We are hopeful that the Smoothie business will catapult us to $230 per share in the future but recognize the risks. If an employee exercises the options at $210 per share, how much would the employee make before taxes? 2. We may instead use restricted stock in issuing them employee equity. The average employee would be issued 100 restricted shares at our current stock price of $210 per share. We are hopeful that the Smoothie business will catapult us to $230 per share or more in the future but recognize the risks. If an employee sells the shares at $210 per share, how much would the employee make before taxes? 3. Comment in 1-2 sentences on whether you would recommend we use Restricted Stock or Options to incentivize our new Smoothie Chief including why you recommend this approach.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Employee Stock Options Calculation When an employee exercises stock options they are essentially p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started