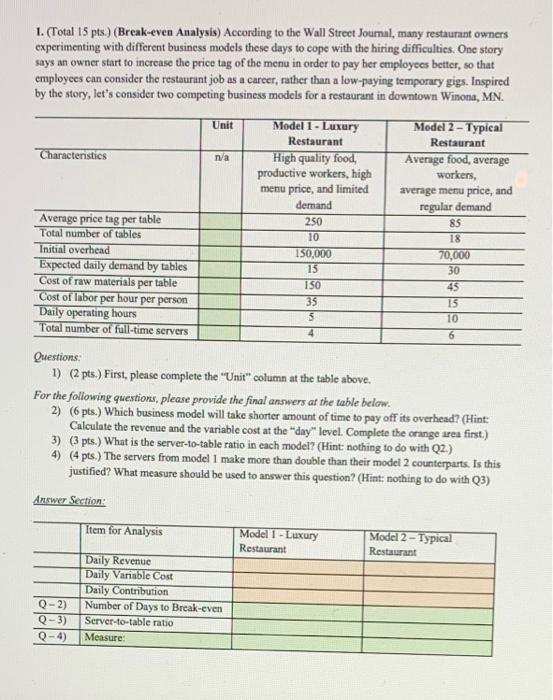

1. (Total 15 pts) (Break-even Analysis) According to the Wall Street Journal, many restaurant owners experimenting with different business models these days to cope with the hiring difficulties. One story says an owner start to increase the price tag of the menu in order to pay her employees better, so that employees can consider the restaurant job as a career, rather than a low-paying temporary gigs. Inspired by the story, let's consider two competing business models for a restaurant in downtown Winona, MN. Unit n/a Model 1 - Luxury Model 2 - Typical Restaurant Restaurant Characteristics High quality food, Average food, average productive workers, high workers, menu price, and limited average menu price, and demand regular demand Average price tag per table 250 85 Total number of tables 10 18 Initial overhead 150,000 70,000 Expected daily demand by tables 15 30 Cost of raw materials per table ISO 45 Cost of labor per hour per person 35 15 Daily operating hours 5 10 Total number of full-time servers 4 6 Questions: 1) (2 pts.) First, please complete the "Unit" column at the table above. For the following questions, please provide the final answers at the table below. 2) (6 pts.) Which business model will take shorter amount of time to pay off its overhead? (Hint: Calculate the revenue and the variable cost at the "day" level. Complete the orange area first.) 3) (3 pts.) What is the server-to-table ratio in each model? (Hint: nothing to do with Q2.) 4) (4 pts.) The servers from model 1 make more than double than their model 2 counterparts. Is this justified? What measure should be used to answer this question? (Hint: nothing to do with Q3) Answer Section: Item for Analysis Model 1 - Luxury Restaurant Model 2 - Typical Restaurant Q-2) Q-3) Q-4) Daily Revenue Daily Variable Cost Daily Contribution Number of Days to Break-even Server-to-table ratio Measure: 1. (Total 15 pts) (Break-even Analysis) According to the Wall Street Journal, many restaurant owners experimenting with different business models these days to cope with the hiring difficulties. One story says an owner start to increase the price tag of the menu in order to pay her employees better, so that employees can consider the restaurant job as a career, rather than a low-paying temporary gigs. Inspired by the story, let's consider two competing business models for a restaurant in downtown Winona, MN. Unit n/a Model 1 - Luxury Model 2 - Typical Restaurant Restaurant Characteristics High quality food, Average food, average productive workers, high workers, menu price, and limited average menu price, and demand regular demand Average price tag per table 250 85 Total number of tables 10 18 Initial overhead 150,000 70,000 Expected daily demand by tables 15 30 Cost of raw materials per table ISO 45 Cost of labor per hour per person 35 15 Daily operating hours 5 10 Total number of full-time servers 4 6 Questions: 1) (2 pts.) First, please complete the "Unit" column at the table above. For the following questions, please provide the final answers at the table below. 2) (6 pts.) Which business model will take shorter amount of time to pay off its overhead? (Hint: Calculate the revenue and the variable cost at the "day" level. Complete the orange area first.) 3) (3 pts.) What is the server-to-table ratio in each model? (Hint: nothing to do with Q2.) 4) (4 pts.) The servers from model 1 make more than double than their model 2 counterparts. Is this justified? What measure should be used to answer this question? (Hint: nothing to do with Q3) Answer Section: Item for Analysis Model 1 - Luxury Restaurant Model 2 - Typical Restaurant Q-2) Q-3) Q-4) Daily Revenue Daily Variable Cost Daily Contribution Number of Days to Break-even Server-to-table ratio Measure