Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Tower Company began operations on January 1, 2020. For financial reporting, the entity recognized revenue from all sales under the accrual method. However,

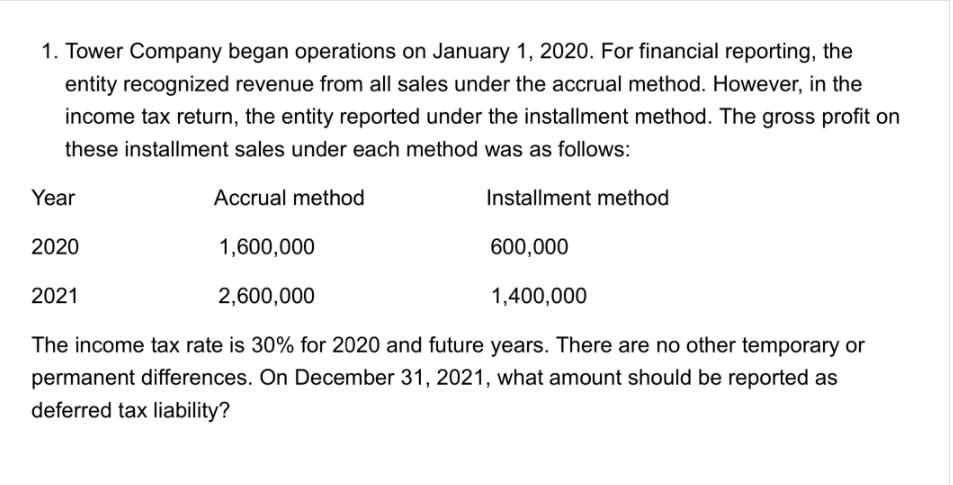

1. Tower Company began operations on January 1, 2020. For financial reporting, the entity recognized revenue from all sales under the accrual method. However, in the income tax return, the entity reported under the installment method. The gross profit on these installment sales under each method was as follows: Year 2020 2021 Accrual method 1,600,000 2,600,000 Installment method 600,000 1,400,000 The income tax rate is 30% for 2020 and future years. There are no other temporary or permanent differences. On December 31, 2021, what amount should be reported as deferred tax liability?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the deferred tax liability on December 31 2021 we need to calculate the temporary diffe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started