Answered step by step

Verified Expert Solution

Question

1 Approved Answer

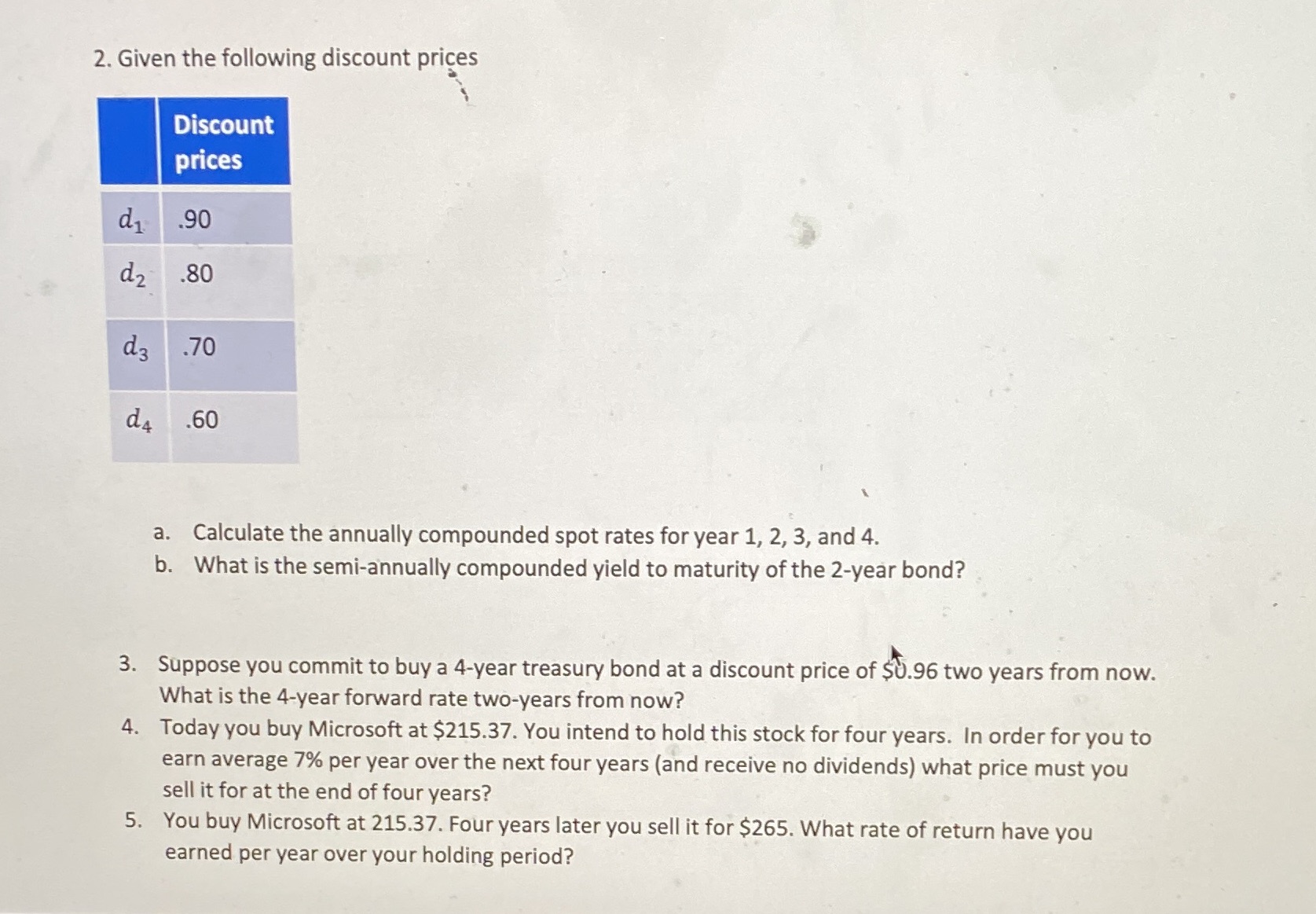

2. Given the following discount prices Discount prices d .90 d2 .80 d3 .70 d .60 a. Calculate the annually compounded spot rates for

2. Given the following discount prices Discount prices d .90 d2 .80 d3 .70 d .60 a. Calculate the annually compounded spot rates for year 1, 2, 3, and 4. b. What is the semi-annually compounded yield to maturity of the 2-year bond? 3. Suppose you commit to buy a 4-year treasury bond at a discount price of $0.96 two years from now. What is the 4-year forward rate two-years from now? 4. Today you buy Microsoft at $215.37. You intend to hold this stock for four years. In order for you to earn average 7% per year over the next four years (and receive no dividends) what price must you sell it for at the end of four years? 5. You buy Microsoft at 215.37. Four years later you sell it for $265. What rate of return have you earned per year over your holding period?

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the annually compounded spot rates we can use the formula Spot Rate 1 Discount Price 1 Given the discount prices d 090 d 080 d 070 d 06...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started