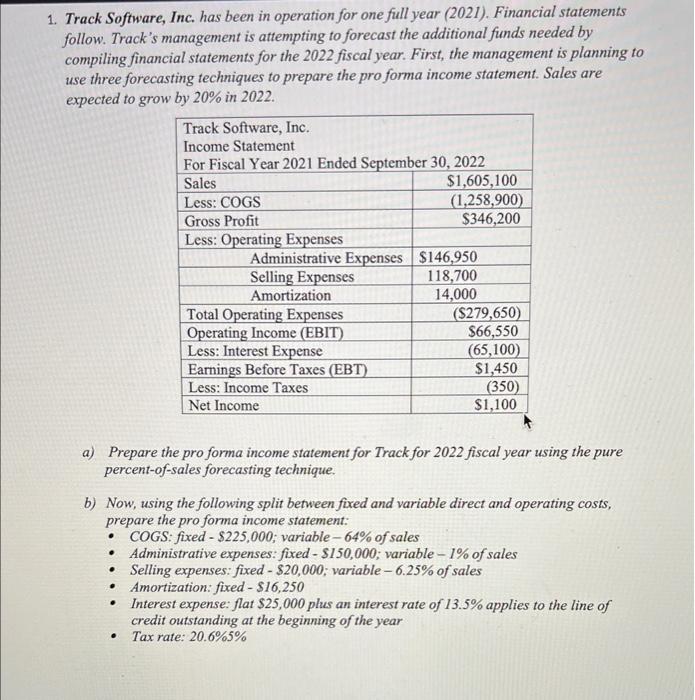

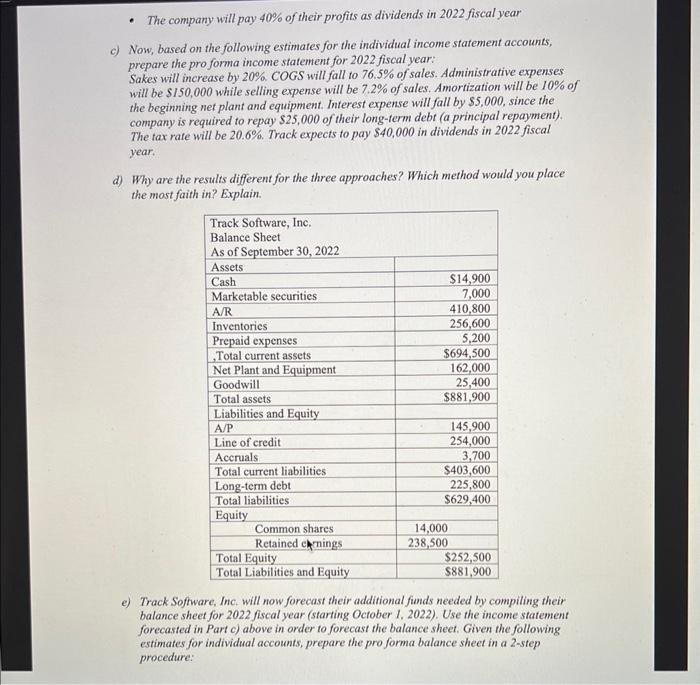

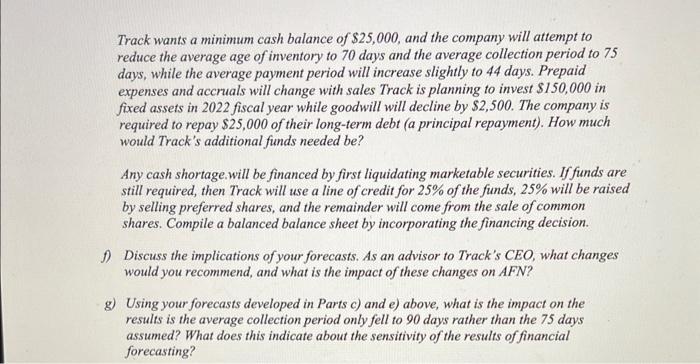

1. Track Software, Inc. has been in operation for one full year (2021). Financial statements follow. Track's management is attempting to forecast the additional funds needed by compiling financial statements for the 2022 fiscal year. First, the management is planning to use three forecasting techniques to prepare the pro forma income statement. Sales are expected to grow by 20% in 2022. a) Prepare the pro forma income statement for Track for 2022 fiscal year using the pure percent-of-sales forecasting technique. b) Now, using the following split between fixed and variable direct and operating costs, prepare the pro forma income statement: - COGS: fixed - $225,000; variable - 64% of sales - Administrative expenses: fixed - $150,000; variable 1% of sales - Selling expenses: fixed - $20,000; variable - 6.25% of sales - Amortization: fixed - $16,250 - Interest expense: flat $25,000 plus an interest rate of 13.5% applies to the line of credit outstanding at the beginning of the year - Tax rate: 20.6%5% - The company will pay 40% of their profits as dividends in 2022 fiscal year c) Now, based on the following estimates for the individual income statement accounts, prepare the pro forma income statement for 2022 fiscal year: Sakes will increase by 20% COGS will fall to 76.5% of sales. Administrative expenses will be $150,000 while selling expense will be 7.2% of sales. Amortization will be 10% of the beginning net plant and equipment. Interest expense will fall by $5,000, since the company is required to repay $25,000 of their long-term debt (a principal repayment). The tax rate will be 20.6%. Track expects to pay $40,000 in dividends in 2022 fiscal year. d) Why are the results different for the three approaches? Which method would you place the most faith in? Explain. e) Track Software, Inc, will now forecast their additional funds needed by compiling their balance sheet for 2022 fiscal year (starting October 1, 2022). Use the income statement forecasted in Part c) above in order to forecast the balance sheet. Given the following estimates for individual accounts, prepare the pro forma balance sheet in a 2-step procedure: Track wants a minimum cash balance of $25,000, and the company will attempt to reduce the average age of inventory to 70 days and the average collection period to 75 days, while the average payment period will increase slightly to 44 days. Prepaid expenses and accruals will change with sales Track is planning to invest $150,000 in fixed assets in 2022 fiscal year while goodwill will decline by \$2,500. The company is required to repay $25,000 of their long-term debt (a principal repayment). How much would Track's additional funds needed be? Any cash shortage. will be financed by first liquidating marketable securities. If funds are still required, then Track will use a line of credit for 25% of the funds, 25\% will be raised by selling preferred shares, and the remainder will come from the sale of common shares. Compile a balanced balance sheet by incorporating the financing decision. f) Discuss the implications of your forecasts. As an advisor to Track's CEO, what changes would you recommend, and what is the impact of these changes on AFN? g) Using your forecasts developed in Parts c) and e) above, what is the impact on the results is the average collection period only fell to 90 days rather than the 75 days assumed? What does this indicate about the sensitivity of the results of financial forecasting