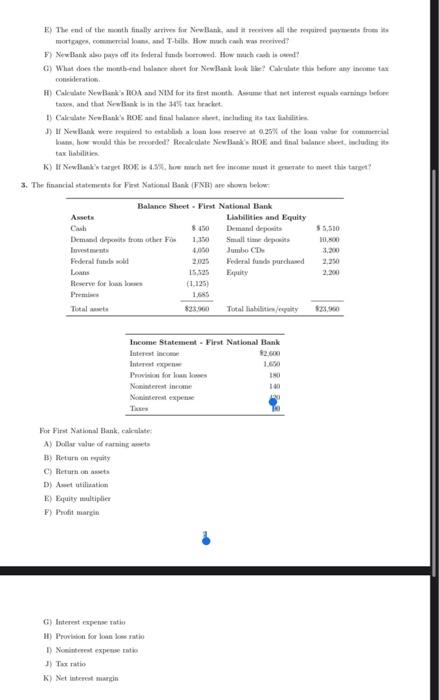

1. True/False For each of the following questions indicate true or false, then fully explain your answer. A) Corporations raise most of their funds through equity issuance. B) The moral hazard issue in lending arises as the borrower may misuse the funds. C) Banks can reduce the adverse selection issue as their monitoring costs are lower. D) The asset transformation function of Fis allows them to eliminate financial risks, such as the risk of default. E) Deposit insurance is deemed to increase the risk of bank failures as it induces bank runs. F) The profitability of traditional banking business has been increasing in recent years. 2. Questions A-L relate to the first month operations of NewBank. A) NewBank started its first day of operations with $6 million in capital $100 million in checkable deposits is received. The bank issues a $25 million commercial loan and another $25 million in mortgages, with the following terms . Mortgages: 100 standard 30-year fixed-rate mortgages with a nominal annual rate of 5.25% each for $250,000. Assuming a plan with constant installments, the monthly payment amounts to $138,050.93. Commercial loan: 3-year loan, simple interest paid monthly at 0.75% per month If required reserves are 8%, what do the bank balance sheets look like? Ignore any loan loss reservere B) New Bank decides to invest $45 million in 30-day T-hills. The T-bills are currently trading at $99 for every $100 of face value. How many do they purchase? What does the balance sheet look like? C) On the third day of operations, deposits full by $5 million. What does the balance sheet look like? Are there any problems? D) To meet any shortfall in the previous question, New Bank will borrow the cash in the federal funds market. Management decides to borrow the needed funds for the remainder of the month (now 29 days). The required yield on a discount basis is 2.9%.? What does the balance sheet look like after this transaction? The fixed monthly payment is computed wing the following formula Prl+)" (1+r)" - 1 where Plathe mortgen principal (825/006), the monthly interest rate (6.25%/12) and will the number of monthly payments The following formula is used to determine the discount yield FV - PP300 yilda where FV is the face value of the instrument, PP the purchase price and M is the number of days to maturity, until maturity (80x12) PV M E) The end of the math finally arrive NewBatik leis all the red tre moto, T. How much w F) New Bank of its federal fame betwee. How much can be G) What does the best balance sheet for New Bank brake Calculate the demany iterumet certi H) Calestate New Bank's 10A and NIM for its first month. Are that interest une earning bedoen troom, and that Newlank bs in the tax bracket 1) Calle New Blank' ROE and finalul set, sluding its tax listine J) L Newlank were lo establish on : 0.26% of the banvibe for commercial how would this bed Recaldate News ROE and final balance sheet welding tax liabilities K) News BOE 4.9. ure te income out it rate to meet this topt? 3. The financial statements Be First National Bank (FNB) e bow how Balance Sheet Pirst National Bank Ats Liabilities and Equity Cash $150 $5.500 Demands from other on 1.150 Small the deposits Invest 4,000 Jumbo CD 3,200 Federal not Federal de pared 2.250 Low Eq 2.0 Rene for (1.125) 2005 $23.00 Totallitty Income Statement - First National Bank 12. Intex 1.650 Prvi fokus Nomineret income Nintertex Tim For First National Bank, catate A) Dell value of earning 13) Return onuity C) Hem D) Attila E) Equity multiple F) Profit margin G) Interest expert H) Pro for lo to 1) Next 3) TX K) Nett 16:30 3/3 Ims.ozyegin.edu.tr 3