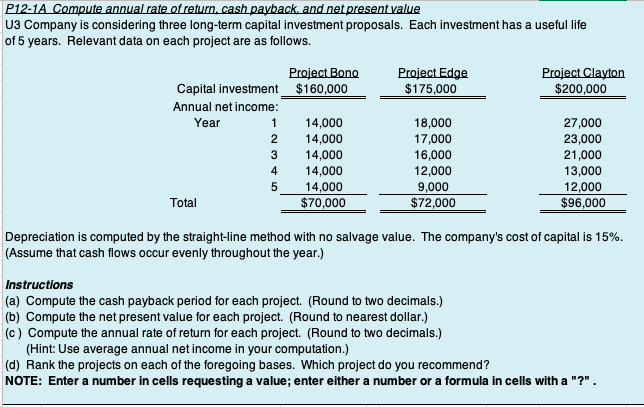

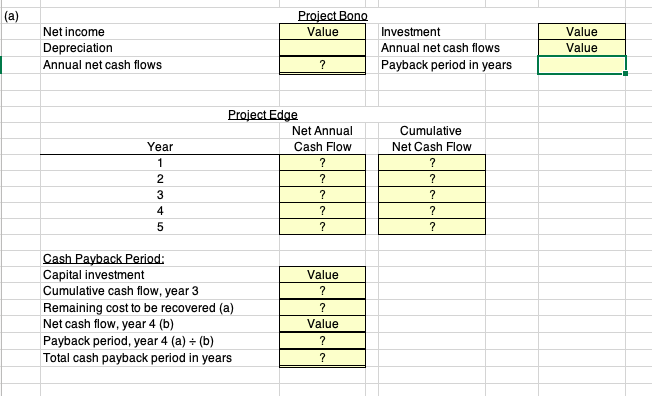

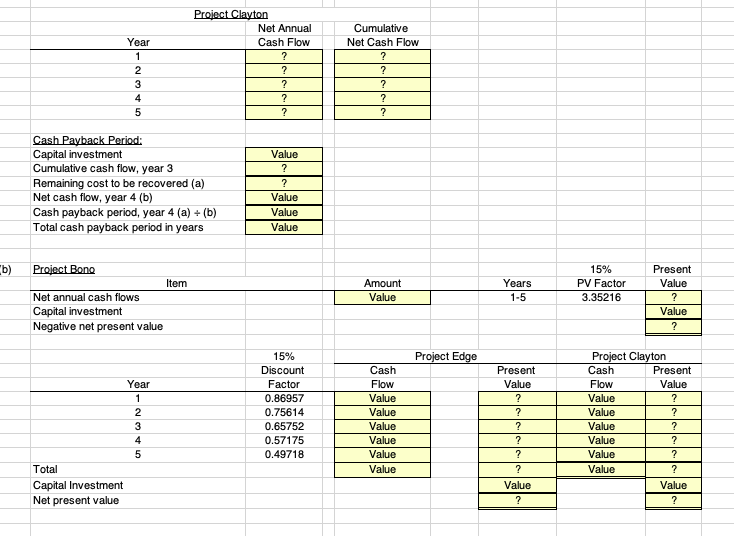

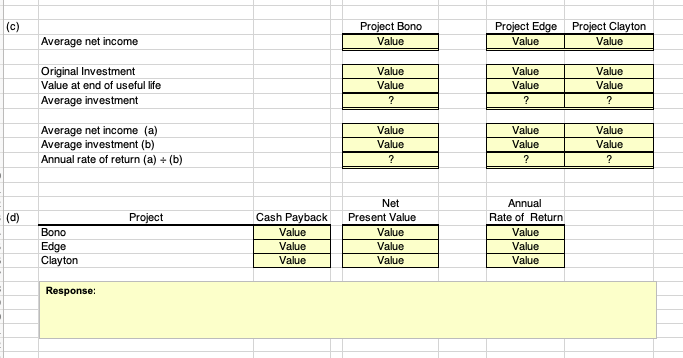

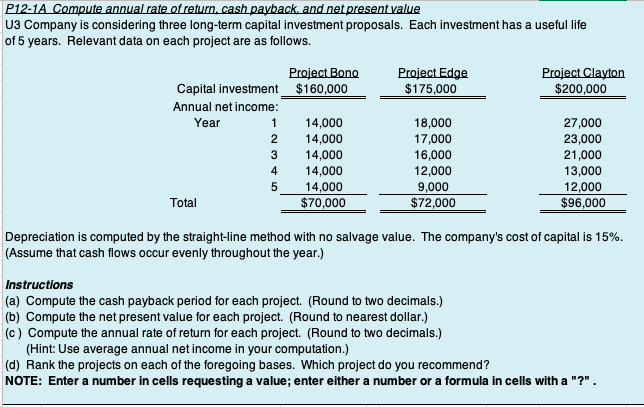

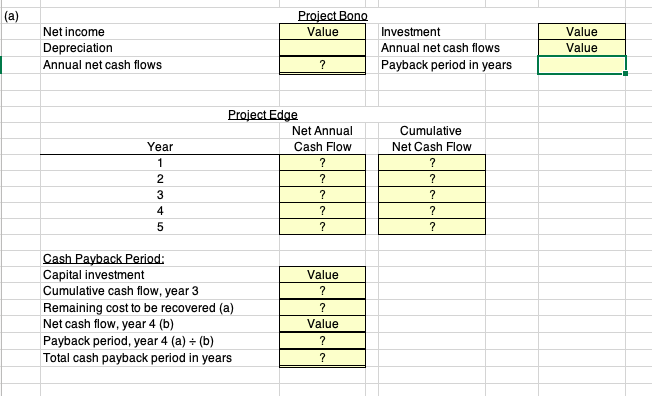

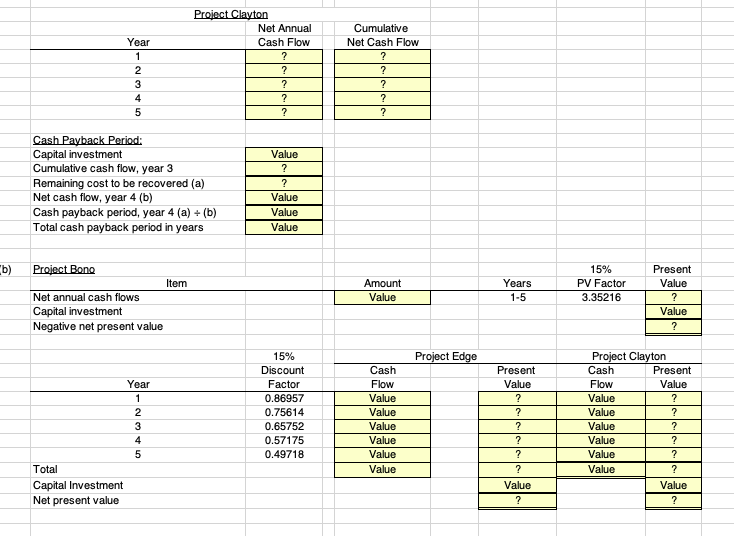

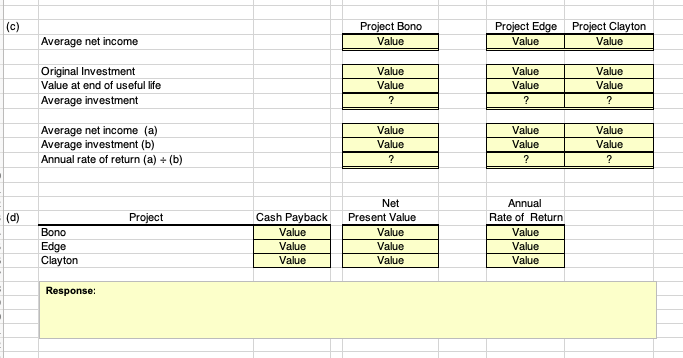

1 U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows ProiectEdge $175,000 Capital investment $160,000 $200,000 Annual net income 14,000 2 14,000 3 14,000 4 14,000 5 14,000 $70,000 18,000 17,000 16,000 12,000 9,000 $72,000 Year 27,000 23,000 21,000 13,000 12,000 $96,000 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Instructions (a) Compute the cash payback period for each project. (Round to two decimals.) (b) Compute the net present value for each project. (Round to nearest dollar.) (c) Compute the annual rate of return for each project. (Round to two decimals.) (Hint: Use average annual net income in your computation.) (d) Rank the projects on each of the foregoing bases. Which project do you recommend? NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "? Value Net income Depreciation Annual net cash flows Investment Annual net cash flows Payback period in years Value Value Net Annual Cash Flow Cumulative Net Cash Flow Year 2 4 Cash Payback Period Capital investment Cumulative cash flow, year 3 Remaining cost to be recovered (a) Net cash flow, year 4 (b) Payback period, year 4 (a) + (b) Total cash payback period in years Value Value Net Annual Cash Flow Cumulative Net Cash Flow Year Capital investment Cumulative cash flow, year 3 Remaining cost to be recovered (a) Net cash flow, year 4 (b) Cash payback period, year 4 (a) + (b) Total cash payback period in years Value Value Value Value 15% PV Factor 3.35216 b)Proiect Bono Present Value Item Years Net annual cash flows Capital investment Negative net present value Value Value 15% Discount Factor 0.86957 0.75614 0.65752 0.57175 0.49718 Cash Flow Value Value Value Value Value Value Present Value Cash Flow Value Value Value Value Value Value Present Value Year Total Capital Investment Net present value Value Value Project Bono Value Project E Value Project Clayton Value Average net income Original Investment Value at end of useful life Value Value Value Value Value Value Average investment Average net income (a) Average investment (b) Annual rate of return (a)-(b) Value Value Value Value Value Value Net Annual Rate of Return Value Value Value Project Cash Payback Value Value Value Present Value Bono Edge Clayton Value Value Value