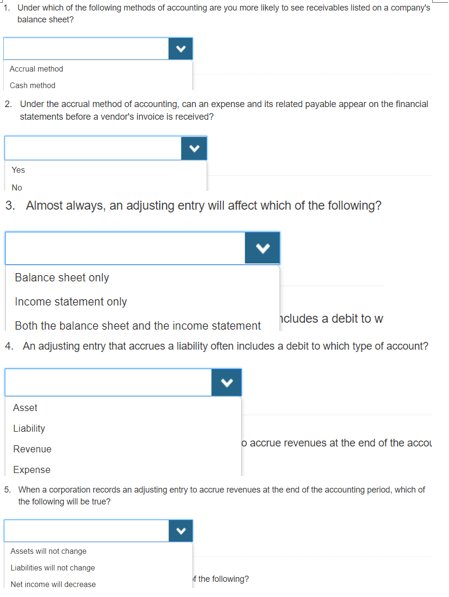

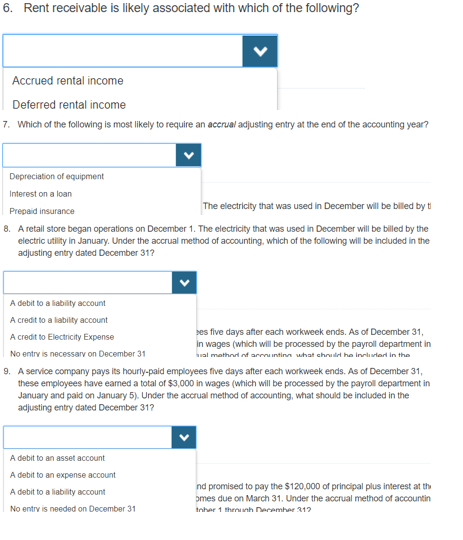

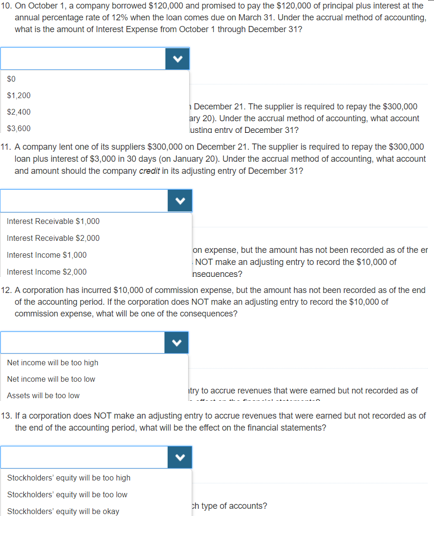

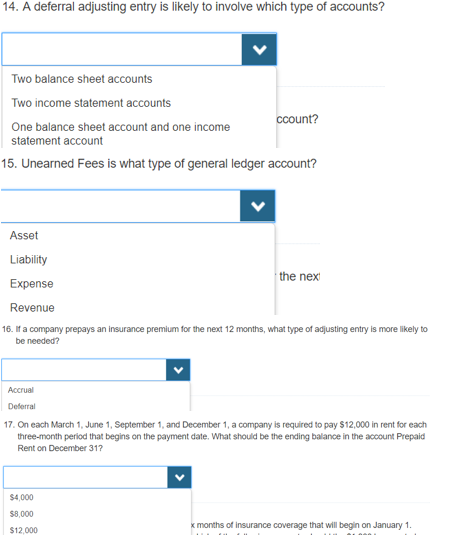

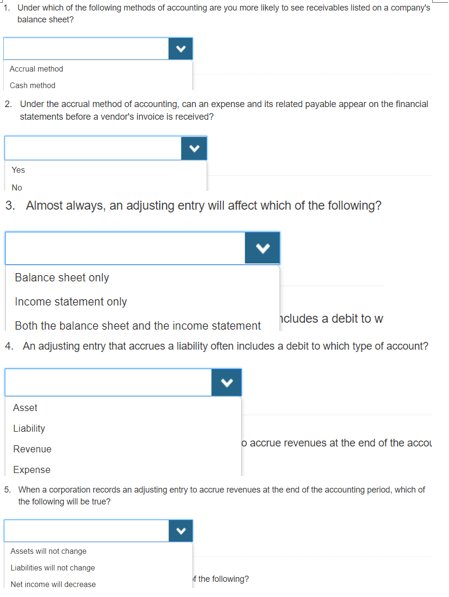

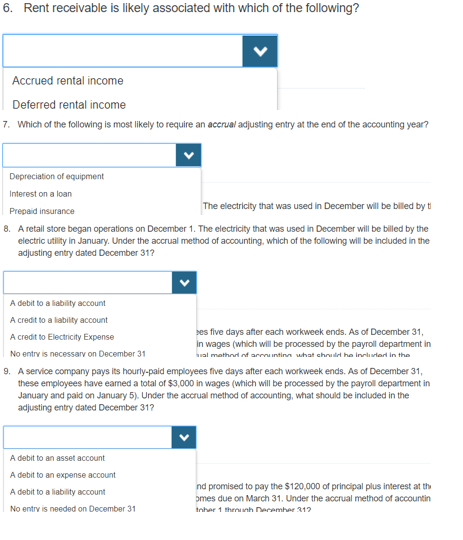

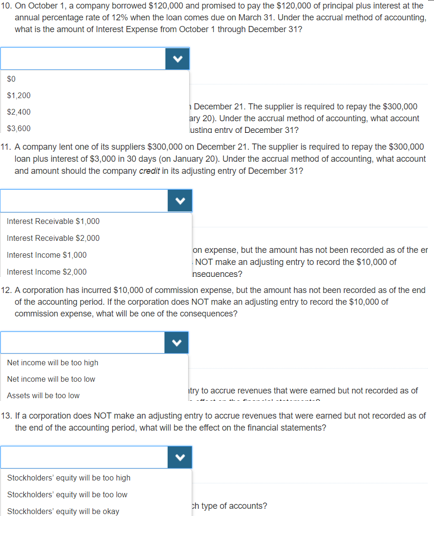

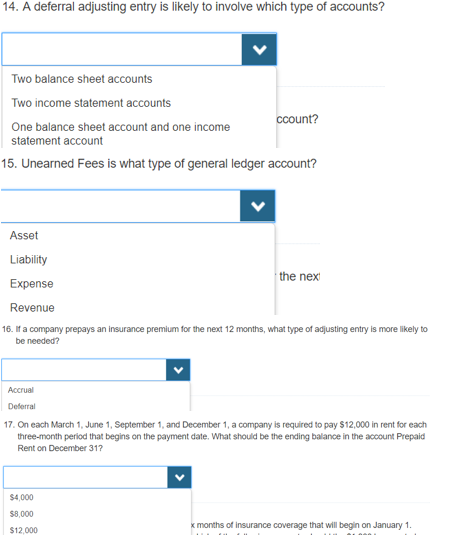

1. Under which of the following methods of accounting are you more likely to see recelvables listed on a company's balance sheet? Accrual method Cash method 2. Under the accrual method of accounting, can an expense and its related payable appear on the financial statements before a vendor's invoice is received? Yes No 3. Almost always, an adjusting entry will affect which of the following? Balance sheet only Income statement only Both the balance sheet and the income statement cludes a debit to w 4. An adjusting entry that accrues a liability often includes a debit to which type of account? Asset Liability Revenue Expense When a corporation records an adjusting entry to accrue revenues at the end of the accounting period, which of accrue revenues at the end of the acco 5. the following will be true? Assets will not change Liablities will not change Net income will decrease the following? 6. Rent receivable is likely associated with which of the following? Accrued rental income Deferred rental income 7. Which of the following is most likely to require an accrual adjusting entry at the end of the accounting year? Depreciation of equipment Interest on a loan Prepaid insurance The electricity that was used in December will be billed by t 8. A retail store began operations on December 1. The electricity that was used in December will be billed by the electric utility in January. Under the accrual method of accounting, which of the following will be included in the adjusting entry dated December 31? A debit to a iability account A credit to a lability account A credit to Electricity Expense No entrv is necessary on December 31 es five days after each workweek ends. As of December 31 wages (which will be processed by the payroll department in 9. A service company pays its hourly-paid employees five days after each workweek ends. As of December 31 these employees have eamed a total of $3,000 in wages (which will be processed by the payrol department in January and paid on January 5). Under the accrual method of accounting, what should be included in the adjusting entry dated December 31? A debit to an asset account A debit to an expense account A debit to a liability account No entry is needed on December 31 promised to pay the $120,000 of principal plus interest at th mes due on March 31, Under the accrual method of accountin 10. On October 1, a company borrowed $120,000 and promised to pay the $120,000 of principal plus interest at the annual percentage rate of 12% when the loan comes due on March 31, Under the accrual method of accounting. what is the amount of Interest Expense from October 1 through December 31? S0 $1,200 2,400 $3,600 December 21. The supplier is required to repay the $300,000 ary 20). Under the accrual method of accounting, what account ustina entrv of December 31 11. A company lent one of its suppliers $300,000 on December 21. The supplier is required to repay the $300,000 loan plus interest of $3,000 in 30 days (on January 20) Under the accrual method of accounting, what account and amount should the company crealit in its adjusting entry of December 31? Interest Receivable $1,000 Interest Receivable $2,000 Interest Income $1,000 Interest Income $2,000 expense, but the NOT make an adjusting entry to record the $10,000 of amount has not been recorded as of the er 12. A corporation has incurred $10,000 of commission expense, but the amount has not been recorded as of the end of the accounting period. If the corporation does NOT make an adjusting entry to record the $10,000 of commission expense, what will be one of the consequences? Net income will be too high Net income will be too low Assets will be too low to accrue revenues that were eaned but not recorded as of 13. If a corporation does NOT make an adjusting entry to accrue revenues that were eamed but not recorded as of the end of the accounting period, what will be the effect on the financial statements? Stockholders' equity will be too high Stockholders equity will be too low Stockholders equity will be okay type of accounts? 14. A deferral adjusting entry is likely to involve which type of accounts? Two balance sheet accounts Two income statement accounts One balance sheet account and one income ccount? statement account 15. Unearned Fees is what type of general ledger account? Asset Liability Expense Revenue the nex 16. If a company prepays an insurance premium for the next 12 months, what type of adjusting entry is more likely to be needed? Accrual Deferral 17. On each March 1, June 1, September 1, and December 1, a company is required to pay $12,000 in rent for each three-month period that begins on the payment date. What should be the ending balance in the account Prepaid Rent on December 31? $4,000 $8,000 $12,000 x months of insurance coverage that will begin on January 1