Question

You are a senior manager of a large public accounting firm. One of your clients, Sam Sellit, recently called you for some tax advice. Sam

You are a senior manager of a large public accounting firm. One of your clients, Sam Sellit, recently called you for some tax advice.

Sam is a salesperson for Panoramic Pools, a construction company that builds and sells prefabricated swimming pools. The company operates several franchises throughout the United States. Sam has progressed to become the top salesperson for the franchise where he is employed. Sam has done so well that he is considering purchasing his own franchise. This year he contacted the regional office about the possibility of opening up his own shop. The vice president in charge of expansion, Greg Grow, suggested that the two of them meet at the company’s annual meeting of franchises, held in Orlando, Florida. Greg knew that Sam, although not a franchisee, would be attending because he was the top salesperson in his office, and the company invites the top salesperson from each office as well as his or her spouse to attend the meeting.

While at the four-day meeting (Tuesday through Friday) in Orlando, Sam and his wife, Sue, met with Greg and discussed the potential venture. In addition, Greg allowed Sam and Sue to attend the parts of the meeting that were only for franchisees so that they could get a glimpse of how the company operated. Of course, while they were in Orlando, Sam and his wife visited all of the tourist attractions. On Tuesday, there were no meetings scheduled and everyone spent the day at Disney World and Epcot Center. On Thursday afternoon, no meetings were scheduled and the couple went with Greg and his wife to Sea World. Sam attended meetings for several hours on Friday while his wife played golf. The couple stayed over through Sunday and continued their sightseeing activities. The company picked up the tab for the couple’s trip, reimbursing Sam $3,500 which included the cost of air fare, meals, lodging, and entertainment.

Sam wants to know if the $3,500 payment he received is considered taxable income to him. If any of the $3,500 is taxable, Sam also wants to know if he will be allowed any offsetting deductions for the expenses he incurred.

Research the issue(s) and write a Research Memorandum detailing the results of your research.

1. Use RIA Checkpoint to research and complete this assignment. Use Chapter #2 of your textbook as a reference as you work on this project.

2. Write a Research Memorandum to convey your conclusions. See Exhibit 2-9 of your textbook for a sample memorandum. Make sure you prepare a Research Memorandum – NOT a Client Letter.

3. The memo must be in proper form:

- A concise statement of pertinent facts.

- An identification of all tax issues (include list of authorities used).

- Your conclusions.

- A thorough discussion of the reasoning (analysis) upon which your conclusions are based.

- Citations, in proper form, to all primary authority relied on in reaching your conclusion,

e.g., code sections, reg. sections, court case, revenue ruling, etc.

4. Any primary authority discussed in your memorandum must be tied into the facts of this particular assignment. Do not merely recite the law without explicitly relating it to the facts at issue.

5. Secondary authority may NOT be cited in your memorandum. It should only be used to help you find relevant primary authority.

6. Your memorandum must be typed. Your paper must be double-spaced.

7. Your grade will be based on the following:

- How well you performed the research, e.g., did you locate, cite, and discuss the

relevant law.

- The quality of your written communication.

- The quality of your discussion of the issues.

- Your conclusions.

8. At a minimum your memorandum should cite:

Two Internal Revenue Code sections.

Two court cases (at least one of the cases should be a circuit court case). Since you are not being given residence information, you may use a circuit court case from any circuit.

One other primary source, e.g., revenue ruling, revenue procedure, notice, etc. Do not use another case or Internal Revenue Code section for this requirement.

Important:

1. You may discuss your conclusions and rationale for such conclusions with your classmates. However, you must perform your own research and write your own memorandum without input from other students. Do not allow other students to read your memorandum.

2. Do not copy and paste any language from any sources into your memorandum.

TAXPAYER INFORMATION

You are a senior manager of a large public accounting firm. One of your clients, Sam Sellit, recently called you for some tax advice.

Sam is a salesperson for Panoramic Pools, a construction company that builds and sells prefabricated swimming pools. The company operates several franchises throughout the United States. Sam has progressed to become the top salesperson for the franchise where he is employed. Sam has done so well that he is considering purchasing his own franchise. This year he contacted the regional office about the possibility of opening up his own shop. The vice president in charge of expansion, Greg Grow, suggested that the two of them meet at the company’s annual meeting of franchises, held in Orlando, Florida. Greg knew that Sam, although not a franchisee, would be attending because he was the top salesperson in his office, and the company invites the top salesperson from each office as well as his or her spouse to attend the meeting.

While at the four-day meeting (Tuesday through Friday) in Orlando, Sam and his wife, Sue, met with Greg and discussed the potential venture. In addition, Greg allowed Sam and Sue to attend the parts of the meeting that were only for franchisees so that they could get a glimpse of how the company operated. Of course, while they were in Orlando, Sam and his wife visited all of the tourist attractions. On Tuesday, there were no meetings scheduled and everyone spent the day at Disney World and Epcot Center. On Thursday afternoon, no meetings were scheduled and the couple went with Greg and his wife to Sea World. Sam attended meetings for several hours on Friday while his wife played golf. The couple stayed over through Sunday and continued their sightseeing activities. The company picked up the tab for the couple’s trip, reimbursing Sam $3,500 which included the cost of air fare, meals, lodging, and entertainment.

Sam wants to know if the $3,500 payment he received is considered taxable income to him. If any of the $3,500 is taxable, Sam also wants to know if he will be allowed any offsetting deductions for the expenses he incurred.

Please research the issue(s) and write a Research Memorandum detailing the results of your research.

1. Use RIA Checkpoint to research and complete this assignment. Use Chapter #2 of your textbook as a reference as you work on this project.

2. Write a Research Memorandum to convey your conclusions. See Exhibit 2-9 of your textbook for a sample memorandum. Make sure you prepare a Research Memorandum – NOT a Client Letter.

3. The memo must be in proper form:

- A concise statement of pertinent facts.

- An identification of all tax issues (include list of authorities used).

- Your conclusions.

- A thorough discussion of the reasoning (analysis) upon which your conclusions are based.

- Citations, in proper form, to all primary authority relied on in reaching your conclusion,

e.g., code sections, reg. sections, court case, revenue ruling, etc.

4. Any primary authority discussed in your memorandum must be tied into the facts of this particular assignment. Do not merely recite the law without explicitly relating it to the facts at issue.

5. Secondary authority may NOT be cited in your memorandum. It should only be used to help you find relevant primary authority.

6. Your memorandum must be typed. Your paper must be double-spaced.

7. Your grade will be based on the following:

- How well you performed the research, e.g., did you locate, cite, and discuss the

relevant law.

- The quality of your written communication.

- The quality of your discussion of the issues.

- Your conclusions.

8. At a minimum your memorandum should cite:

Two Internal Revenue Code sections.

Two court cases (at least one of the cases should be a circuit court case). Since you are not being given residence information, you may use a circuit court case from any circuit.

One other primary source, e.g., revenue ruling, revenue procedure, notice, etc. Do not use another case or Internal Revenue Code section for this requirement.

Important:

1. You may discuss your conclusions and rationale for such conclusions with your classmates. However, you must perform your own research and write your own memorandum without input from other students. Do not allow other students to read your memorandum.

2. Do not copy and paste any language from any sources into your memorandum.

TAXPAYER INFORMATION

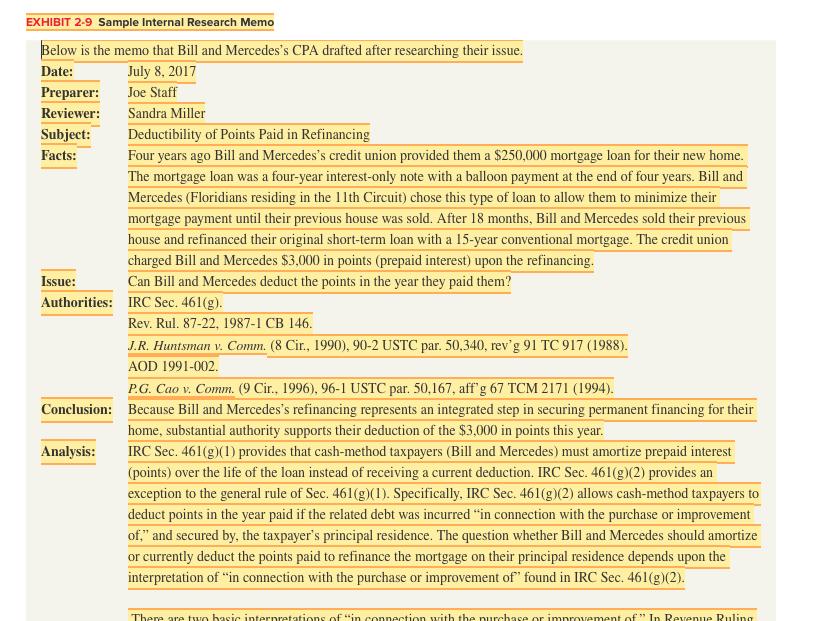

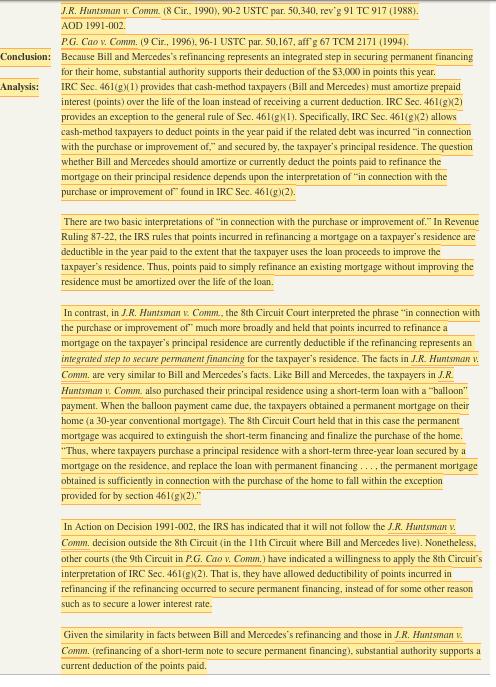

EXHIBIT 2-9 Sample Internal Research Memo Below is the memo that Bill and Mercedes's CPA drafted after researching their issue. Date: July 8, 2017 Joe Staff Preparer: Reviewer: Sandra Miller Subject: Deductibility of Points Paid in Refinancing Four years ago Bill and Mercedes's credit union provided them a $250,000 mortgage loan for their new home. The mortgage loan was a four-year interest-only note with a balloon payment at the end of four years. Bill and Facts: Mercedes (Floridians residing in the 1lth Circuit) chose this type of loan to allow them to minimize their mortgage payment until their previous house was sold. After 18 months, Bill and Mercedes sold their previous house and refinanced their original short-term loan with a 15-year conventional mortgage. The credit union charged Bill and Mercedes $3,000 in points (prepaid interest) upon the refinancing. Can Bill and Mercedes deduct the points in the year they paid them? Issue: Authorities: IRC Sec. 461(g). Rev. Rul. 87-22, 1987-1 CB 146. J.R. Huntsman v. Comm. (8 Cir., 1990), 90-2 USTC par. 50,340, rev'g 91 TC 917 (1988). AOD 1991-002. P.G. Cao v. Comm. (9 Cir., 1996), 96-1 USTC par. 50,167, aff'g 67 TCM 2171 (1994). Conclusion: Because Bill and Mercedes's refinancing represents an integrated step in securing permanent financing for their home, substantial authority supports their deduction of the $3,000 in points this year. Analysis: IRC Sec. 461(g)(1) provides that cash-method taxpayers (Bill and Mercedes) must amortize prepaid interest (points) over the life of the loan instead of receiving a current deduction. IRC Sec. 461(g)(2) provides an exception to the general rule of Sec. 461(g)(1). Specifically, IRC Sec. 461(g)(2) allows cash-method taxpayers to deduct points in the year paid if the related debt was incurred "in connection with the purchase or improvement of," and secured by, the taxpayer's principal residence. The question whether Bill and Mercedes should amortize or currently deduct the points paid to refinance the mortgage on their principal residence depends upon the interpretation of "in connection with the purchase or improvement of" found in IRC Sec. 461(g)(2). There are two hasi interpretations of "in connection with the purchase or improvement of " In Revenue Ruling

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

All money paid to Sam which included the cost of ai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started