Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am learning intermediate accounting and how to account for leases. I have a question about the calculation of present value for the right to

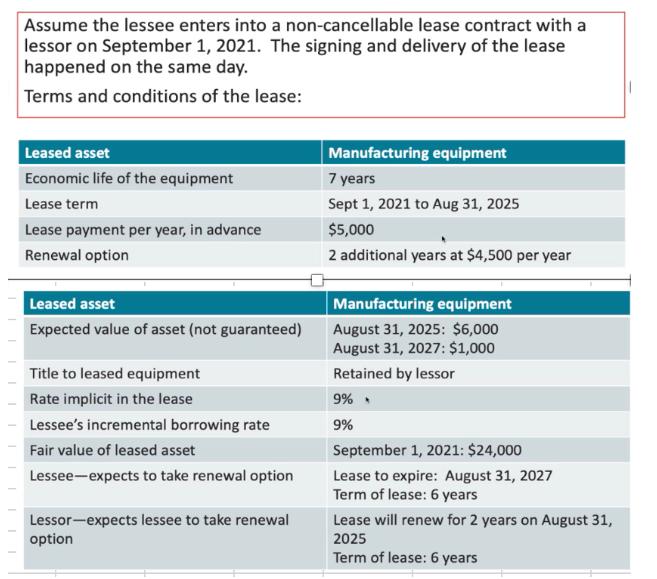

I am learning intermediate accounting and how to account for leases. I have a question about the calculation of present value for the right to use of the lease. my example specifically has a potential 2 year extension that both the lessee and lessor expect to use. here is the example:

I am curious to know why the "n" value for the extension of the lease is calculated at 4 and 5 for the lease when the original lease is for 4 years and the extensions are for years 5 and 6?

Assume the lessee enters into a non-cancellable lease contract with a lessor on September 1, 2021. The signing and delivery of the lease happened on the same day. Terms and conditions of the lease: Leased asset Economic life of the equipment Lease term Lease payment per year, in advance Renewal option Leased asset Expected value of asset (not guaranteed) Title to leased equipment Rate implicit in the lease Lessee's incremental borrowing rate Fair value of leased asset Lessee-expects to take renewal option Lessor-expects lessee to take renewal option Manufacturing equipment 7 years Sept 1, 2021 to Aug 31, 2025 $5,000 2 additional years at $4,500 per year Manufacturing equipment August 31, 2025: $6,000 August 31, 2027: $1,000 Retained by lessor 9% 9% September 1, 2021: $24,000 Lease to expire: August 31, 2027 Term of lease: 6 years Lease will renew for 2 years on August 31, 2025 Term of lease: 6 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution The n value in the calculation of the present value of the lease payments represents the nu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started