Answered step by step

Verified Expert Solution

Question

1 Approved Answer

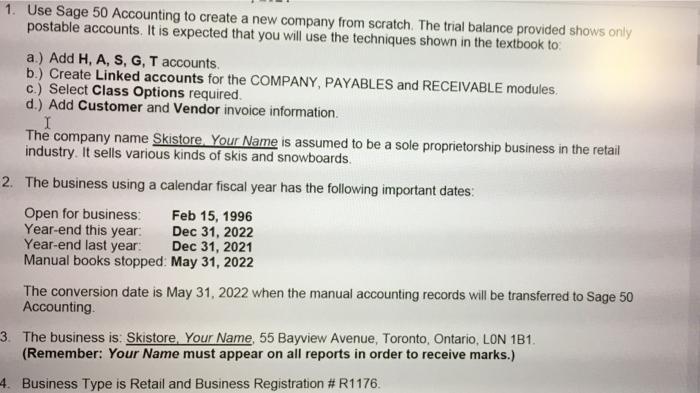

1. Use Sage 50 Accounting to create a new company from scratch. The trial balance provided shows only postable accounts. It is expected that

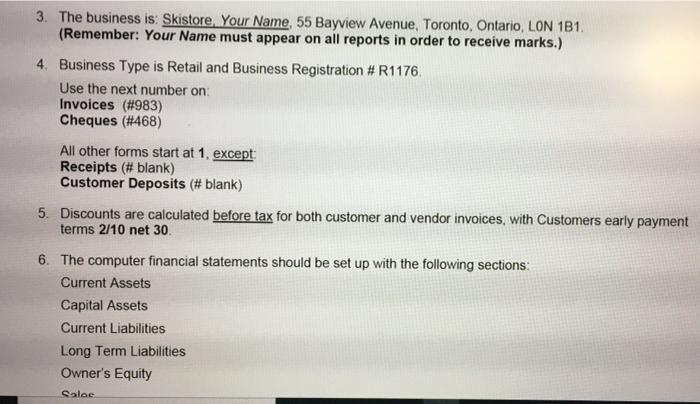

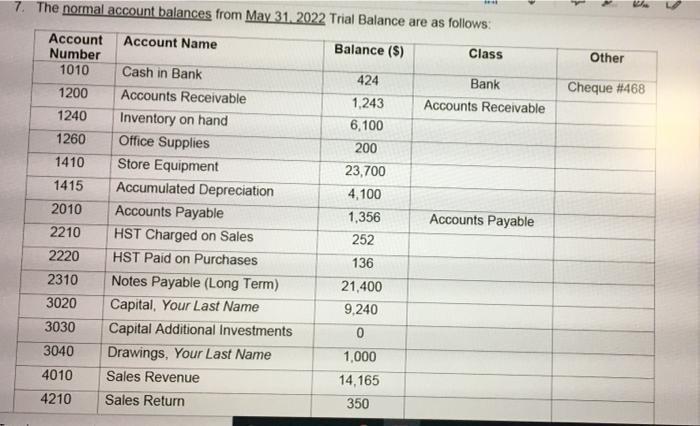

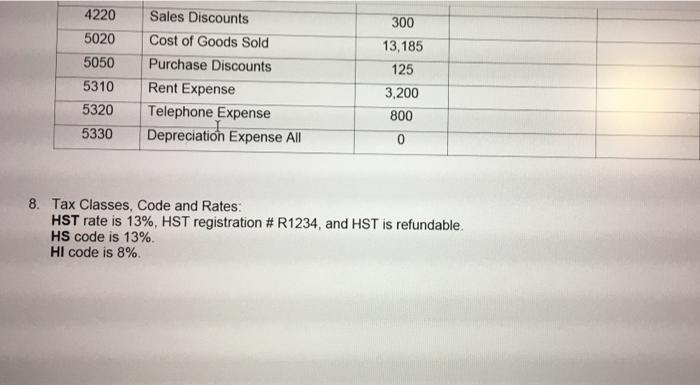

1. Use Sage 50 Accounting to create a new company from scratch. The trial balance provided shows only postable accounts. It is expected that you will use the techniques shown in the textbook to: a.) Add H, A, S, G, T accounts. b.) Create Linked accounts for the COMPANY, PAYABLES and RECEIVABLE modules. c.) Select Class Options required. d.) Add Customer and Vendor invoice information. I The company name Skistore, Your Name is assumed to be a sole proprietorship business in the retail industry. It sells various kinds of skis and snowboards. 2. The business using a calendar fiscal year has the following important dates: Open for business: Year-end this year: Year-end last year: Feb 15, 1996 Dec 31, 2022 Dec 31, 2021 Manual books stopped: May 31, 2022 The conversion date is May 31, 2022 when the manual accounting records will be transferred to Sage 50 Accounting. 3. The business is: Skistore, Your Name, 55 Bayview Avenue, Toronto, Ontario, LON 1B1. (Remember: Your Name must appear on all reports in order to receive marks.) 4. Business Type is Retail and Business Registration # R1176. 3. The business is: Skistore, Your Name, 55 Bayview Avenue, Toronto, Ontario, LON 1B1. (Remember: Your Name must appear on all reports in order to receive marks.) 4. Business Type is Retail and Business Registration # R1176. Use the next number on: Invoices (#983) Cheques (#468) All other forms start at 1, except: Receipts (# blank) Customer Deposits (# blank) 5. Discounts are calculated before tax for both customer and vendor invoices, with Customers early payment terms 2/10 net 30. 6. The computer financial statements should be set up with the following sections: Current Assets Capital Assets Current Liabilities Long Term Liabilities Owner's Equity Salos 7. The normal account balances from May 31, 2022 Trial Balance are as follows: Account Account Name Number 1010 1200 1240 1260 1410 1415 2010 2210 2220 2310 3020 3030 3040 4010 4210 Cash in Bank Accounts Receivable Inventory on hand Office Supplies Store Equipment Accumulated Depreciation Accounts Payable HST Charged on Sales HST Paid on Purchases Notes Payable (Long Term) Capital, Your Last Name Capital Additional Investments Drawings, Your Last Name Sales Revenue Sales Return Balance ($) 424 1,243 6,100 200 23,700 4,100 1,356 252 136 21,400 9,240 0 1,000 14,165 350 Class Bank Accounts Receivable Accounts Payable Other Cheque #468 4220 5020 5050 5310 5320 5330 Sales Discounts Cost of Goods Sold Purchase Discounts Rent Expense Telephone Expense Depreciation Expense All 300 13,185 125 3,200 800 0 8. Tax Classes, Code and Rates: HST rate is 13%, HST registration # R1234, and HST is refundable. HS code is 13%. HI code is 8%.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To create a new company in Sage 50 Accounting you will need to follow the steps outlined in the textbook Start by entering the company information inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started