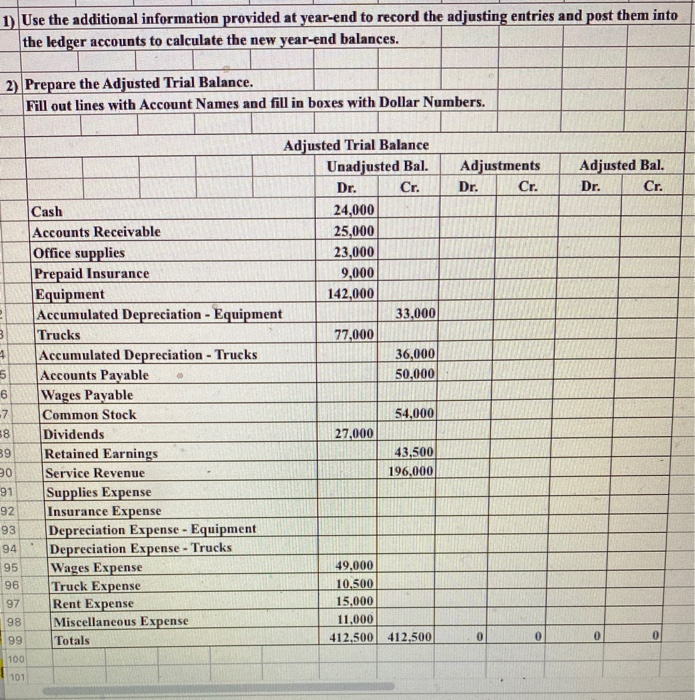

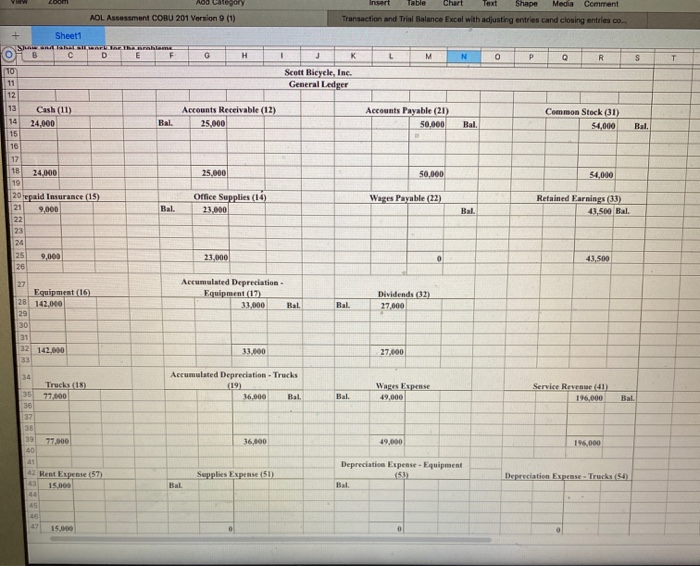

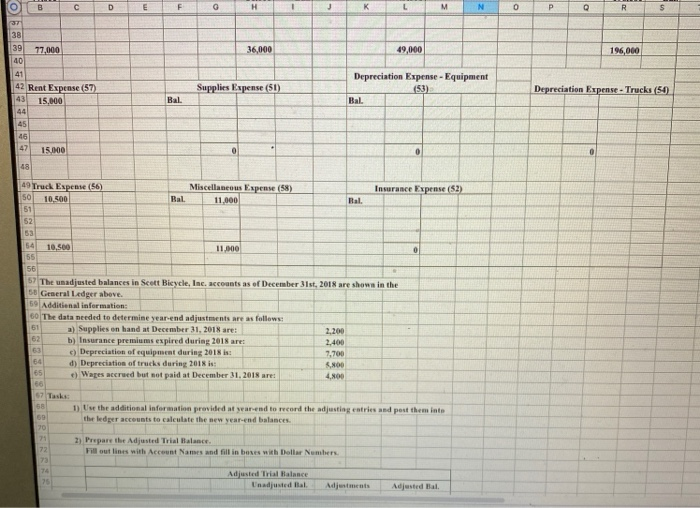

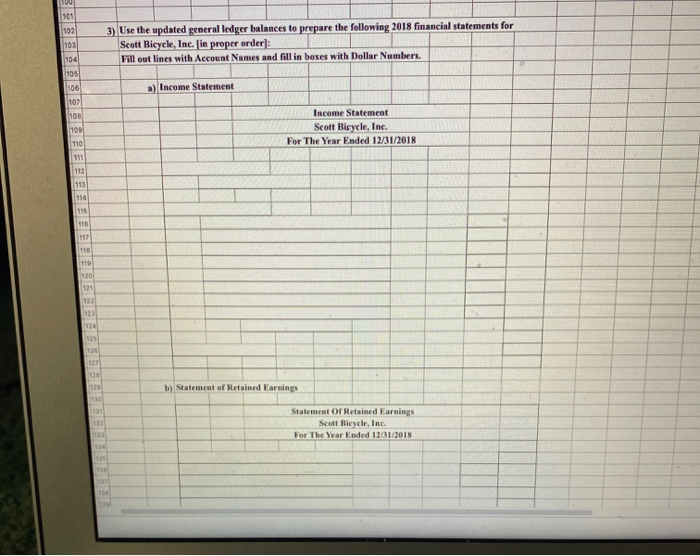

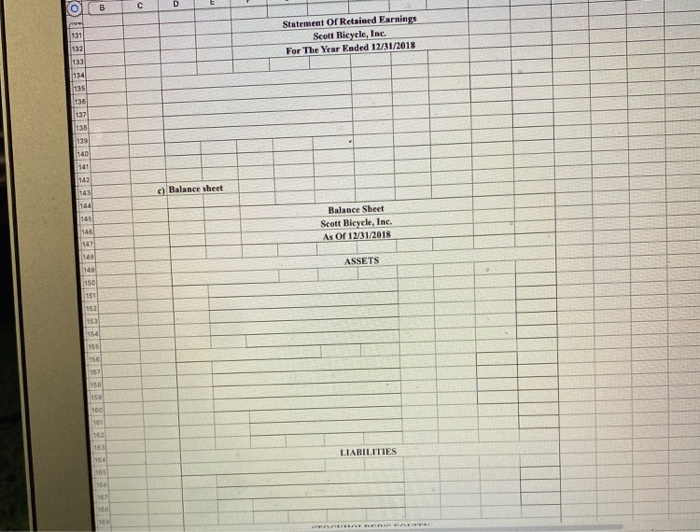

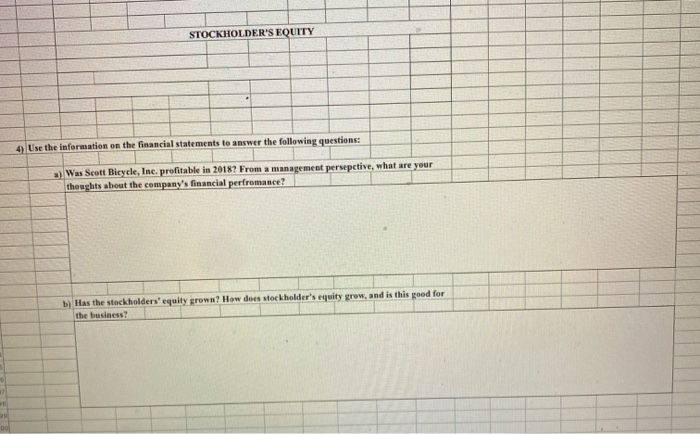

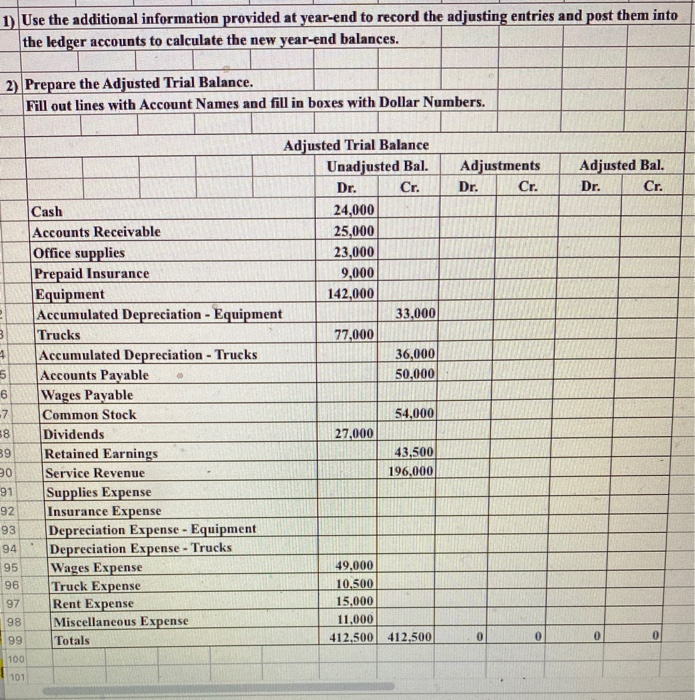

1) Use the additional information provided at year-end to record the adjusting entries and post them into the ledger accounts to calculate the new year-end balances. 2) Prepare the Adjusted Trial Balance. Fill out lines with Account Names and fill in boxes with Dollar Numbers. Adjustments Dr. Cr. Adjusted Bal. Dr. Cr. + Adjusted Trial Balance Unadjusted Bal. Dr. Cr. Cash 24,000 Accounts Receivable 25,000 Office supplies 23,000 Prepaid Insurance 9,000 Equipment 142,000 Accumulated Depreciation - Equipment 33.000 Trucks 77,000 Accumulated Depreciation - Trucks 36,000 Accounts Payable 50,000 Wages Payable Common Stock 54,000 Dividends 27,000 Retained Earnings 43,500 Service Revenue 196,000 Supplies Expense Insurance Expense Depreciation Expense - Equipment Depreciation Expense - Trucks Wages Expense 49.000 Truck Expense 10,500 Rent Expense 15,000 Miscellaneous Expense 11,000 Totals 412.500 412.500 0 Table Chart Text Shape Veda Comment AOL Assessment COBU 201 Version (1) Transaction and Trial Balance Excel with adjusting entries and closing entries o Sheet N Scott Bicycle, Inc. General Ledger Accounts Receivable (12) 25.000 Accounts Payable (21) 50,000 Common Stock (31) 54,000 14 24.000 Bal Bal Bal. 24.100 50.000 20 paid leverance (15) Wages Payale (22) Office Supplies (14) 23.000 Retained Earnings (1) 41. Bal. Bal 9.000 23.000 41.500 Equipment (16) 28 142.000 Accumulated Depreciation Equipment (1) 11,000 Ral 27 000 32 142000 33.000 Accumulated Depreciation - Trucks Wages Expo Service Re (41) 196,000 36,000 Ral 49.000 Bal. 36,000 195.000 Depreciation Expense - Equipment 42 Rent Expo (57) Supplies Expense (51) 39 27.000 196,000 Depreciation Expense - Equipment Supplies Expense (51) 53 Depreciation Expense - Trucks (54) 42 Rent Expense (57) 43 15.000 e Bal. 47 15 100 49 Truck Expense (56 Miscellaneous Expense (58) Ral 11.000 57 The unadjusted balances in Scott Bicycle, Inc. accounts as of December 31st, 2018 are shown in the 58 General Ledger above. 59 Additional information 60 The data needed to determine yearend adjustments are as follows: a) Supplies on hand at December 31, 2018 are: 2200 b) Insurance premiums expired during 2018 are: 2.400 c) Depreciation of equipment during 2018 is: 2700 d) Depreciation of trucks during 2018 is: 6) Wages accrued but not paid at December 31, 2018 are: 4,800 NOD 57 Taske 59 1) Uw the additional information provided at yearend to record the adjusting entries and post them into the ledger accounts to calculate the new year-end balances 2) Prepare the Adjusted Trial Balance Fill outlines with Account Names and fill in boxes with Dollar Numbers Adjusted Trial Balance Unadjusted al Adjust Adjusted Bal. 3) Use the updated general ledger balances to prepare the following 2018 financial statements for Scott Bicycle, Inc. in proper order: Fill out lines with Account Names and fill in boxes with Dollar Numbers. Income Statements Scott Bigyele, Inc. SE For The Year Ended 12/31/2018 Statement of Retained Earnings Scott Bicycle, Inc. Statement or Retained Earnings Scott Bicycle, Inc. For The Year Ended 12/31/2018 a Balance sheet Balance Sheet Scott Bicycle, Inc. As of 12/01/2018 ASSETS STOCKHOLDER'S EQUITY Use the information on the financial statements to answer the following questions: a) Was Scott Bicycle, Inc. profitable in 2018? From a management perspetive, what are your thoughts about the company's financial perfromance? b) Has the stockholders' equity grow? How does stockholder's equity grow, and is this good for the business