Question: 1) Use the Balance Sheet Equation tab to record the transactions below and the adjusting entries for the 2022 calendar year. Use the first column

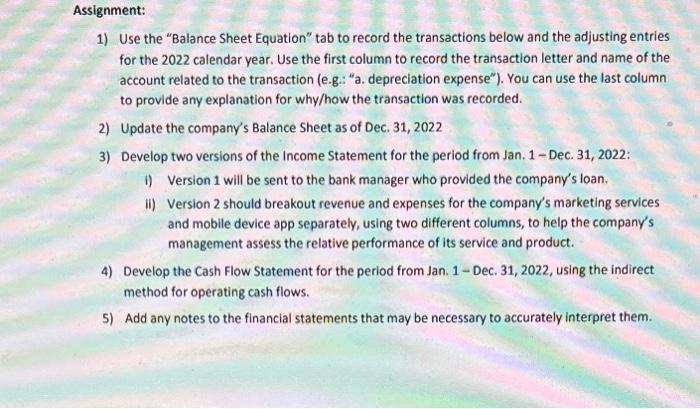

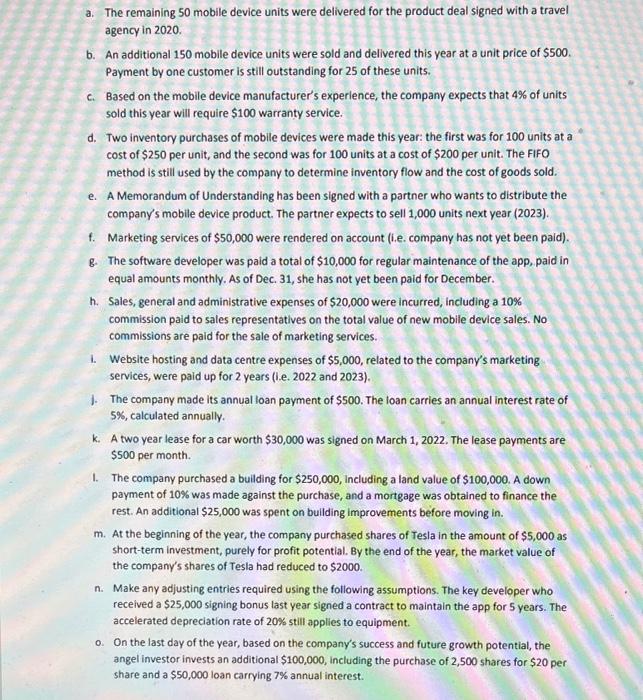

1) Use the "Balance Sheet Equation" tab to record the transactions below and the adjusting entries for the 2022 calendar year. Use the first column to record the transaction letter and name of the account related to the transaction (e.g.: "a. depreciation expense"). You can use the last column to provide any explanation for why/how the transaction was recorded. 2) Update the company's Balance Sheet as of Dec. 31, 2022 3) Develop two versions of the Income Statement for the period from Jan. 1 - Dec. 31, 2022: i) Version 1 will be sent to the bank manager who provided the company's loan. ii) Version 2 should breakout revenue and expenses for the company's marketing services and mobile device app separately, using two different columns, to help the company's management assess the relative performance of its service and product. 4) Develop the Cash Flow Statement for the period from Jan. 1 - Dec. 31, 2022, using the indirect method for operating cash flows. 5) Add any notes to the financial statements that may be necessary to accurately interpret them. a. The remaining 50 mobile device units were delivered for the product deal signed with a travel agency in 2020. b. An additional 150 mobile device units were sold and delivered this year at a unit price of $500. Payment by one customer is still outstanding for 25 of these units. c. Based on the mobile device manufacturer's experience, the company expects that 4% of units sold this year will require $100 warranty service. d. Two inventory purchases of mobile devices were made this year: the first was for 100 units at a cost of $250 per unit, and the second was for 100 units at a cost of $200 per unit. The FIFO method is still used by the company to determine inventory flow and the cost of goods sold. e. A Memorandum of Understanding has been signed with a partner who wants to distribute the company's mobile device product. The partner expects to sell 1,000 units next year (2023). f. Marketing services of $50,000 were rendered on account (i.e. company has not yet been paid). g. The software developer was paid a total of $10,000 for regular maintenance of the app, paid in equal amounts monthly. As of Dec. 31, she has not yet been paid for December. h. Sales, general and administrative expenses of $20,000 were incurred, including a 10% commission paid to sales representatives on the total value of new mobile device sales. No commissions are paid for the sale of marketing services. 1. Website hosting and data centre expenses of $5,000, related to the company's marketing services, were paid up for 2 years (i.e. 2022 and 2023). 1. The company made its annual loan payment of $500. The loan carries an annual interest rate of 5%, calculated annually. k. A two year lease for a car worth $30,000 was signed on March 1, 2022. The lease payments are $500 per month. 1. The company purchased a building for $250,000, including a land value of $100,000. A down payment of 10% was made against the purchase, and a mortgage was obtained to finance the rest. An additional $25,000 was spent on building improvements before moving in. m. At the beginning of the year, the company purchased shares of Tesla in the amount of $5,000 as short-term investment, purely for profit potential. By the end of the year, the market value of the company's shares of Tesla had reduced to $2000. n. Make any adjusting entries required using the following assumptions. The key developer who received a $25,000 signing bonus last year signed a contract to maintain the app for 5 years. The accelerated depreciation rate of 20% still applies to equipment. 0. On the last day of the year, based on the company's success and future growth potential, the angel investor invests an additional $100,000, including the purchase of 2,500 shares for $20 per share and a $50,000 loan carrying 7% annual interest. 1) Use the "Balance Sheet Equation" tab to record the transactions below and the adjusting entries for the 2022 calendar year. Use the first column to record the transaction letter and name of the account related to the transaction (e.g.: "a. depreciation expense"). You can use the last column to provide any explanation for why/how the transaction was recorded. 2) Update the company's Balance Sheet as of Dec. 31, 2022 3) Develop two versions of the Income Statement for the period from Jan. 1 - Dec. 31, 2022: i) Version 1 will be sent to the bank manager who provided the company's loan. ii) Version 2 should breakout revenue and expenses for the company's marketing services and mobile device app separately, using two different columns, to help the company's management assess the relative performance of its service and product. 4) Develop the Cash Flow Statement for the period from Jan. 1 - Dec. 31, 2022, using the indirect method for operating cash flows. 5) Add any notes to the financial statements that may be necessary to accurately interpret them. a. The remaining 50 mobile device units were delivered for the product deal signed with a travel agency in 2020. b. An additional 150 mobile device units were sold and delivered this year at a unit price of $500. Payment by one customer is still outstanding for 25 of these units. c. Based on the mobile device manufacturer's experience, the company expects that 4% of units sold this year will require $100 warranty service. d. Two inventory purchases of mobile devices were made this year: the first was for 100 units at a cost of $250 per unit, and the second was for 100 units at a cost of $200 per unit. The FIFO method is still used by the company to determine inventory flow and the cost of goods sold. e. A Memorandum of Understanding has been signed with a partner who wants to distribute the company's mobile device product. The partner expects to sell 1,000 units next year (2023). f. Marketing services of $50,000 were rendered on account (i.e. company has not yet been paid). g. The software developer was paid a total of $10,000 for regular maintenance of the app, paid in equal amounts monthly. As of Dec. 31, she has not yet been paid for December. h. Sales, general and administrative expenses of $20,000 were incurred, including a 10% commission paid to sales representatives on the total value of new mobile device sales. No commissions are paid for the sale of marketing services. 1. Website hosting and data centre expenses of $5,000, related to the company's marketing services, were paid up for 2 years (i.e. 2022 and 2023). 1. The company made its annual loan payment of $500. The loan carries an annual interest rate of 5%, calculated annually. k. A two year lease for a car worth $30,000 was signed on March 1, 2022. The lease payments are $500 per month. 1. The company purchased a building for $250,000, including a land value of $100,000. A down payment of 10% was made against the purchase, and a mortgage was obtained to finance the rest. An additional $25,000 was spent on building improvements before moving in. m. At the beginning of the year, the company purchased shares of Tesla in the amount of $5,000 as short-term investment, purely for profit potential. By the end of the year, the market value of the company's shares of Tesla had reduced to $2000. n. Make any adjusting entries required using the following assumptions. The key developer who received a $25,000 signing bonus last year signed a contract to maintain the app for 5 years. The accelerated depreciation rate of 20% still applies to equipment. 0. On the last day of the year, based on the company's success and future growth potential, the angel investor invests an additional $100,000, including the purchase of 2,500 shares for $20 per share and a $50,000 loan carrying 7% annual interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts