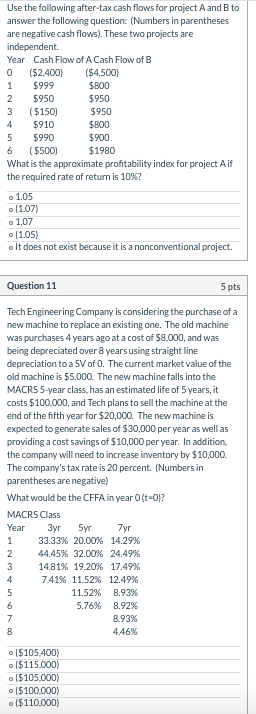

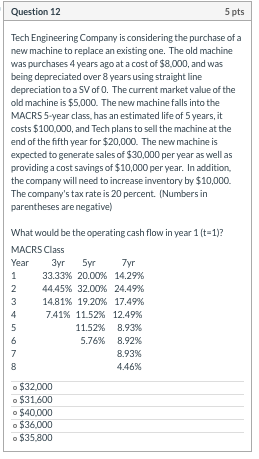

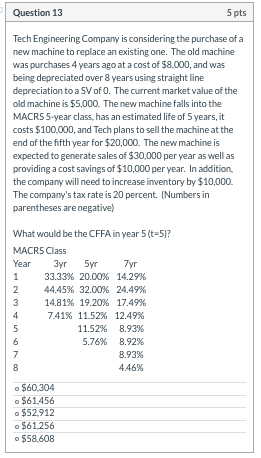

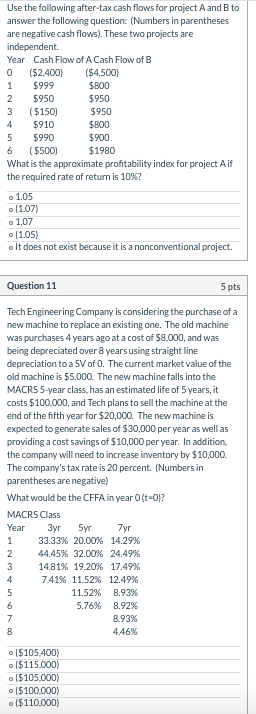

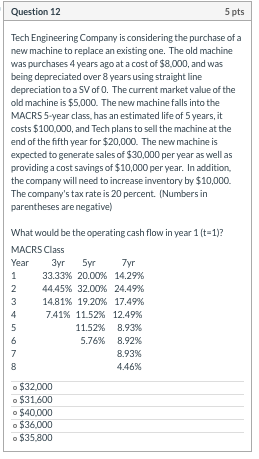

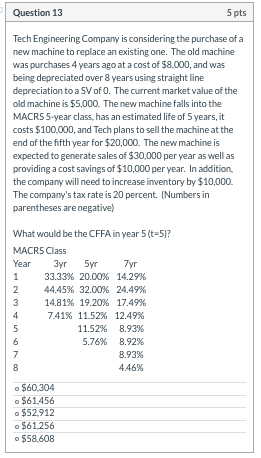

1 Use the following after-tax cash flows for project A and B to answer the following question: (Numbers in parentheses are negative cash flows). These two projects are independent. Year Cash Flow of A Cash Flow of B 0 ($2,400) ($4,500) $999 $800 2 $950 3 ($150) $950 4 $910 $800 5 $990 $900 6 ($500) $1980 What is the approximate profitability index for project Aif the required rate of return is 10%? $950 . 1.05 (1.07) . 107 (1.05) o It does not exist because it is a nonconventional project. Question 11 5 pts Tech Engineering Company is considering the purchase of a new machine to replace an existing one. The old machine was purchases 4 years ago at a cost of $8,000, and was being depreciated over 8 years using straight line depreciation to a SV of O. The current market value of the old machine is $5,000. The new machine falls into the MACRS 5-year class, has an estimated life of 5 years, it costs $100,000, and Tech plans to sell the machine at the end of the fifth year for $20,000. The new machine is expected to generate sales of $30,000 per year as well as providing a cost savings of $10,000 per year. In addition, the company will need to increase inventory by $10,000 The company's tax rate is 20 percent. (Numbers in parentheses are negative) What would be the CFFA in year (t=0)? MACRS Class Year Syr 7yr 33.33% 20.00% 14.29% 44.45% 32.00% 24.49% 14.81% 19.20% 17.49% 7.41% 11.52% 12.49% 5 11.52% 8.93% 5.76% 8.92% 7 8.93% 4.46% 2 3 4 6 8 ($105.400) ($115.000) ($105.000) ($100.000) ($110.000) Question 12 5 pts Tech Engineering Company is considering the purchase of a new machine to replace an existing one. The old machine was purchases 4 years ago at a cost of $8,000, and was being depreciated over 8 years using straight line depreciation to a SV of O. The current market value of the old machine is $5,000. The new machine falls into the MACRS 5-year class, has an estimated life of 5 years, it costs $100,000, and Tech plans to sell the machine at the end of the fifth year for $20,000. The new machine is expected to generate sales of $30,000 per year as well as providing a cost savings of $10,000 per year. In addition, the company will need to increase inventory by $10,000. The company's tax rate is 20 percent. (Numbers in parentheses are negative) 1 What would be the operating cash flow in year 1 (t=1)? MACRS Class Year 3yr 5yr 7yr 33.33% 20.00% 14.29% 2 44.45% 32.00% 24,49% 3 14.81% 19.20% 17.49% 4 7.41% 11.52% 12.49% 5 11.52% 8.93% 6 5.76% 8.92% 7 8.93% 8 4.46% o $32.000 o $31,600 $40,000 o $36.000 o $35,800 Question 13 5 pts Tech Engineering Company is considering the purchase of a new machine to replace an existing one. The old machine was purchases 4 years ago at a cost of $8,000, and was being depreciated over 8 years using straight line depreciation to a SV of O. The current market value of the old machine is $5,000. The new machine falls into the MACRS 5-year class, has an estimated life of 5 years, it costs $100,000, and Tech plans to sell the machine at the end of the fifth year for $20,000. The new machine is expected to generate sales of $30,000 per year as well as providing a cost savings of $10,000 per year. In addition, the company will need to increase inventory by $10,000 The company's tax rate is 20 percent. (Numbers in parentheses are negative) What would be the CFFA in year 5 (t-5)? MACRS Class Year 3yr Syr 7yr 1 33.33% 20.00% 14.29% 2 44.45% 32.00% 24.49% 3 14.81% 19.20% 17.49% 4 7.41% 11.52% 12.49% 5 11.52% 8.93% 6 5.76% 8.92% 7 8.93% 8 4.46% o $60,304 o $61.456 $52,912 o $61.256 $58,608