Answered step by step

Verified Expert Solution

Question

1 Approved Answer

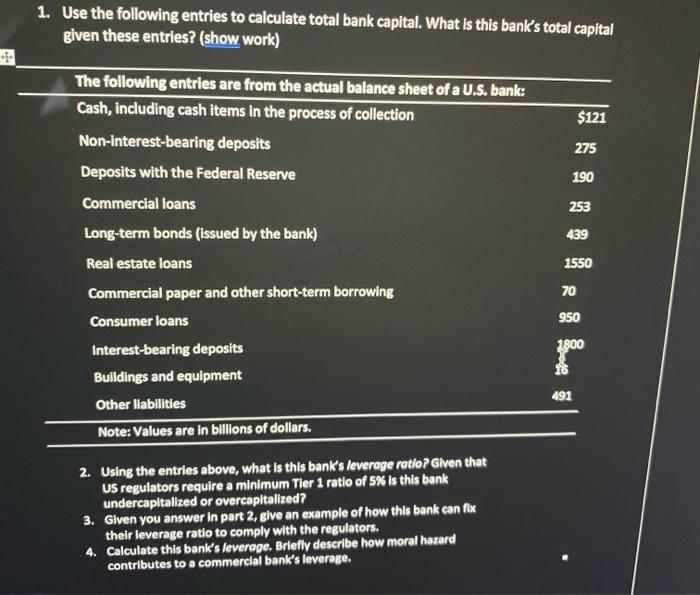

1. Use the following entries to calculate total bank capital. What is this bank's total capital given these entries? (show work) The following entries are

1. Use the following entries to calculate total bank capital. What is this bank's total capital given these entries? (show work) The following entries are from the actual balance sheet of a U.S. bank: Cash, including cash items in the process of collection Non-interest-bearing deposits Deposits with the Federal Reserve Commercial loans Long-term bonds (issued by the bank) Real estate loans Commercial paper and other short-term borrowing Consumer loans Interest-bearing deposits Buildings and equipment Other liabilities Note: Values are in billions of dollars. 2. Using the entries above, what is this bank's leverage ratio? Given that US regulators require a minimum Tier 1 ratio of 5% is this bank undercapitalized or overcapitalized? 3. Given you answer in part 2, give an example of how this bank can fix their leverage ratio to comply with the regulators. 4. Calculate this bank's leverage. Briefly describe how moral hazard contributes to a commercial bank's leverage. $121 275 190 253 439 1550 491 70 950 1800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started