Answered step by step

Verified Expert Solution

Question

1 Approved Answer

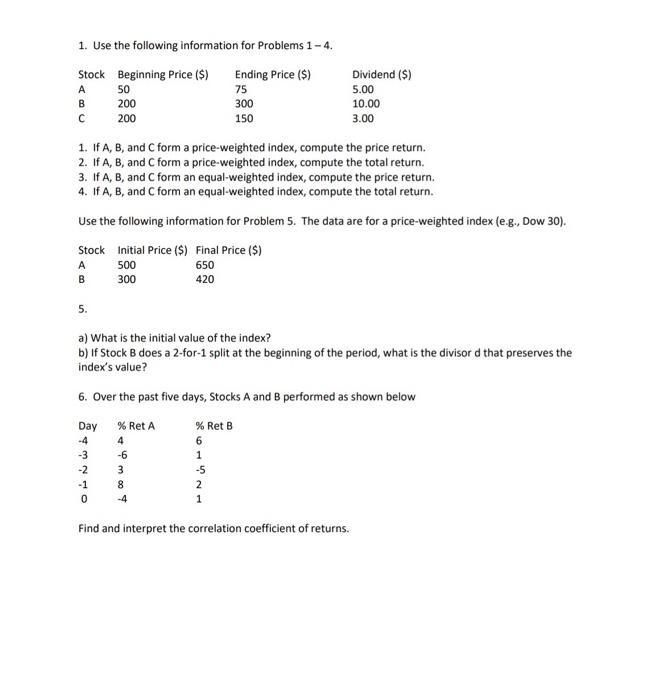

1. Use the following information for Problems 1-4. Stock Beginning Price ($) Ending Price ($) A 50 75 Dividend ($) 5.00 B 200 300

1. Use the following information for Problems 1-4. Stock Beginning Price ($) Ending Price ($) A 50 75 Dividend ($) 5.00 B 200 300 10.00 C 200 150 3.00 1. If A, B, and C form a price-weighted index, compute the price return. 2. If A, B, and C form a price-weighted index, compute the total return. 3. If A, B, and C form an equal-weighted index, compute the price return. 4. If A, B, and C form an equal-weighted index, compute the total return. Use the following information for Problem 5. The data are for a price-weighted index (e.g., Dow 30). Stock Initial Price ($) Final Price ($) A B 500 300 5. 650 420 a) What is the initial value of the index? b) If Stock B does a 2-for-1 split at the beginning of the period, what is the divisor d that preserves the index's value? 6. Over the past five days, Stocks A and B performed as shown below Day % Ret A % Ret B -4 4 6 -3 -6 1 -2 3 -5 -1 8 2 0 Find and interpret the correlation coefficient of returns.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 If A B and C form a priceweighted index the price return is calculated by taking the average price change of the constituent stocks Price Return Ending Price Beginning Price Beginning Price For Stoc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started