Question

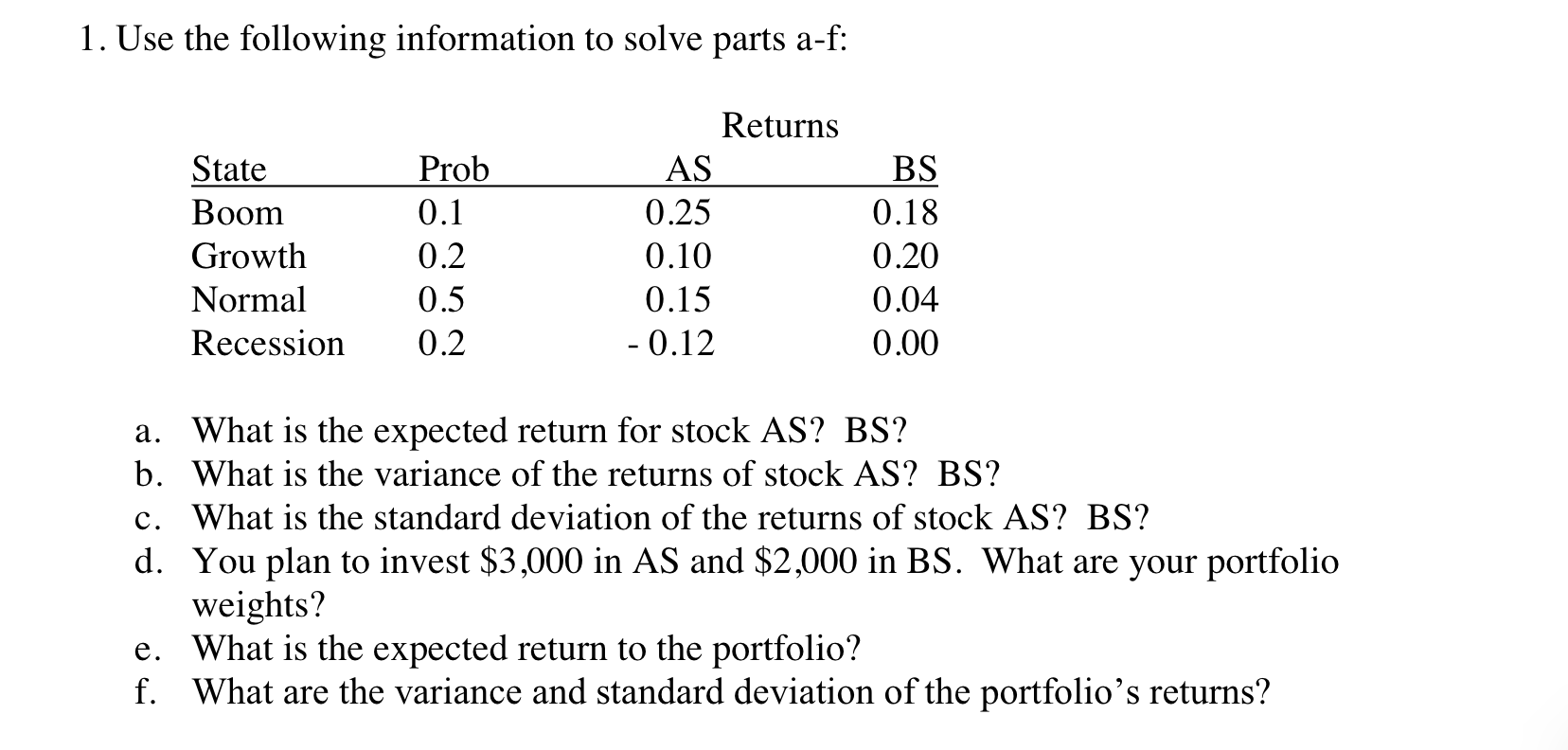

1. Use the following information to solve parts a-f: Returns State Prob AS BS Boom 0.1 0.25 0.18 Growth 0.2 0.10 0.20 Normal 0.5

1. Use the following information to solve parts a-f: Returns State Prob AS BS Boom 0.1 0.25 0.18 Growth 0.2 0.10 0.20 Normal 0.5 0.15 0.04 Recession 0.2 -0.12 0.00 a. What is the expected return for stock AS? BS? b. What is the variance of the returns of stock AS? BS? c. What is the standard deviation of the returns of stock AS? BS? d. You plan to invest $3,000 in AS and $2,000 in BS. What are your portfolio weights? e. What is the expected return to the portfolio? f. What are the variance and standard deviation of the portfolio's returns?

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Okay here are the answers a Expected return for AS 01 025 02 05 015 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Basic Statistics

Authors: Charles Henry Brase, Corrinne Pellillo Brase

6th Edition

978-1133525097, 1133525091, 1111827028, 978-1133110316, 1133110312, 978-1111827021

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App