Question

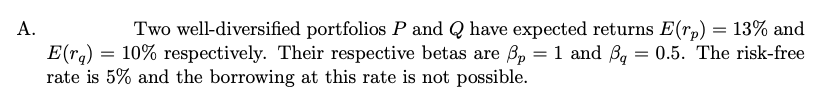

A. Two well-diversified portfolios P and Q have expected returns E(rp) = 13% and 10% respectively. Their respective betas are p = 1 and

A. Two well-diversified portfolios P and Q have expected returns E(rp) = 13% and 10% respectively. Their respective betas are p = 1 and = 0.5. The risk-free rate is 5% and the borrowing at this rate is not possible. E(ra) = In each of the following cases, determine whether or not there is an arbitrage opportunity and, where possible, describe the steps you would take in order to construct an arbitrage portfolio. Compute the certain payoff from your strategy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine if there is an arbitrage opportunity we need to compare the expected returns of the por...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Statistical Methods And Data Analysis

Authors: R. Lyman Ott, Micheal T. Longnecker

7th Edition

1305269470, 978-1305465527, 1305465520, 978-1305269477

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App