Answered step by step

Verified Expert Solution

Question

1 Approved Answer

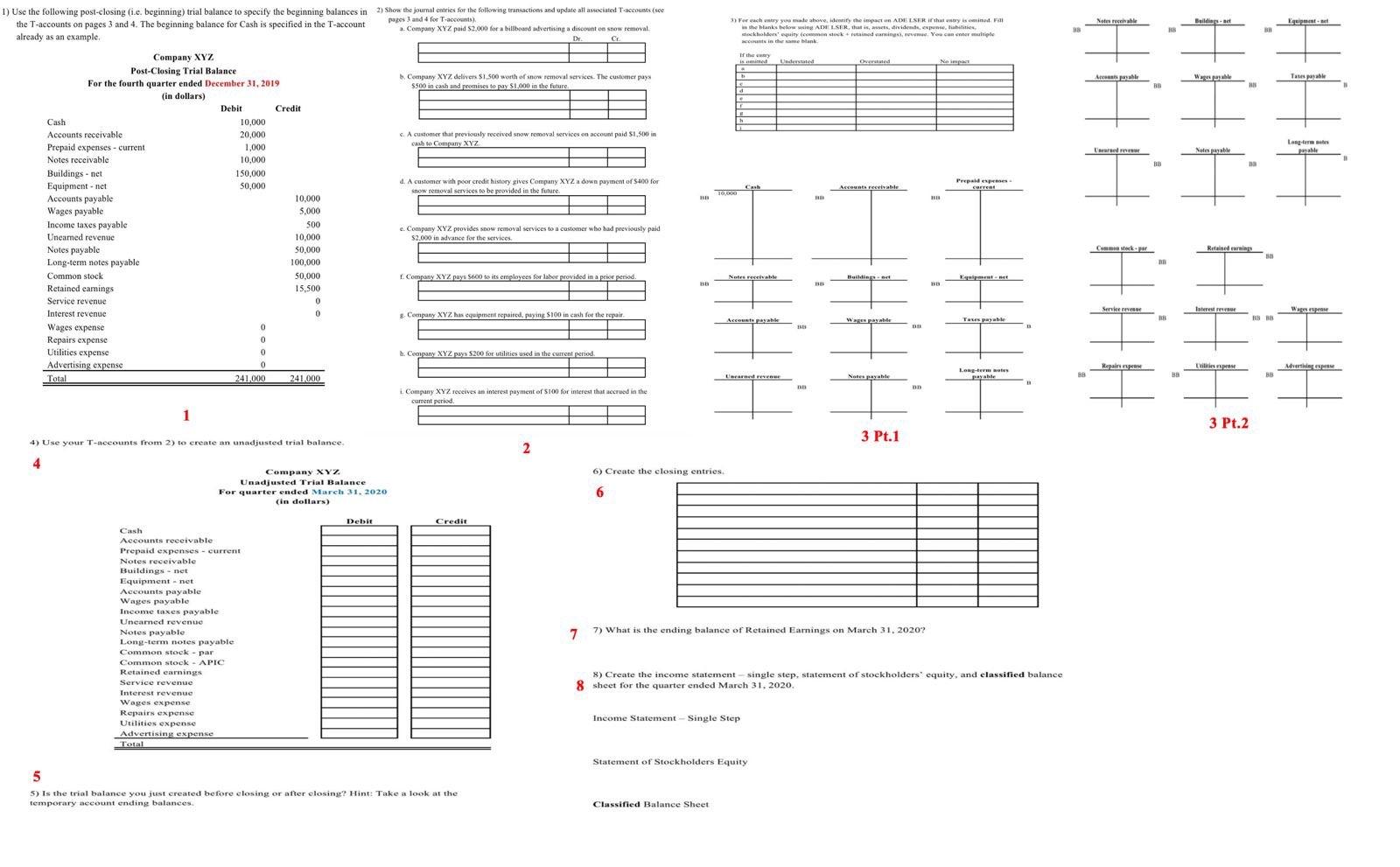

1) Use the following post-closing (i.e. beginning) trial balance to specify the beginning balances in 2) Show the journal entries for the following transactions

1) Use the following post-closing (i.e. beginning) trial balance to specify the beginning balances in 2) Show the journal entries for the following transactions and update all associated T-accounts (see pages 3 and 4 for T-accounts). the T-accounts on pages 3 and 4. The beginning balance for Cash is specified in the T-account already as an example. Company XYZ Post-Closing Trial Balance For the fourth quarter ended December 31, 2019 a. Company XYZ paid $2,000 for a billboard advertising a discount on snow removal. Dr. Cr b. Company XYZ delivers $1,500 worth of snow removal services. The customer pays $500 in cash and promises to pay $1,000 in the future. 3) For each entry you made above, identify the impact on ADE LSER if that entry is mined. Fill is the blanks below sexing ADELSER, that is, assets, dividends, expense, liabilities, stockholders' equity (common stock retained earnings), revenue. You can enter multiple accounts in the same blank. If the entry is omitted Understated Overstated No impact 38 (in dollars) Debit Credit Cash Accounts receivable 10,000 20,000 Prepaid expenses- current 1,000 c. A customer that previously received snow removal services on account paid $1,500 in cash to Company XYZ Notes receivable 10,000 Buildings net 150,000 Equipment - net 50,000 d. A customer with poor credit history gives Company XYZ a down payment of $400 for snow removal services to be provided in the future Prepaid expenses corrent 10,000 Accounts payable 10,000 Wages payable 5,000 Income taxes payable 500 Unearned revenue Notes payable 10,000 50,000 e. Company XYZ provides snow removal services to a customer who had previously paid $2,000 in advance for the services. Long-term notes payable 100,000 Common stock Retained earnings Service revenue Interest revenue Wages expense Repairs expense 50,000 Company XYZ pays $600 to its employees for labor provided in a prior period. Notes receivable Buildings Equipment-net BB BB 15,500 Utilities expense Advertising expense Total 0 g. Company XYZ has equipment repaired, paying $100 in cash for the repair. 0 0 0 b. Company XYZ pays $200 for utilities used in the current period. 0 241,000 241,000 i. Company XYZ receives an interest payment of $100 for interest that accrued in the current period. Accounts payable Wages payable BB Taxes payable Long-term notes Notes payable BB BB 1 4) Use your T-accounts from 2) to create an unadjusted trial balance. 4 5 Company XYZ Unadjusted Trial Balance For quarter ended March 31, 2020 (in dollars) Cash Accounts receivable Prepaid expenses current Notes receivable Buildings - net Equipment net Accounts payable Wages payable Income taxes payable Unearned revenue Notes payable Long-term notes payable Common stock Common stock par APIC Retained earnings. Service revenue Interest revenue Wages expense Repairs expense Utilities expense Advertising expense Total Debit Credit 2 6) Create the closing entries. 6 3 Pt.1 7 7) What is the ending balance of Retained Earnings on March 31, 2020? 8) Create the income statement single step, statement of stockholders' equity, and classified balance 8 sheet for the quarter ended March 31, 2020. Income Statement - Single Step Statement of Stockholders Equity 5) Is the trial balance you just created before closing or after closing? Hint: Take a look at the temporary account ending balances. Classified Balance Sheet Accounts payable Wages payable Tases payable BB Long-term tes Notes payable Common stock-par Retained earnings BH 3 Pt.2 BB BB BB

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started