Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Use the following to answer questions 6 - 12 J&TR, Inc., has two classes of stock authorized: $100.00 par preferred and $0.10 par value

1

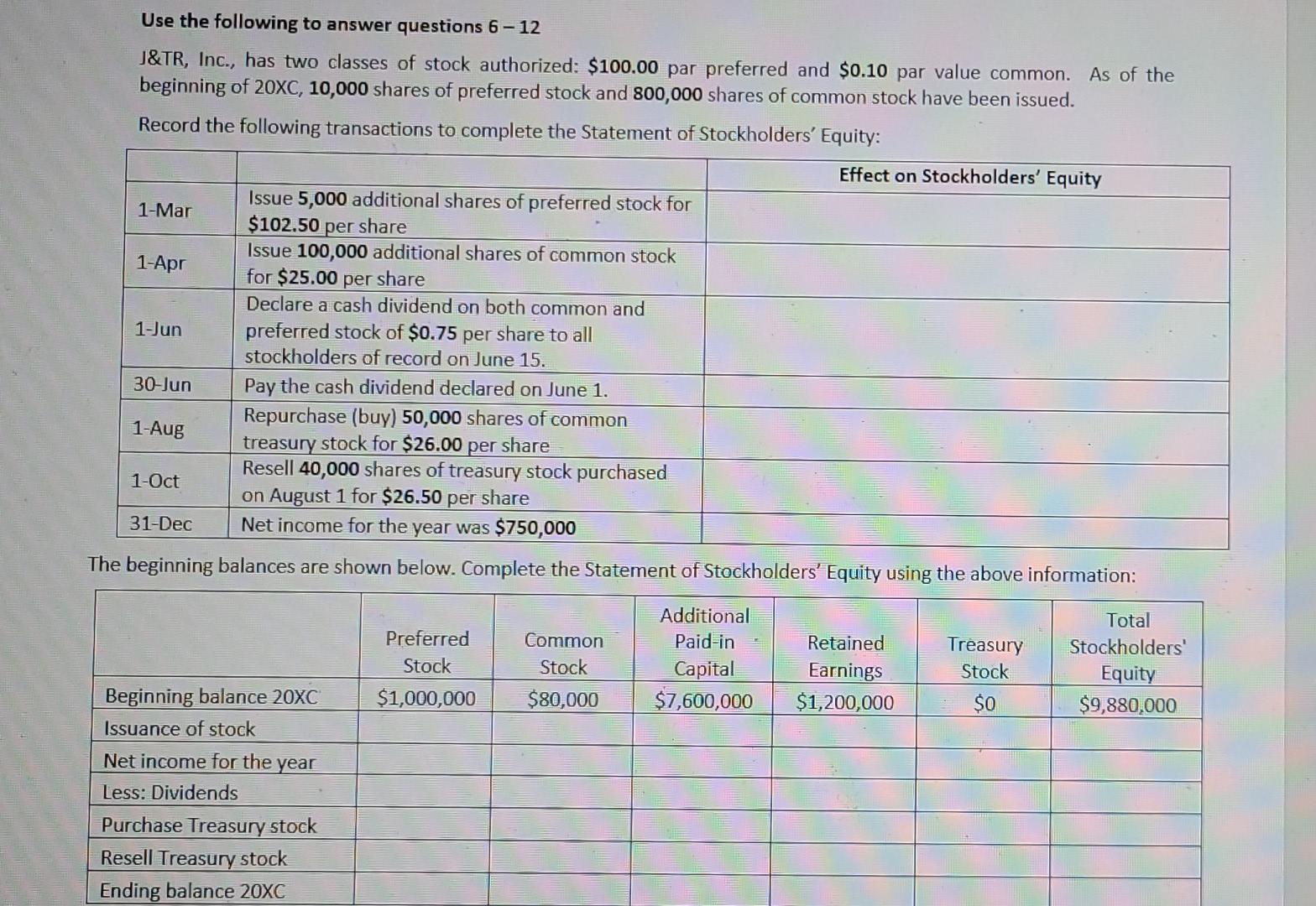

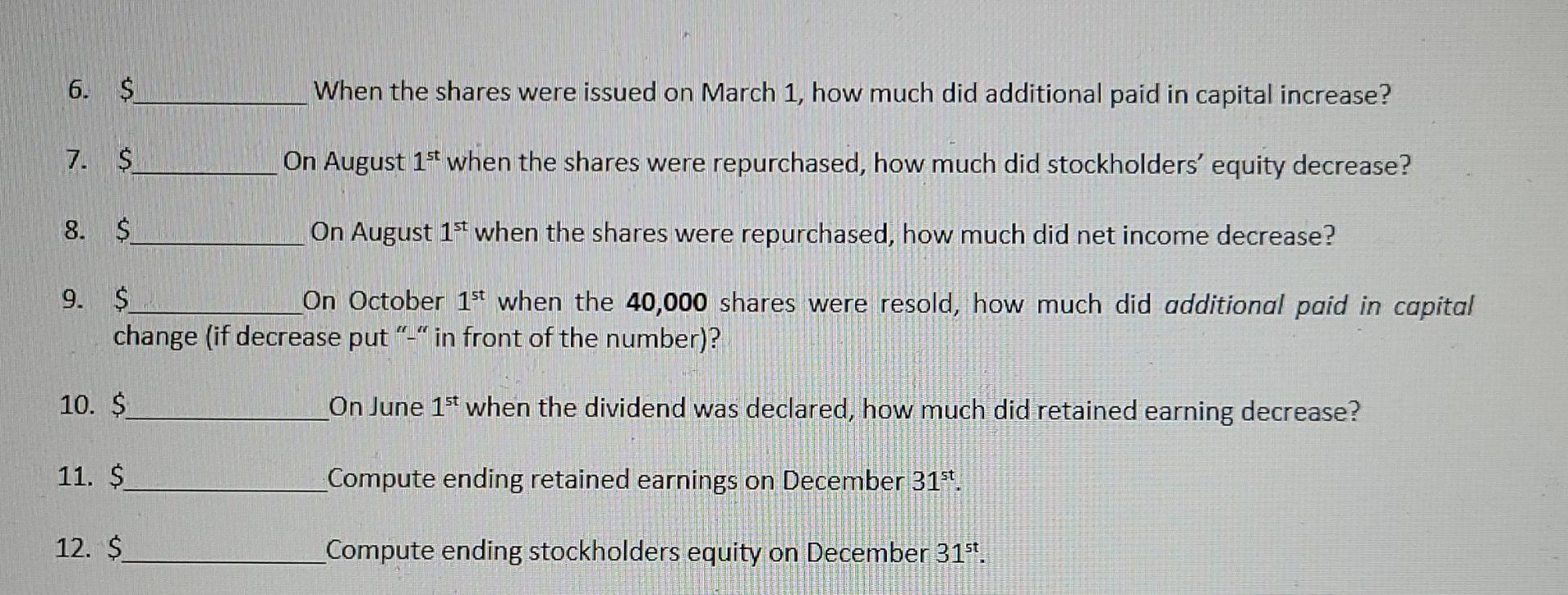

Use the following to answer questions 6 - 12 J&TR, Inc., has two classes of stock authorized: $100.00 par preferred and $0.10 par value common. As of the beginning of 20XC, 10,000 shares of preferred stock and 800,000 shares of common stock have been issued. Record the following transactions to complete the Statement of Stockholders' Equity: Effect on Stockholders' Equity Issue 5,000 additional shares of preferred stock for 1-Mar $102.50 per share Issue 100,000 additional shares of common stock 1-Apr for $25.00 per share Declare a cash dividend on both common and 1-Jun preferred stock of $0.75 per share to all stockholders of record on June 15. 30-Jun Pay the cash dividend declared on June 1. Repurchase (buy) 50,000 shares of common 1-Aug treasury stock for $26.00 per share Resell 40,000 shares of treasury stock purchased 1-Oct on August 1 for $26.50 per share 31-Dec Net income for the year was $750,000 The beginning balances are shown below. Complete the Statement of Stockholders' Equity using the above information: Preferred Stock Common Stock $80,000 Additional Paid-in Capital $7,600,000 Retained Earnings $1,200,000 Treasury Stock $0 Total Stockholders' Equity $9,880,000 $1,000,000 Beginning balance 20XC Issuance of stock Net income for the year Less: Dividends Purchase Treasury stock Resell Treasury stock Ending balance 20XC 6. $ When the shares were issued on March 1, how much did additional paid in capital increase? 7. $ On August 1st when the shares were repurchased, how much did stockholders' equity decrease? 8. $ On August 1st when the shares were repurchased, how much did net income decrease? 9. $ On October 1st when the 40,000 shares were resold, how much did additional paid in capital change (if decrease put "-" in front of the number)? 10. $ On June 1st when the dividend was declared, how much did retained earning decrease? 11. $ Compute ending retained earnings on December 31st. 12. $ Compute ending stockholders equity on December 31stStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started