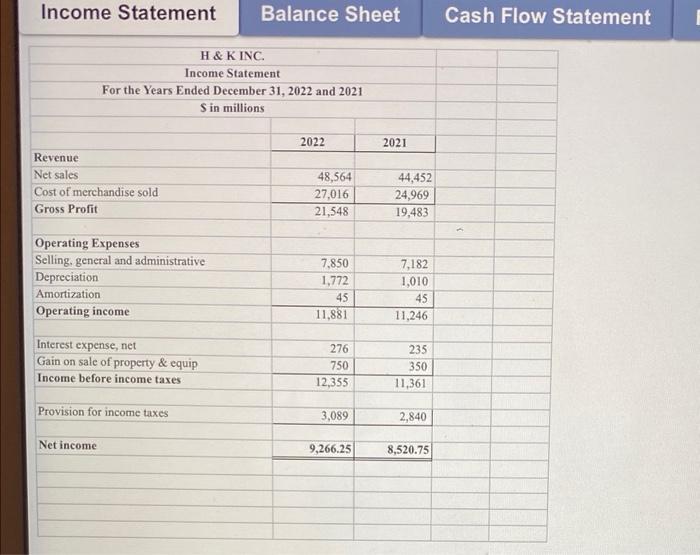

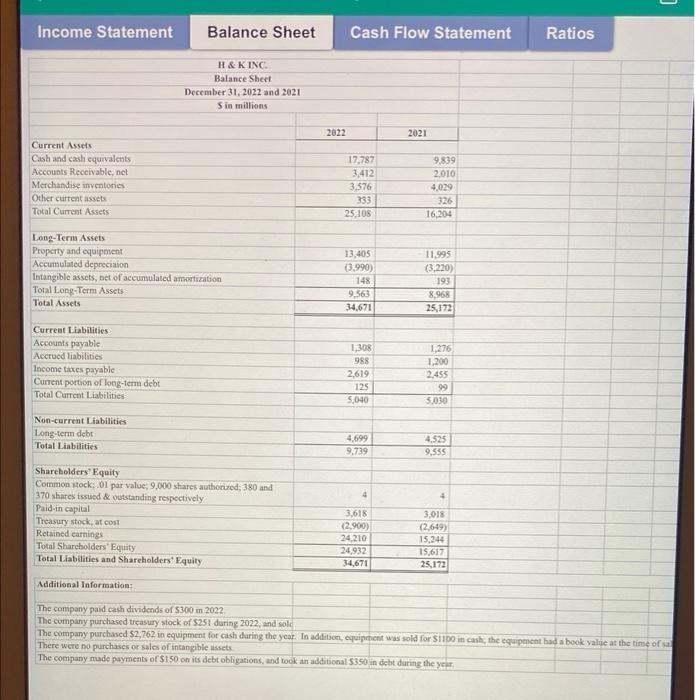

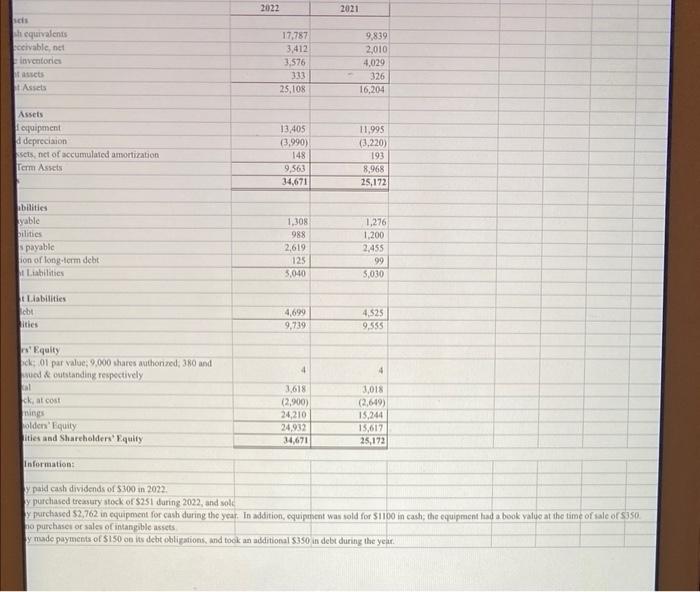

1. Use the information in the provided Income Statement and Balance Sheet to create the 2022 Statement of Cash Flows for H\&KInc. This should be created on the appropriate Tab of the Excel Workbook Template provided on Canvas. 2. Formulas: a. Use Excel to setup the Statement of Cash. Flows by linking the values from the Income Statement and the Balance Sheet. b. Use Excel formulas to calculate all totals and sub-totals. 3. Complete the ratio calculations for 2022 on the appropriate tab using the income Statement and Balance Sheet. All ratios should be linked back to your financial statements. Income Statement Income Statement Balance Sheet Cash Flow Statement Ratios If \& K INC. Balance Sheet December 31, 2022 and 2021 5 in millions Current Assets. Cash and cash equivaleats. Accounts Receivable, net Merchandise inventonies Other curreat assets Total Current Assets: \begin{tabular}{|l|l|} \hline 2022 & 2021 \\ \hline \end{tabular} Long-Term Assets Property and equipment Accumslated depreciaion Intangible assets, bet of accumulated amortization Total Long-Term Assets: Total Assets Curreat Liabilities Accounts payable Accrued liabilities lncome taxes payable Current portion of long-terma debt Total Current Liabilities Non-current Liabilities Long-term debt- Total Liabilities \begin{tabular}{|r|r|} \hline 13,405 & 11,995 \\ \hline(3,990) & (3,220) \\ \hline 148 & 193 \\ \hline 9,563 & 8,968 \\ \hline 34,671 & 25,172 \\ \hline \hline \end{tabular} Sharebolders' Equity Common stock; .01 par value; 9,000 shares authorized; 380 and 370 shares issued 2 outstanding respoctively. Paid-in capilal Treasury stock, at cost Retained carning Total Shareholders' Equity Total Liabilities and Shareholders' Equity \begin{tabular}{|r|r|} \hline 17,787 & 9,839 \\ \hline 3,412 & 2,010 \\ \hline 3,576 & 4,029 \\ \hline 333 & 326 \\ \hline 25,105 & 16,204 \\ \hline \end{tabular} Additional Information: The company paid cash dividends of 5300 in 2022. Thic company purchased treasury stock of 5251 during 2022 ; and solc The company purchased $2,762 in equipment for cash daring the yeaz. In addition, equiprient was sold for 51100 it cask, the equipenent bad a book value at the time of a There were no purchases or sales of intangible assets. The company made payments of 5150 on its debt obligations, and took an additional 5350 in debt during the year, Income Statement | Balance Sheet Cash Flow Statement Ratios HI S. K INC. Statement of Cash Flows For the Year Ended December 31, 2022 USD (5) in Millions Income Statement Balance Sheet Cash Flow Statement Ratios \[ \begin{array}{|c|} \hline \multicolumn{2}{r|}{} \\ \hline \text { Current Ratio }= \\ \text { Acid-Test Ratio - } \\ \hline \text { AR Tumover - } \\ \hline \end{array} \] Days Sales Uncollected = Inventory tarnover Days sales in Inventory = Total Asset Tumover = Debt to Equify = Times Interest Eamed = Net Profit Margin = Return on Total Assets = Return on Stockholders Equity = Earnings per Share (EPS)