1) Use the VCVtools.com site to compute the value of the random expiration call option with the same inputs as in HW 1, reproduced

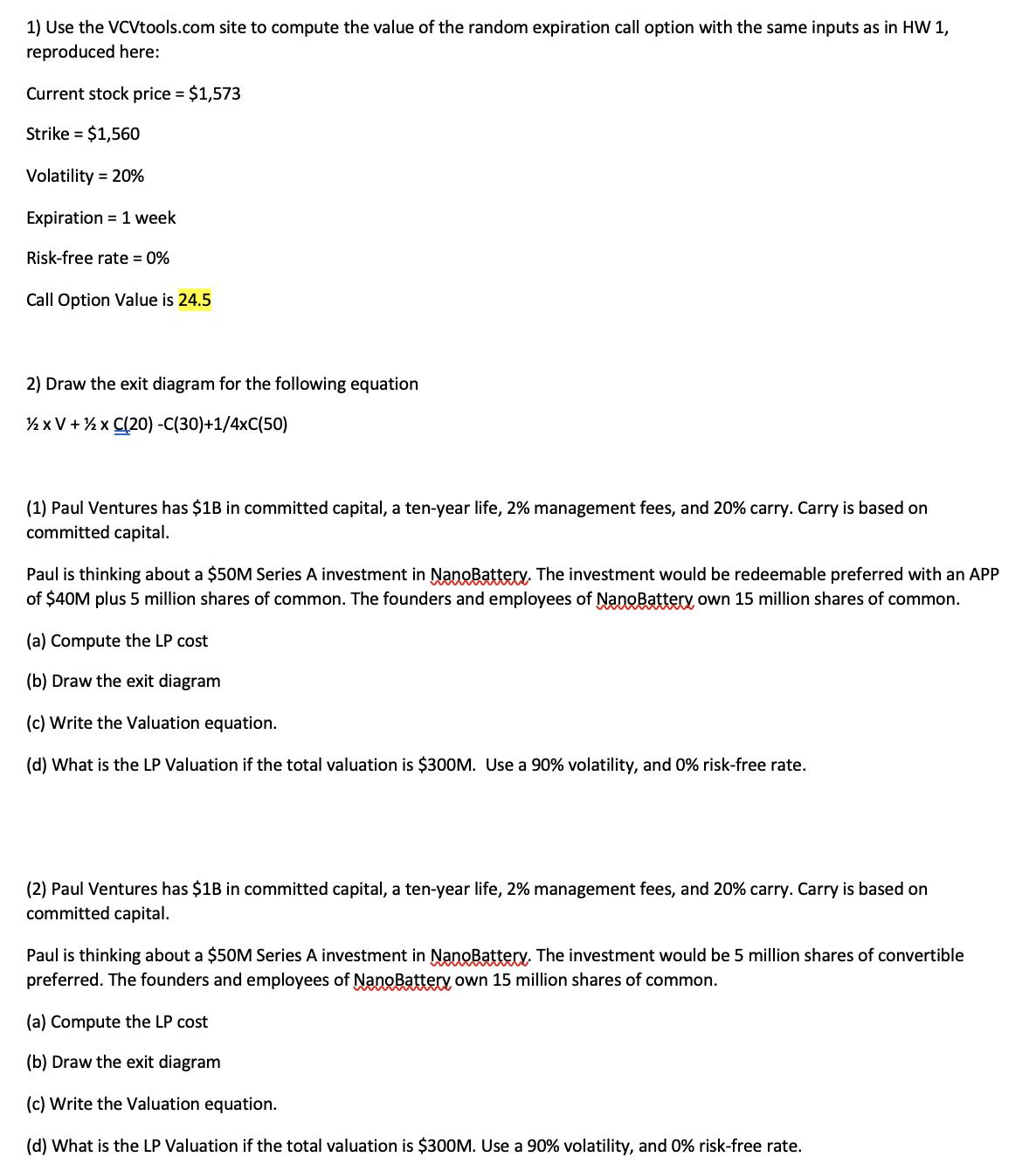

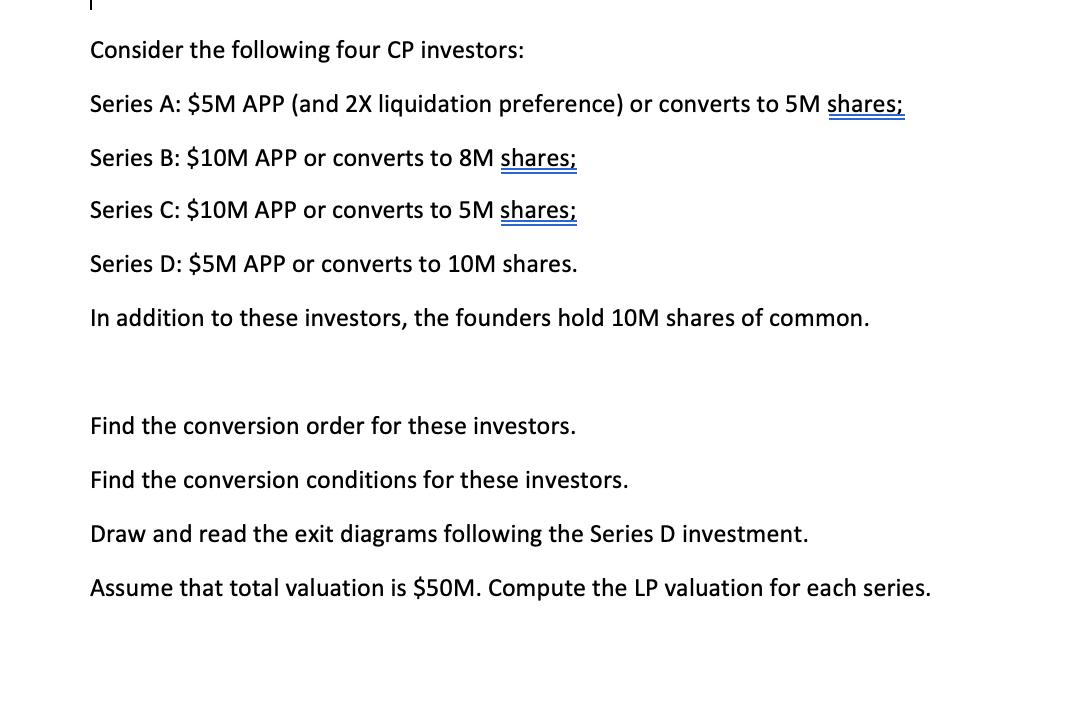

1) Use the VCVtools.com site to compute the value of the random expiration call option with the same inputs as in HW 1, reproduced here: Current stock price = $1,573 Strike = $1,560 Volatility = 20% Expiration 1 week Risk-free rate = 0% Call Option Value is 24.5 2) Draw the exit diagram for the following equation 1/2 x V + 2x C(20) -C(30)+1/4xC(50) (1) Paul Ventures has $1B in committed capital, a ten-year life, 2% management fees, and 20% carry. Carry is based on committed capital. Paul is thinking about a $50M Series A investment in NanoBattery. The investment would be redeemable preferred with an APP of $40M plus 5 million shares of common. The founders and employees of Nano Battery own 15 million shares of common. (a) Compute the LP cost (b) Draw the exit diagram (c) Write the Valuation equation. (d) What is the LP Valuation if the total valuation is $300M. Use a 90% volatility, and 0% risk-free rate. (2) Paul Ventures has $1B in committed capital, a ten-year life, 2% management fees, and 20% carry. Carry is based on committed capital. Paul is thinking about a $50M Series A investment in NanoBattery. The investment would be 5 million shares of convertible preferred. The founders and employees of Nano Battery own 15 million shares of common. (a) Compute the LP cost (b) Draw the exit diagram (c) Write the Valuation equation. (d) What is the LP Valuation if the total valuation is $300M. Use a 90% volatility, and 0% risk-free rate. Consider the following four CP investors: Series A: $5M APP (and 2X liquidation preference) or converts to 5M shares; Series B: $10M APP or converts to 8M shares; Series C: $10M APP or converts to 5M shares; Series D: $5M APP or converts to 10M shares. In addition to these investors, the founders hold 10M shares of common. Find the conversion order for these investors. Find the conversion conditions for these investors. Draw and read the exit diagrams following the Series D investment. Assume that total valuation is $50M. Compute the LP valuation for each series.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute the value of a random expiration call option with the given inputs you can use VCVtoolsco...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started