Question

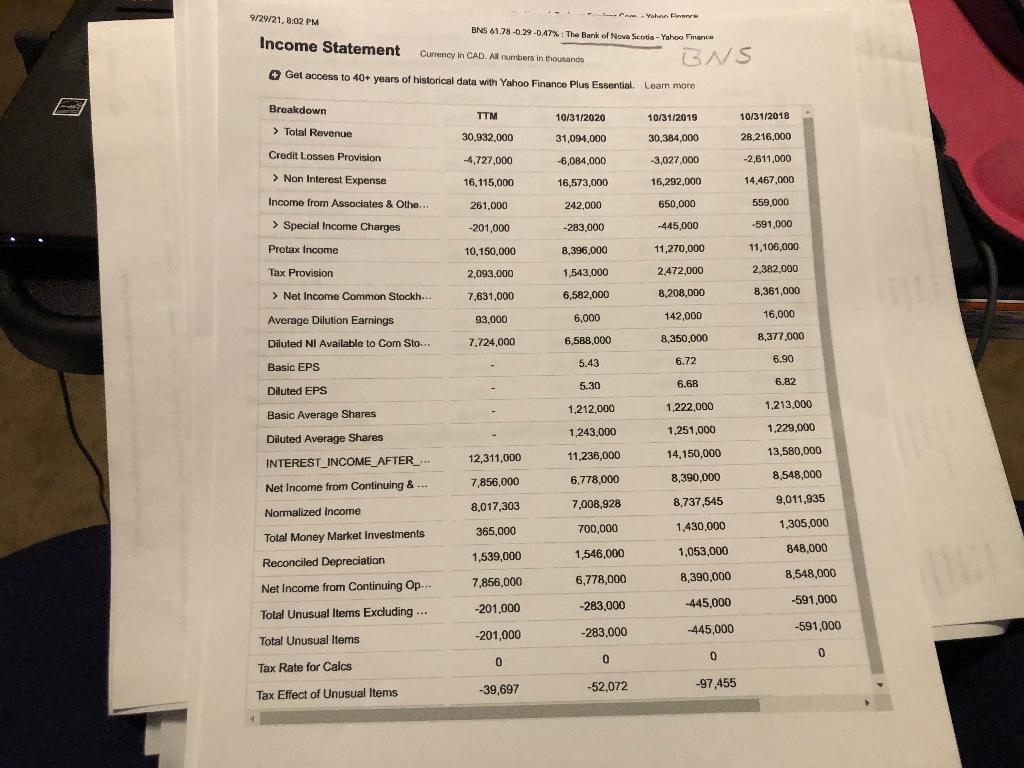

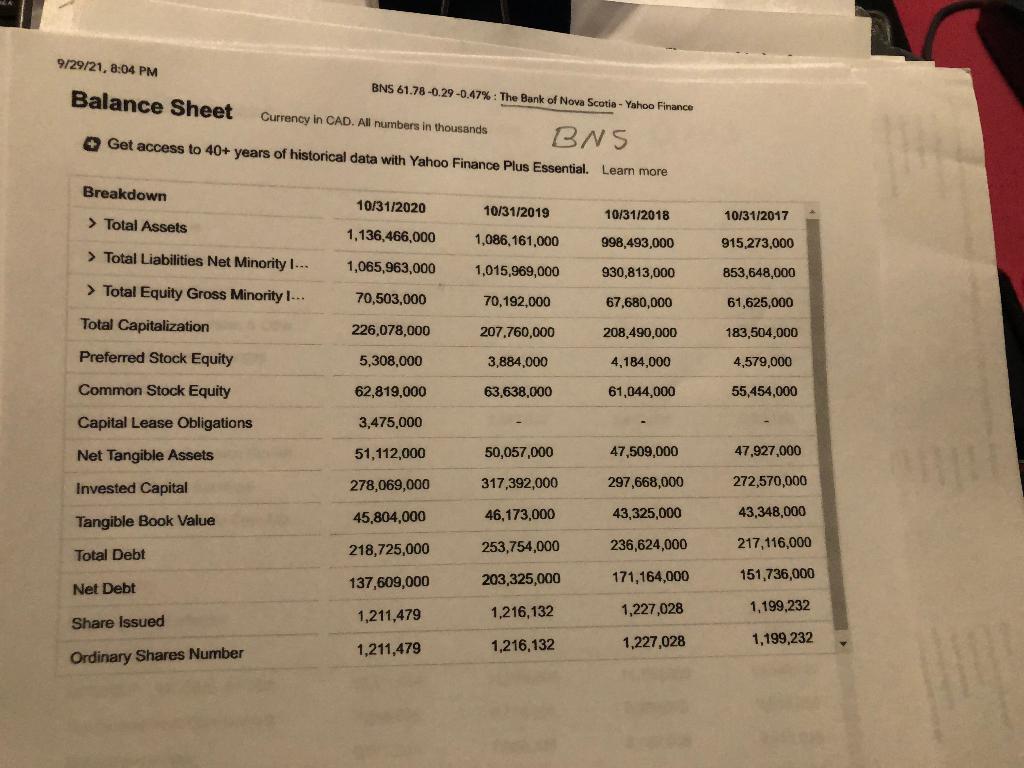

1. Using 2020 common-size balance sheet and income statement, compare your company with the benchmark, and describe how your company is similar to or different

1. Using 2020 common-size balance sheet and income statement, compare your company with the benchmark, and describe how your company is similar to or different from the benchmark.

2. Using 2019 & 2020 common-size balance sheet and income statement of each company, do the time trend analysis and describe how each company changes over time.

3. (Financial Ratio Analysis) Using 2019 & 2020 Balance sheet & Income statement for each company, compute the following financial ratios for each company: (25 points)

Current ratio, Quick ratio, Debt-to-equity ratio, Times interest earned ratio (Interest coverage ratio), Inventory Turnover, Receivable turnover, Total asset turnover, Profit margin, Return on Asset (ROA), Return on Equity (ROE), Price-earnings ratio, and Market-to-book ratio

4. (Financial Ratio Analysis) Select the benchmark for peer group analysis.

5. Using the 2020 ratios, compare your company's ratios to both competitor's and industry averages. Then describe how good or bad ratios of your company are considered.

6. Using 2019 & 2020 ratios for your company, compare your company's 2019 ratios with 2020 ratios and describe the similarities and differences.

7. Using the DuPont Identity equation, compare your companys 2020 ROE with competitors 2020 ROE. Find out what makes differences in ROEs between your company and competitor.

8. Using the DuPont Identity equation, compare your companys 2019 ROE with 2020 ROE. Find out what makes differences in ROE between two periods if there is any difference.

Please use excel and show formulas

- 9/29/21, 8:02 PM term Volun Elman BNS 61.78 -0.29 -0.47%: The Bank of Nova Scotia - Yahoo Finance Income Statement Currency in CAD. Al numbers in thousands ONS Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn more Breakdown > Total Revenue TTM 10/31/2020 10/31/2019 10/31/2018 30,932,000 31,094.000 30,384,000 28,216,000 Credit Losses Provision -4,727,000 -6,084,000 -3,027,000 -2,611,000 > Nan Interest Expense 16,115,000 16,573,000 16,292,000 14,467,000 261,000 242,000 650.000 559.000 Income from Associates & Othe... > Special Income Charges -201,000 -283.000 -445,000 -591,000 Protax Income 10,150,000 8,396,000 11,270,000 11,106,000 Tax Provision 2,093,000 2,382,000 1,543,000 2.472,000 > Net Income Common Stockh.. 7,631,000 6,582,000 8,208,000 8,361,000 6,000 142,000 16,000 Average Dilution Earnings 93.000 8,377.000 Diluted NI Available to Com Sto... 7.724,000 6,588.000 8,350,000 6.72 6.90 5.43 Basic EPS 5.30 6.68 6.82 Diluted EPS 1,212,000 1,222,000 1,213,000 Basic Average Shares 1.243,000 1,251,000 1,229,000 Diluted Average Shares 14,150,000 11.236,000 13,580,000 INTEREST INCOME AFTER_... 12,311,000 6,778.000 7,856,000 8,390,000 8,548,000 Net Income from Continuing & ... 7,008,928 8,017,303 8,737,545 9,011,935 Normalized Income 700,000 365.000 1,430,000 1,305,000 Total Money Market Investments 1,546,000 1,539,000 1,053,000 848,000 Reconciled Depreciation 8,548,000 8,390,000 7.856,000 6,778,000 Net Income from Continuing Op... Tolal Unusual Items Excluding ... -283,000 -201.000 -445,000 -591,000 -283,000 -445,000 -591,000 -201,000 Total Unusual Items 0 0 0 0 Tax Rate for Calcs -39,697 -52,072 -97.455 Tax Effect of Unusual Items 9/29/21, 8:04 PM BNS 61.78 -0.29-0.47%: The Bank of Nova Scotia - Yahoo Finance Balance Sheet Currency in CAD. All numbers in thousands BNS Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn more Breakdown 10/31/2020 10/31/2019 10/31/2018 10/31/2017 > Total Assets 1,136,466,000 1,086,161,000 998,493,000 915,273,000 > Total Liabilities Net Minority I... 1,065,963,000 1,015,969,000 930,813,000 853,648,000 70,503,000 70,192,000 67,680,000 61,625,000 > Total Equity Gross Minority I... Total Capitalization Preferred Stock Equity 226,078,000 207.760,000 208,490,000 183,504,000 5,308,000 3,884,000 4,184,000 4,579,000 Common Stock Equity 62,819,000 63,638,000 61,044,000 55,454,000 Capital Lease Obligations 3,475,000 Net Tangible Assets 51,112,000 50,057,000 47,509,000 47,927,000 Invested Capital 278,069,000 317,392,000 297,668,000 272,570,000 45,804,000 46,173,000 43,325,000 43,348,000 Tangible Book Value 218,725,000 253,754,000 236,624,000 Total Debt 217,116,000 137,609,000 203,325,000 171,164,000 151,736,000 Net Debt 1,216,132 1,211,479 1,227,028 1,199,232 Share Issued 1,211,479 1,216,132 1,227,028 1,199,232 Ordinary Shares Number - 9/29/21, 8:02 PM term Volun Elman BNS 61.78 -0.29 -0.47%: The Bank of Nova Scotia - Yahoo Finance Income Statement Currency in CAD. Al numbers in thousands ONS Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn more Breakdown > Total Revenue TTM 10/31/2020 10/31/2019 10/31/2018 30,932,000 31,094.000 30,384,000 28,216,000 Credit Losses Provision -4,727,000 -6,084,000 -3,027,000 -2,611,000 > Nan Interest Expense 16,115,000 16,573,000 16,292,000 14,467,000 261,000 242,000 650.000 559.000 Income from Associates & Othe... > Special Income Charges -201,000 -283.000 -445,000 -591,000 Protax Income 10,150,000 8,396,000 11,270,000 11,106,000 Tax Provision 2,093,000 2,382,000 1,543,000 2.472,000 > Net Income Common Stockh.. 7,631,000 6,582,000 8,208,000 8,361,000 6,000 142,000 16,000 Average Dilution Earnings 93.000 8,377.000 Diluted NI Available to Com Sto... 7.724,000 6,588.000 8,350,000 6.72 6.90 5.43 Basic EPS 5.30 6.68 6.82 Diluted EPS 1,212,000 1,222,000 1,213,000 Basic Average Shares 1.243,000 1,251,000 1,229,000 Diluted Average Shares 14,150,000 11.236,000 13,580,000 INTEREST INCOME AFTER_... 12,311,000 6,778.000 7,856,000 8,390,000 8,548,000 Net Income from Continuing & ... 7,008,928 8,017,303 8,737,545 9,011,935 Normalized Income 700,000 365.000 1,430,000 1,305,000 Total Money Market Investments 1,546,000 1,539,000 1,053,000 848,000 Reconciled Depreciation 8,548,000 8,390,000 7.856,000 6,778,000 Net Income from Continuing Op... Tolal Unusual Items Excluding ... -283,000 -201.000 -445,000 -591,000 -283,000 -445,000 -591,000 -201,000 Total Unusual Items 0 0 0 0 Tax Rate for Calcs -39,697 -52,072 -97.455 Tax Effect of Unusual Items 9/29/21, 8:04 PM BNS 61.78 -0.29-0.47%: The Bank of Nova Scotia - Yahoo Finance Balance Sheet Currency in CAD. All numbers in thousands BNS Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn more Breakdown 10/31/2020 10/31/2019 10/31/2018 10/31/2017 > Total Assets 1,136,466,000 1,086,161,000 998,493,000 915,273,000 > Total Liabilities Net Minority I... 1,065,963,000 1,015,969,000 930,813,000 853,648,000 70,503,000 70,192,000 67,680,000 61,625,000 > Total Equity Gross Minority I... Total Capitalization Preferred Stock Equity 226,078,000 207.760,000 208,490,000 183,504,000 5,308,000 3,884,000 4,184,000 4,579,000 Common Stock Equity 62,819,000 63,638,000 61,044,000 55,454,000 Capital Lease Obligations 3,475,000 Net Tangible Assets 51,112,000 50,057,000 47,509,000 47,927,000 Invested Capital 278,069,000 317,392,000 297,668,000 272,570,000 45,804,000 46,173,000 43,325,000 43,348,000 Tangible Book Value 218,725,000 253,754,000 236,624,000 Total Debt 217,116,000 137,609,000 203,325,000 171,164,000 151,736,000 Net Debt 1,216,132 1,211,479 1,227,028 1,199,232 Share Issued 1,211,479 1,216,132 1,227,028 1,199,232 Ordinary Shares NumberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started