Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using a binomial interest rate tree, fill out the table below. (100 points) The first four columns are inputs. P is the price

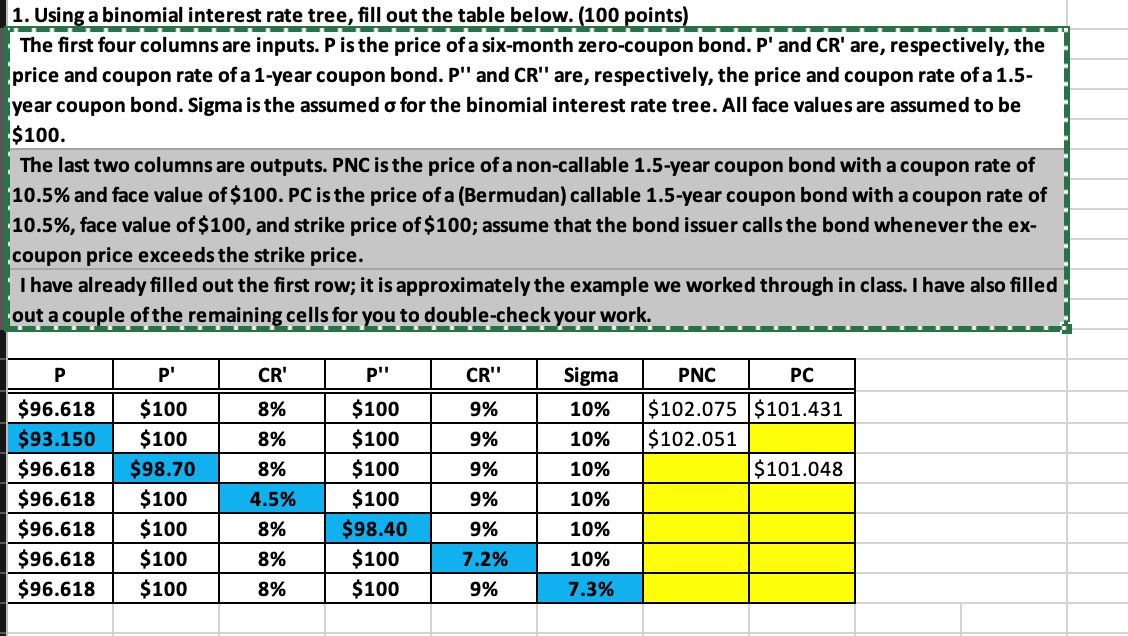

1. Using a binomial interest rate tree, fill out the table below. (100 points) The first four columns are inputs. P is the price of a six-month zero-coupon bond. P' and CR' are, respectively, the price and coupon rate of a 1-year coupon bond. P" and CR" are, respectively, the price and coupon rate of a 1.5- year coupon bond. Sigma is the assumed for the binomial interest rate tree. All face values are assumed to be $100. The last two columns are outputs. PNC is the price of a non-callable 1.5-year coupon bond with a coupon rate of 10.5% and face value of $100. PC is the price of a (Bermudan) callable 1.5-year coupon bond with a coupon rate of 10.5%, face value of $100, and strike price of $100; assume that the bond issuer calls the bond whenever the ex- coupon price exceeds the strike price. I have already filled out the first row; it is approximately the example we worked through in class. I have also filled out a couple of the remaining cells for you to double-check your work. P P' CR' P' CR" Sigma PNC PC $96.618 $100 8% $100 9% 10% $102.075 $101.431 $93.150 $100 8% $100 9% 10% $102.051 $96.618 $98.70 8% $100 9% 10% $101.048 $96.618 $100 4.5% $100 9% 10% $96.618 $100 8% $98.40 9% 10% $96.618 $100 8% $100 7.2% 10% $96.618 $100 8% $100 9% 7.3%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started