1. Using data in the case, estimate market and sales potential in the projected market area. There are at least two ways to estimate market and sales potential from data in the attached studies. I suggest computing the market and sales potential in both gallons of beer sold and in dollar sales.

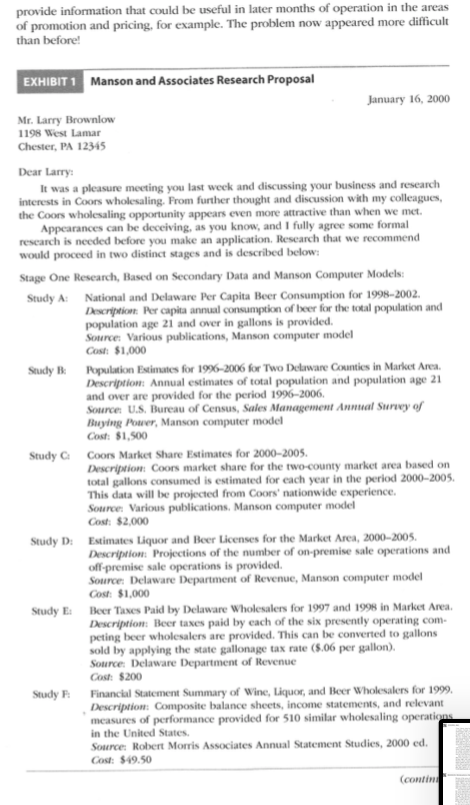

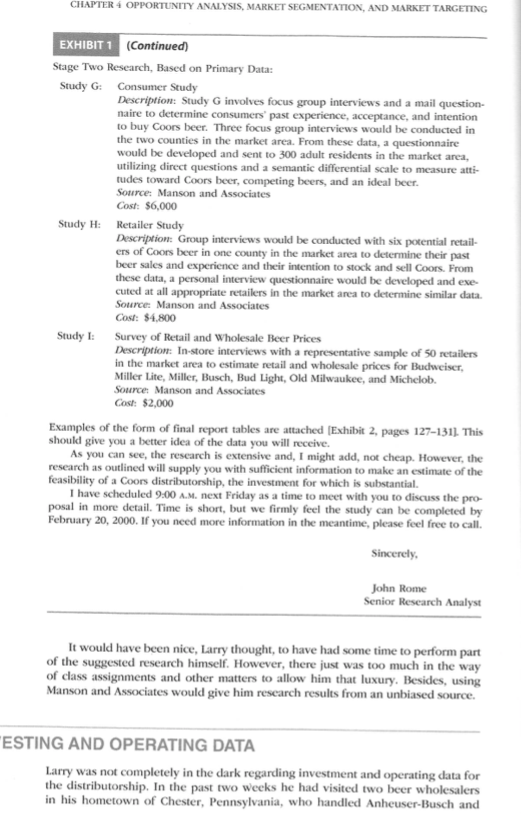

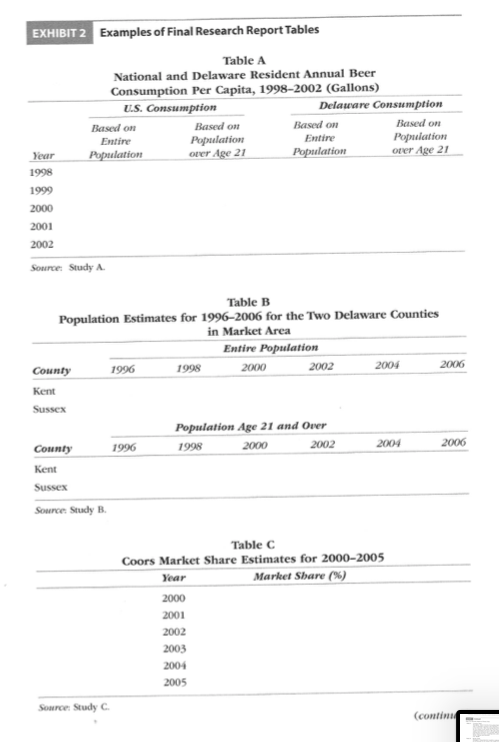

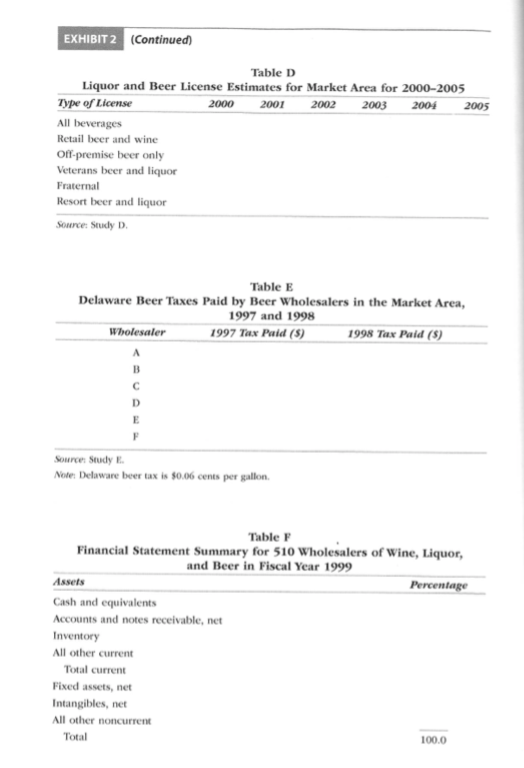

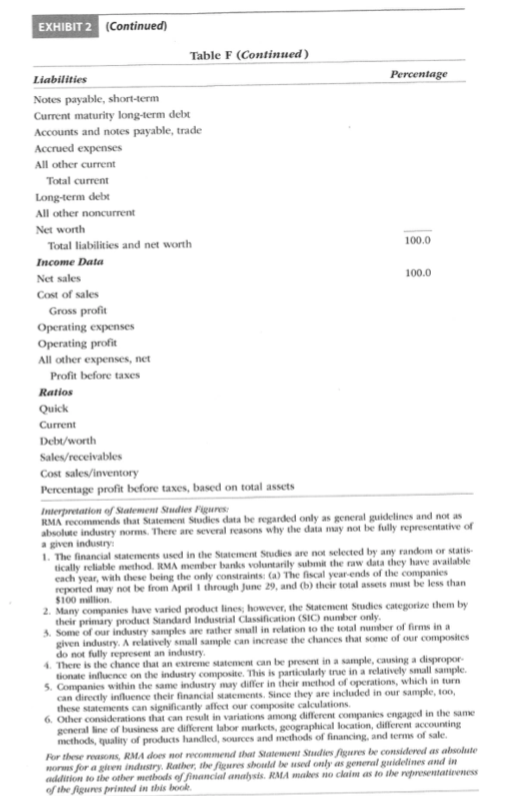

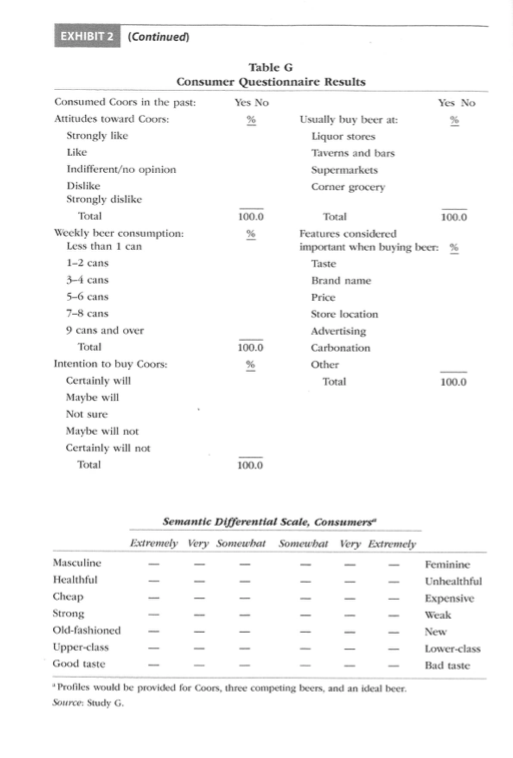

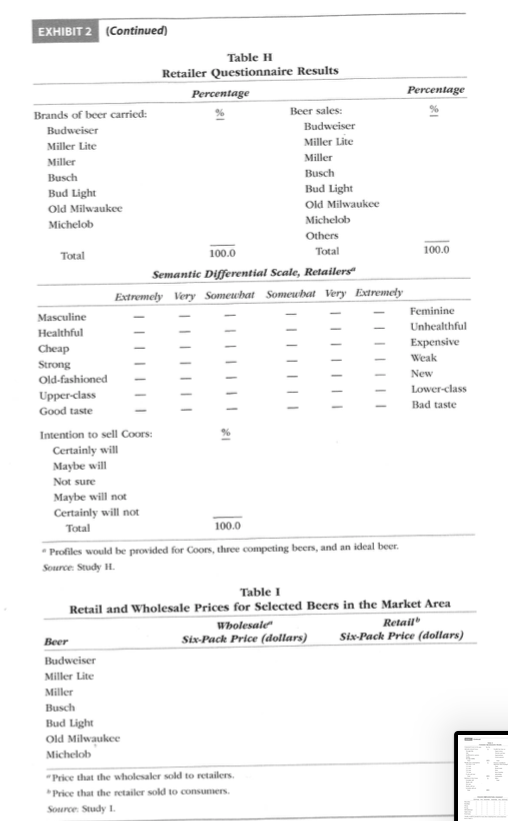

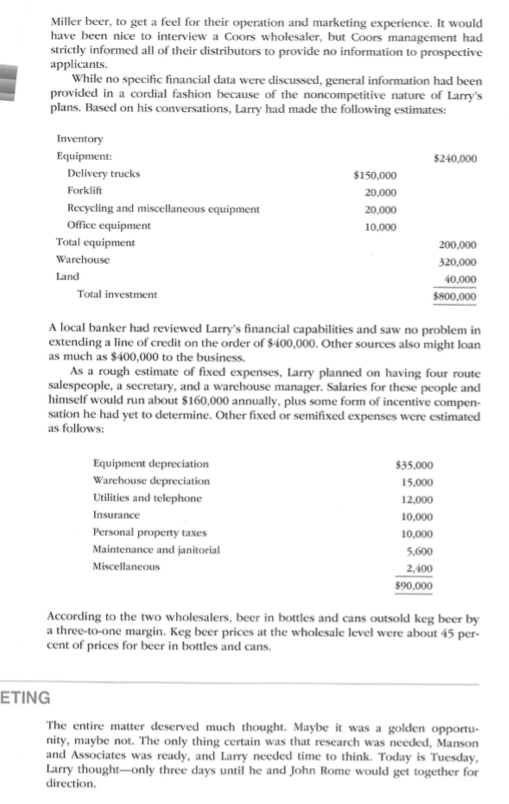

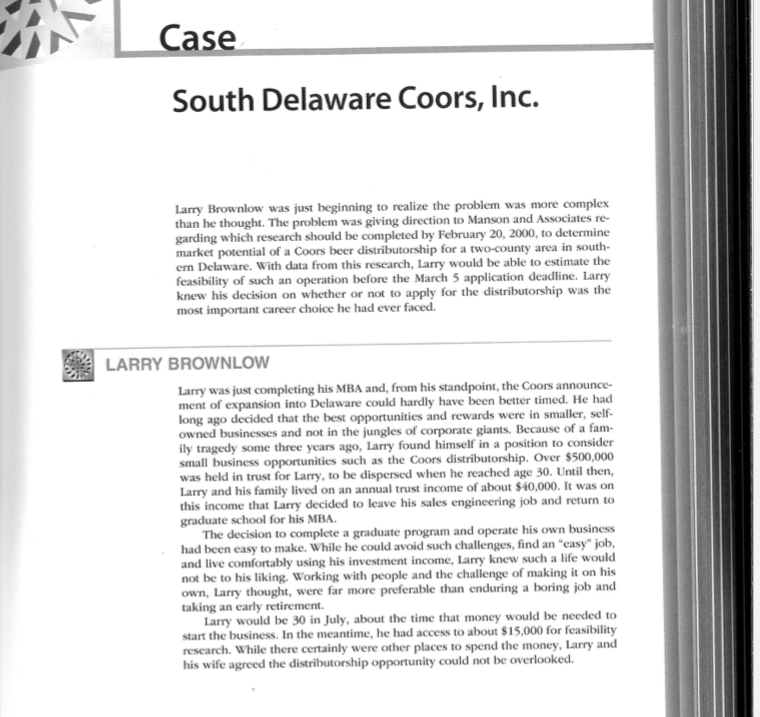

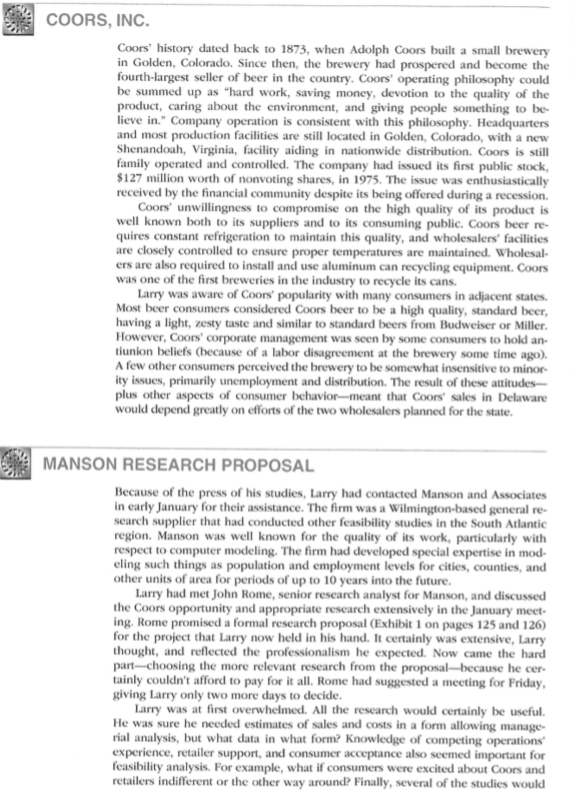

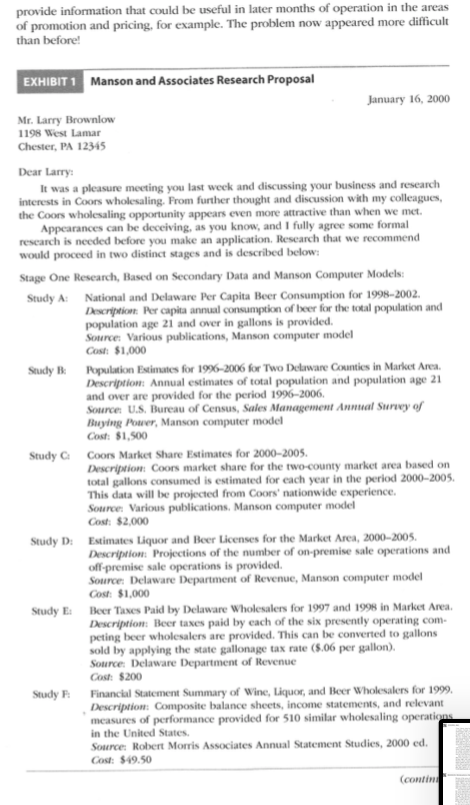

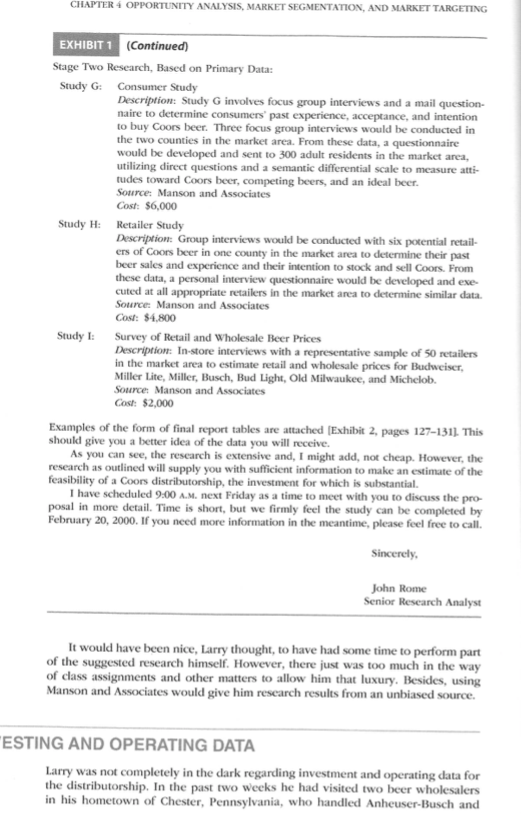

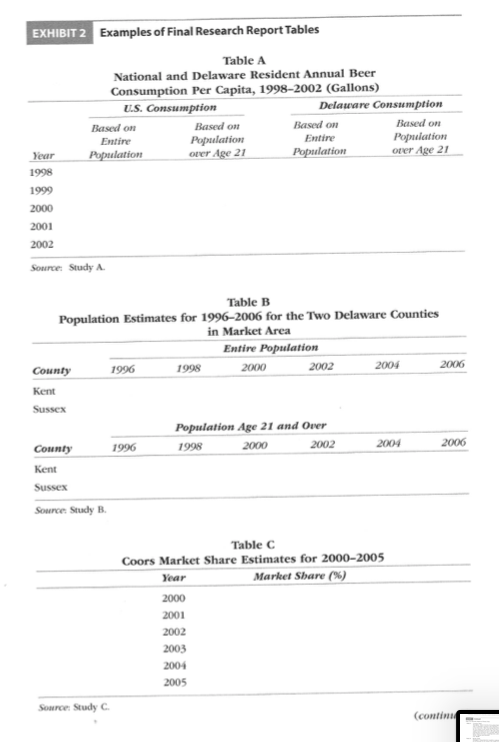

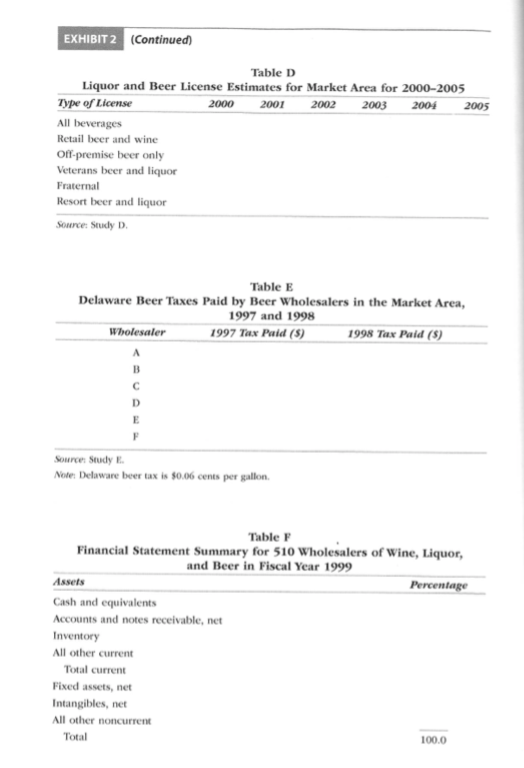

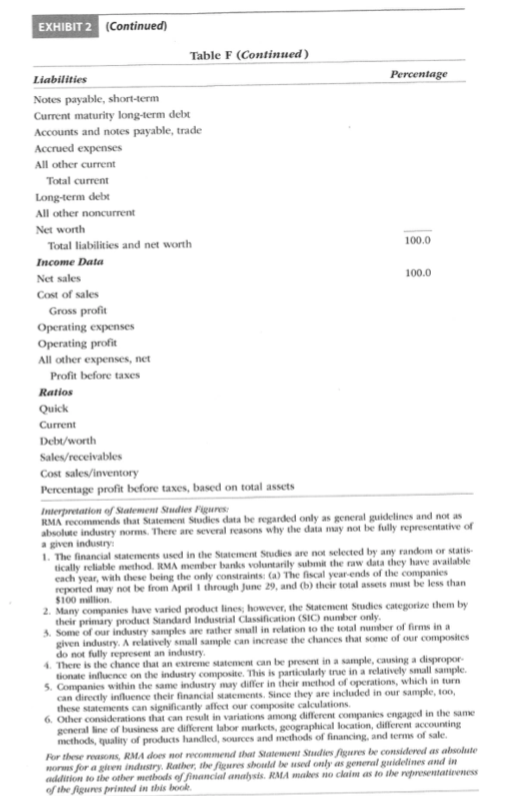

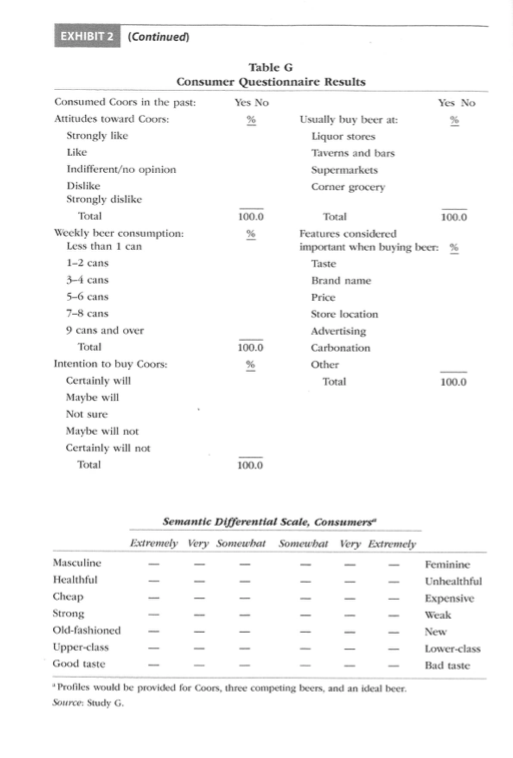

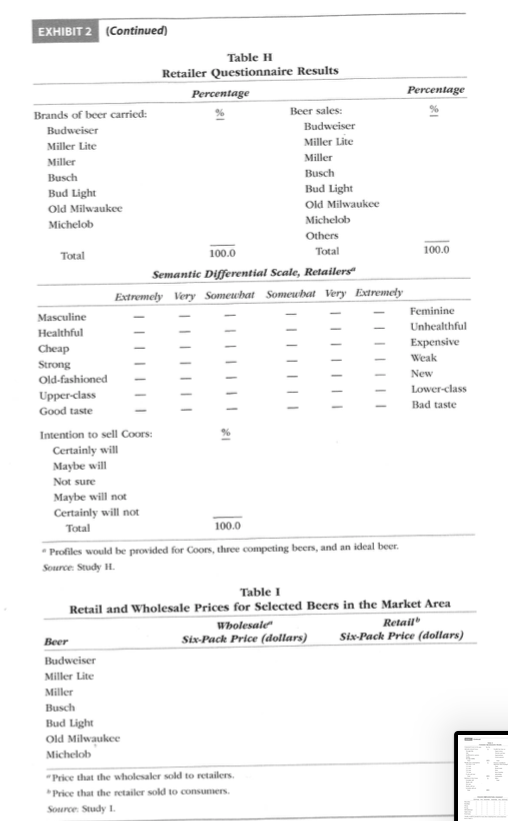

South Delaware Coors, Inc. Larry Brownlow was just beginning to realize the problem was more complex than he thought. The problem was giving direction to Manson and Associates re- garding which research should be completed by February 20, 2000, to determine market potential of a Coors beer distributorship for a two-county area in south ern Delaware. With data from this research, Larry would be able to estimate the feasibility of such an operation before the March 5 application deadline. Larry knew his decision on whether or not to apply for the distributorship was the most important career choice he had ever faced LARRY BROWNLOW Larry was just completing his MBA and, from his standpoint, the Coors announce- ment of expansion into Delaware could hardly have been better timed. He long ago decided that the best opportunities and rewards were in smaller, self owned businesses and not in the jungles of corporate giants. Because of a fam- ily tragedy some three years ago, Larry found himself in a position to consider small business was held in trust for Larry, to be dispersed when he reached age 30. Until then Larry and his family lived on an annual trust income of about S40,000. It was on this income that Larry decided to leave his sales engineering job and return to opportunities such as the Coors distributorship. Over $500,000 The decision to complete a graduate program and operate his own business had been easy to make. While he could avoid such challenges, find an "easy" job, and live comfortably using his investment income, Larry knew such a life would not be to his liking. Working with people and the challenge of making it on his own, Larry thought, were far more preferable than enduring a boring job and taking an early retirement. Larry would be 30 in July, about the time that money would be start the business. In the meantime, he had access to about $15,000 for feasibility rescarch. While there certainly were other places to spend the money, Larry and his wife agreed the distributorship opportunity could not be overlook COORS, INC Coors' history dated back to 1873, when Adolph Coors built a small brewery in Golden, Colorado. Since then, the brewery had prospered and become the fourth-largest seller of beer in the country. Coors' operating philosophy could be summed up as "hard work, saving money, devotion to the quality of the product, caring about the environment, and giving people something to be- lieve in." Company operation is consistent with this philosophy. Headquarters and most production facilities are still located in Golden, Colorado, with a new Shenandoah, Virginia, facility aiding in nationwide distribution. Coors is still family operated and controlled. The company had issued its first public stock, 127 million worth of nonvoting shares, in 1975. The issue was enthusiastically received by the financial community despite its being offered during a recession. Coors' unwillingness to compromise on the high quality of its product is well known both to its suppliers and to its consuming public. Coors beer re- quires constant refrigeration to maintain this quality, and wholesalers' facilities are closely controlled to ensure proper temperatures are maintained. Wholesal ers are also required to install and use aluminum can recycling equipment. Coors was one of the first breweries in the industry to recycle its cans. Larry was aware of Coors' popularity with many consumers in adjacent states Most beer consumers considered Coors beer to be a high quality, standard beer having a light, zesty taste and similar to standard beers from Budweiser or Miller However, Coors' corporate management was seen by some consumers to hold an- iunion beliefs (because of a labor disagreement at the brewery some time ago). A few other consumers perceived the brewery to be somewhat insensitive to minor- ity issues, primarily unemployment and distribution. The result of these attitudes plus other aspects of consumer behavior-meant that Coors' sales in Delaware would depend greatly on efforts of the two wholesalers planned for the state MANSON RESEARCH PROPOSAL Because of the press of his studiesLarry had contacted Manson and Associates in carly January for their assistance. The firm was a Wilmington-based general re- search supplier that had conducted other feasibility studies in the South Atlantic region. Manson was well known for the quality of its work, particularly with respect to computer modeling. The firm had developed special expertise in mod eling such things as population and employment levels for cities, counties, and other units of area for periods of up to 10 years into the future Larry had met John Rome, senior research analyst for Manson, and discussed the Coors opportunity and appropriate research extensively in the January meet ing. Rome promised a formal research proposal (Exhibit 1 on pages 125 and 126) for the project that Larry now held in his hand. It certainly was extensive, Larry thought, and reflected the professionalism he expected. Now came the hard part-choosing the more relevant research from the proposal-because he cer- tainly couldn't afford to pay for it all. Rome had suggested a meeting for Friday giving Larry only two more days to decide Larry was at first overwhelmed. All the research would certainly be useful. He was sure he needed estimates of sales and costs in a form allowing manage- rial analysis, but what data in what form Knowledge of competing operations experience, retailer support, and consumer acceptance also seemed important for feasibility analysis. For example, what if consumers were excited about Coors and retailers indifferent or the other way around? Finally, several of the studies would CHAPTER 4 OPPORTUNITY ANALYSIS, MARKET SEGMENTATION, AND MARKErTARGEmo EXHIBIT 1 (Continued) Stage Two Research, Based on Primary Data Study G: Consumer Study Description: Study G involves focus group interviews and a mail question naire to determine consumers past experience, acceptance, and intention to buy Coors beer. Three focus group interviews would be conducted in the two counties in the market area. From these data, a questionnaire would be developed and sent to 300 adult residents in the market area, utilizing direct questions and a semantic differential scale to measure atti- tudes toward Coors beer, competing beers, and an ideal beer Source: Manson and Associates Cost: $6,000 Study H: Retailer Study Description Group interviews would be conducted with six potential retail- ers of Coors beer in one county in the market area to determine their past beer sales and experience and their intention to stock and sell Coors. From these data, a personal interview questionnaire would be developed and exe- cuted at all appropriate retailers in the market area to determine similar data. Source: Manson and Associates Cost: $4,800 Study I: Survey of Retail and Wholesale Beer Prices Description In-store interviews with a representative sample of 50 retailers in the market area to estimate retail and wholesale prices for Budweiser Miller Lite, Miller, Busch, Bud Light, Old Milwaukee, and Michelob. Source: Manson and Associates Cost: $2,000 Examples of the form of final report tables are attached (Exhibit 2, pages 127-1311. This should give you a better idea of the data you will receive. As you can see, the research is extensive and, I might add, not cheap. However, the research as outlined will supply you with sufficient information to make an estimate of the feasibility of a Coors distributorship, the investment for which is substantial. I have scheduled 9:00 A.M.next Friday as a time to meet with you to discuss the pro- posal in more detail. Time is short, but we firmly feel the study can be completed by February 20, 2000. If you need more information in the meantime, please feel free to call. Sincerely John Rome Senior Research Analyst It would have been nice, Larry thought, to have had some time to perform part of the suggested research himself. However, there just was too much in the way of class assignments and other matters to allow him that luxury. Besides, using Manson and Associates would give him research results from an unbiased source. ESTING AND OPERATING DATA Larry was not completely in the dark regarding investment and operating data for the distributorship. In the past two weeks he had visited two beer wholesalers in his hometown of Chester, Pennsylvania, who handled Anheuser-Busch and EXHIBIT2 Examples of Final Research Report Tables Table A National and Delaware Resident Annual Beer Consumption Per Capita, 1998-2002 (Gallons) U.S. Consumption Delauare Consumption Based on Entire Based o Based on Population Based o 1999 2000 2001 2002 Source Study A Table B Population Estimates for 1996-2006 for the Two Delaware Counties in Market Area 1996 1998 2000 2000 Kent Population Age 21 and Over 1998 1996 2004 Source Study B Table C Coors Market Share Estimates for 2000-2005 ear 2000 2001 2002 2003 2004 2005 Market Share) Source Study C contin4 EXHIBIT 2 (Continued) Table D Liquor and Beer License Estimates for Market Area for 2000-2005 Type of License All beverages Retail beer and wine Off-premise beer only Veterans beer and liquor Fraternal Resort beer and liquor 2000 20012002 2003 2004 2005 Source: Study D Table E Delaware Beer Taxes Paid by Beer Wholesalers in the Market Area, 1997 and 1998 Wholesaler 997 Tax Paid (S 998 Tax Paid (S Source Study E Note Delaware beer tax is $0.06 cents per gallon Table F Financial Statement Summary for 510 Wholesalers of Wine, Liquor and Beer in Fiscal Year 1999 Assets Cash and equivalents Accounts and notes receivable, net Inventory All other current Total current Fixed assets, net Intangibles, net All other noncurrent Total 100.0 EXHIBIT 2 Table F (Continued Percentage Liabilities Notes payable, short-term Current maturity long-term debt Accounts and notes payable, trade Accrued expenses All other current Total current Long-term debt All other noncurrent Net worth 100.0 Total liabilities and net worth Income Data Net sales Cost of sales 100.0 Gross profit Operating expenses Operating profit All other expenses, net Profit before taxes Ratios Quick Current Cost sales/inventory Percentage profit before taxes, based on total assets RMA recommends that Statement Studies data be regarded only as general guidelines and not as absolute industry norms. There are several reasons why the data may not be fully representative of a given industry 1The financial statements used in the Statement Studies are not selected by any random or statis tically reliable method. RMA member banks voluntarily submil the raw data they have available each year, wish these being the only constraints: (a) The fiscal year-ends of the companies reported $100 million may not be from April I through June 29, and (b) their total assets must be less than Many companies have varied product lines, however, the Statement Studies categorize them by their primary product Standard Industrial Classification (SIC) S. Some of our industry samples are rather small in relation to the total number of firms in a given indusiry A relatihvely small sample can increase the chanceshat some of our do not fully represent an industry . There is the chance t 5. Companies within the same industry may differ in their method of operations, which in turn that an extreme statement can be present in a sample, causing a dispropor tionate influence on the industry composite. This is particularly true in a relatively small sample can directly influence their financial statements. Since they are included in our sample, too these statements can our composite calculations significantly 6 Other considerations that can result in variations among different companikes engaged in the sanse are diferent labor markets, geographical location, different mcthods, quality of products handled, sources and mcthods of financing, and terms of sale For these resons, RMA dos not recommend that Statement Studies ogures be considered as absolute minns jor a gnen industry Rather, the focares shoeeld be sed only, as general gitidelines and in addition to the other metbods of financial anabsis. RMA makes no claim as to the representatieness of the Agures printed in this book EXHIBIT 2 Continued) Table G Consumer Questionnaire Results Consumed Coors in the past: Yes No Yes No Usually buy beer at Taverns and bars o opinion 100.0 100.0 Weekly beer consumption Features considered important when buying beer Less than 1 can % 100.0 Intention to buy Coors: 100.0 Maybe will not Certainly will not 00.0 Semantic Differential Scale, Consumers Extremely Very Somewbat Somewbat Very Extremely Unhealthful Profiles would be provided for Coors, three competing beers, and an ideal beer (Continued) EXHIBIT 2 Table H Retailer Questionnaire Results Beer sales: Brands of beer carried Miller Lite Miller Busch Bud Light Old Milwaukee Michelob Miller Lite Miller Busch Bud Light Old Milwaukee Michelolb 100.0 Total 100.0 Total Semantic Differential Scale, Retailers Extremely Very Somewhat Someubat Very Extremely Feminine Weak New Strong Upper-class Good taste Bad taste Intention to sell Coors: Certainly will Maybe will Not sure Maybe will not Certainly will not 100.0 Total Profiles would be provided for Coons, three competing beers, and an ideal beer. Source Study H Table I Retail and Wholesale Prices for Selected Beers in the Market Area Retail Wholesale Six-Pack Price (dollas Sx-Pack Price (dollars) Beer Miller Lite Busch Bud Light Old Milwaukee Michelolb Price that the wholesaler sold to retailers. b Price that the retailer sold to consumers. Source Study 1 Miller beer, to get a feel for their operation and marketing experience. It would have been nice to interview a Coors wholesaler, but Coors management had strictly informed all of their distributors to provide no information to prospective applicants. While no specific financial data were discussed, general information had been provided in a cordial fashion because of the noncompetitive nature of Larry's plans. Based on his conversations, Larry had made the following estimates: Inventory Equipment $240,000 Delivery trucks Forklift $150,000 20,000 20,000 10,000 Office equipment Total equipment Warehouse Land 200,000 320,000 40,000 $800,00 Total investment A local banker had reviewed Larry's financial capabilities and saw no problem in extending a line of credit on the order of $400,000. Other sources also might loan as much as $400,000 to the business. As a rough estimate of fixed expenses, Larry planned on having four route salespeople, a secretary, and a warehouse manager. Salaries for these people and himself would run about $160,000 annually, plus some form of incentive compen- sation he had yet to determine. Other fixed or semifixed expenses were estimated as follows: Equipment depreciation Warehouse depreciation Utilities and telephone 35,000 15,000 12,000 10,000 10,000 5,600 2,400 $90,000 Personal property taxes Maintenance and janitorial According to the two wholesalers, beer in bottles and cans outsold keg beer by a three-to-one margin. Keg beer prices at the wholesale level were about 45 per- cent of prices for beer in bottles and cans. ETING The entire matter deserved much thought. Maybe it was a golden opportu- nity, maybe not. The only thing certain was that research was needed, Manson and Associates was ready, and Larry needed time to think. Today is Tuesday Larry thought-only three days until he and John Rome would get together for direction. South Delaware Coors, Inc. Larry Brownlow was just beginning to realize the problem was more complex than he thought. The problem was giving direction to Manson and Associates re- garding which research should be completed by February 20, 2000, to determine market potential of a Coors beer distributorship for a two-county area in south ern Delaware. With data from this research, Larry would be able to estimate the feasibility of such an operation before the March 5 application deadline. Larry knew his decision on whether or not to apply for the distributorship was the most important career choice he had ever faced LARRY BROWNLOW Larry was just completing his MBA and, from his standpoint, the Coors announce- ment of expansion into Delaware could hardly have been better timed. He long ago decided that the best opportunities and rewards were in smaller, self owned businesses and not in the jungles of corporate giants. Because of a fam- ily tragedy some three years ago, Larry found himself in a position to consider small business was held in trust for Larry, to be dispersed when he reached age 30. Until then Larry and his family lived on an annual trust income of about S40,000. It was on this income that Larry decided to leave his sales engineering job and return to opportunities such as the Coors distributorship. Over $500,000 The decision to complete a graduate program and operate his own business had been easy to make. While he could avoid such challenges, find an "easy" job, and live comfortably using his investment income, Larry knew such a life would not be to his liking. Working with people and the challenge of making it on his own, Larry thought, were far more preferable than enduring a boring job and taking an early retirement. Larry would be 30 in July, about the time that money would be start the business. In the meantime, he had access to about $15,000 for feasibility rescarch. While there certainly were other places to spend the money, Larry and his wife agreed the distributorship opportunity could not be overlook COORS, INC Coors' history dated back to 1873, when Adolph Coors built a small brewery in Golden, Colorado. Since then, the brewery had prospered and become the fourth-largest seller of beer in the country. Coors' operating philosophy could be summed up as "hard work, saving money, devotion to the quality of the product, caring about the environment, and giving people something to be- lieve in." Company operation is consistent with this philosophy. Headquarters and most production facilities are still located in Golden, Colorado, with a new Shenandoah, Virginia, facility aiding in nationwide distribution. Coors is still family operated and controlled. The company had issued its first public stock, 127 million worth of nonvoting shares, in 1975. The issue was enthusiastically received by the financial community despite its being offered during a recession. Coors' unwillingness to compromise on the high quality of its product is well known both to its suppliers and to its consuming public. Coors beer re- quires constant refrigeration to maintain this quality, and wholesalers' facilities are closely controlled to ensure proper temperatures are maintained. Wholesal ers are also required to install and use aluminum can recycling equipment. Coors was one of the first breweries in the industry to recycle its cans. Larry was aware of Coors' popularity with many consumers in adjacent states Most beer consumers considered Coors beer to be a high quality, standard beer having a light, zesty taste and similar to standard beers from Budweiser or Miller However, Coors' corporate management was seen by some consumers to hold an- iunion beliefs (because of a labor disagreement at the brewery some time ago). A few other consumers perceived the brewery to be somewhat insensitive to minor- ity issues, primarily unemployment and distribution. The result of these attitudes plus other aspects of consumer behavior-meant that Coors' sales in Delaware would depend greatly on efforts of the two wholesalers planned for the state MANSON RESEARCH PROPOSAL Because of the press of his studiesLarry had contacted Manson and Associates in carly January for their assistance. The firm was a Wilmington-based general re- search supplier that had conducted other feasibility studies in the South Atlantic region. Manson was well known for the quality of its work, particularly with respect to computer modeling. The firm had developed special expertise in mod eling such things as population and employment levels for cities, counties, and other units of area for periods of up to 10 years into the future Larry had met John Rome, senior research analyst for Manson, and discussed the Coors opportunity and appropriate research extensively in the January meet ing. Rome promised a formal research proposal (Exhibit 1 on pages 125 and 126) for the project that Larry now held in his hand. It certainly was extensive, Larry thought, and reflected the professionalism he expected. Now came the hard part-choosing the more relevant research from the proposal-because he cer- tainly couldn't afford to pay for it all. Rome had suggested a meeting for Friday giving Larry only two more days to decide Larry was at first overwhelmed. All the research would certainly be useful. He was sure he needed estimates of sales and costs in a form allowing manage- rial analysis, but what data in what form Knowledge of competing operations experience, retailer support, and consumer acceptance also seemed important for feasibility analysis. For example, what if consumers were excited about Coors and retailers indifferent or the other way around? Finally, several of the studies would CHAPTER 4 OPPORTUNITY ANALYSIS, MARKET SEGMENTATION, AND MARKErTARGEmo EXHIBIT 1 (Continued) Stage Two Research, Based on Primary Data Study G: Consumer Study Description: Study G involves focus group interviews and a mail question naire to determine consumers past experience, acceptance, and intention to buy Coors beer. Three focus group interviews would be conducted in the two counties in the market area. From these data, a questionnaire would be developed and sent to 300 adult residents in the market area, utilizing direct questions and a semantic differential scale to measure atti- tudes toward Coors beer, competing beers, and an ideal beer Source: Manson and Associates Cost: $6,000 Study H: Retailer Study Description Group interviews would be conducted with six potential retail- ers of Coors beer in one county in the market area to determine their past beer sales and experience and their intention to stock and sell Coors. From these data, a personal interview questionnaire would be developed and exe- cuted at all appropriate retailers in the market area to determine similar data. Source: Manson and Associates Cost: $4,800 Study I: Survey of Retail and Wholesale Beer Prices Description In-store interviews with a representative sample of 50 retailers in the market area to estimate retail and wholesale prices for Budweiser Miller Lite, Miller, Busch, Bud Light, Old Milwaukee, and Michelob. Source: Manson and Associates Cost: $2,000 Examples of the form of final report tables are attached (Exhibit 2, pages 127-1311. This should give you a better idea of the data you will receive. As you can see, the research is extensive and, I might add, not cheap. However, the research as outlined will supply you with sufficient information to make an estimate of the feasibility of a Coors distributorship, the investment for which is substantial. I have scheduled 9:00 A.M.next Friday as a time to meet with you to discuss the pro- posal in more detail. Time is short, but we firmly feel the study can be completed by February 20, 2000. If you need more information in the meantime, please feel free to call. Sincerely John Rome Senior Research Analyst It would have been nice, Larry thought, to have had some time to perform part of the suggested research himself. However, there just was too much in the way of class assignments and other matters to allow him that luxury. Besides, using Manson and Associates would give him research results from an unbiased source. ESTING AND OPERATING DATA Larry was not completely in the dark regarding investment and operating data for the distributorship. In the past two weeks he had visited two beer wholesalers in his hometown of Chester, Pennsylvania, who handled Anheuser-Busch and EXHIBIT2 Examples of Final Research Report Tables Table A National and Delaware Resident Annual Beer Consumption Per Capita, 1998-2002 (Gallons) U.S. Consumption Delauare Consumption Based on Entire Based o Based on Population Based o 1999 2000 2001 2002 Source Study A Table B Population Estimates for 1996-2006 for the Two Delaware Counties in Market Area 1996 1998 2000 2000 Kent Population Age 21 and Over 1998 1996 2004 Source Study B Table C Coors Market Share Estimates for 2000-2005 ear 2000 2001 2002 2003 2004 2005 Market Share) Source Study C contin4 EXHIBIT 2 (Continued) Table D Liquor and Beer License Estimates for Market Area for 2000-2005 Type of License All beverages Retail beer and wine Off-premise beer only Veterans beer and liquor Fraternal Resort beer and liquor 2000 20012002 2003 2004 2005 Source: Study D Table E Delaware Beer Taxes Paid by Beer Wholesalers in the Market Area, 1997 and 1998 Wholesaler 997 Tax Paid (S 998 Tax Paid (S Source Study E Note Delaware beer tax is $0.06 cents per gallon Table F Financial Statement Summary for 510 Wholesalers of Wine, Liquor and Beer in Fiscal Year 1999 Assets Cash and equivalents Accounts and notes receivable, net Inventory All other current Total current Fixed assets, net Intangibles, net All other noncurrent Total 100.0 EXHIBIT 2 Table F (Continued Percentage Liabilities Notes payable, short-term Current maturity long-term debt Accounts and notes payable, trade Accrued expenses All other current Total current Long-term debt All other noncurrent Net worth 100.0 Total liabilities and net worth Income Data Net sales Cost of sales 100.0 Gross profit Operating expenses Operating profit All other expenses, net Profit before taxes Ratios Quick Current Cost sales/inventory Percentage profit before taxes, based on total assets RMA recommends that Statement Studies data be regarded only as general guidelines and not as absolute industry norms. There are several reasons why the data may not be fully representative of a given industry 1The financial statements used in the Statement Studies are not selected by any random or statis tically reliable method. RMA member banks voluntarily submil the raw data they have available each year, wish these being the only constraints: (a) The fiscal year-ends of the companies reported $100 million may not be from April I through June 29, and (b) their total assets must be less than Many companies have varied product lines, however, the Statement Studies categorize them by their primary product Standard Industrial Classification (SIC) S. Some of our industry samples are rather small in relation to the total number of firms in a given indusiry A relatihvely small sample can increase the chanceshat some of our do not fully represent an industry . There is the chance t 5. Companies within the same industry may differ in their method of operations, which in turn that an extreme statement can be present in a sample, causing a dispropor tionate influence on the industry composite. This is particularly true in a relatively small sample can directly influence their financial statements. Since they are included in our sample, too these statements can our composite calculations significantly 6 Other considerations that can result in variations among different companikes engaged in the sanse are diferent labor markets, geographical location, different mcthods, quality of products handled, sources and mcthods of financing, and terms of sale For these resons, RMA dos not recommend that Statement Studies ogures be considered as absolute minns jor a gnen industry Rather, the focares shoeeld be sed only, as general gitidelines and in addition to the other metbods of financial anabsis. RMA makes no claim as to the representatieness of the Agures printed in this book EXHIBIT 2 Continued) Table G Consumer Questionnaire Results Consumed Coors in the past: Yes No Yes No Usually buy beer at Taverns and bars o opinion 100.0 100.0 Weekly beer consumption Features considered important when buying beer Less than 1 can % 100.0 Intention to buy Coors: 100.0 Maybe will not Certainly will not 00.0 Semantic Differential Scale, Consumers Extremely Very Somewbat Somewbat Very Extremely Unhealthful Profiles would be provided for Coors, three competing beers, and an ideal beer (Continued) EXHIBIT 2 Table H Retailer Questionnaire Results Beer sales: Brands of beer carried Miller Lite Miller Busch Bud Light Old Milwaukee Michelob Miller Lite Miller Busch Bud Light Old Milwaukee Michelolb 100.0 Total 100.0 Total Semantic Differential Scale, Retailers Extremely Very Somewhat Someubat Very Extremely Feminine Weak New Strong Upper-class Good taste Bad taste Intention to sell Coors: Certainly will Maybe will Not sure Maybe will not Certainly will not 100.0 Total Profiles would be provided for Coons, three competing beers, and an ideal beer. Source Study H Table I Retail and Wholesale Prices for Selected Beers in the Market Area Retail Wholesale Six-Pack Price (dollas Sx-Pack Price (dollars) Beer Miller Lite Busch Bud Light Old Milwaukee Michelolb Price that the wholesaler sold to retailers. b Price that the retailer sold to consumers. Source Study 1 Miller beer, to get a feel for their operation and marketing experience. It would have been nice to interview a Coors wholesaler, but Coors management had strictly informed all of their distributors to provide no information to prospective applicants. While no specific financial data were discussed, general information had been provided in a cordial fashion because of the noncompetitive nature of Larry's plans. Based on his conversations, Larry had made the following estimates: Inventory Equipment $240,000 Delivery trucks Forklift $150,000 20,000 20,000 10,000 Office equipment Total equipment Warehouse Land 200,000 320,000 40,000 $800,00 Total investment A local banker had reviewed Larry's financial capabilities and saw no problem in extending a line of credit on the order of $400,000. Other sources also might loan as much as $400,000 to the business. As a rough estimate of fixed expenses, Larry planned on having four route salespeople, a secretary, and a warehouse manager. Salaries for these people and himself would run about $160,000 annually, plus some form of incentive compen- sation he had yet to determine. Other fixed or semifixed expenses were estimated as follows: Equipment depreciation Warehouse depreciation Utilities and telephone 35,000 15,000 12,000 10,000 10,000 5,600 2,400 $90,000 Personal property taxes Maintenance and janitorial According to the two wholesalers, beer in bottles and cans outsold keg beer by a three-to-one margin. Keg beer prices at the wholesale level were about 45 per- cent of prices for beer in bottles and cans. ETING The entire matter deserved much thought. Maybe it was a golden opportu- nity, maybe not. The only thing certain was that research was needed, Manson and Associates was ready, and Larry needed time to think. Today is Tuesday Larry thought-only three days until he and John Rome would get together for direction