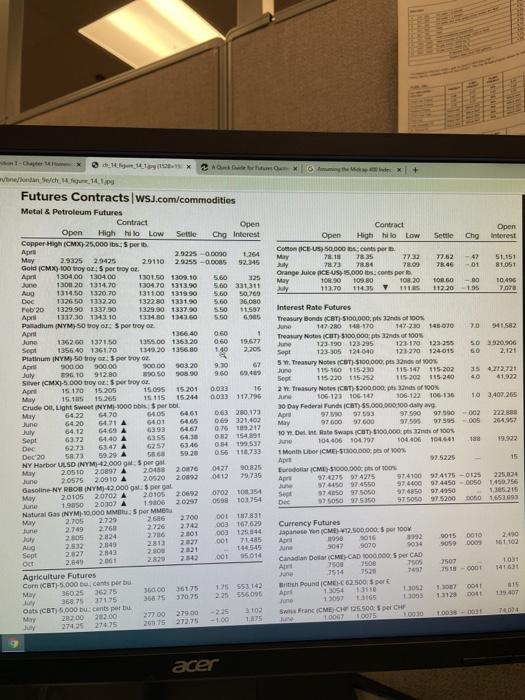

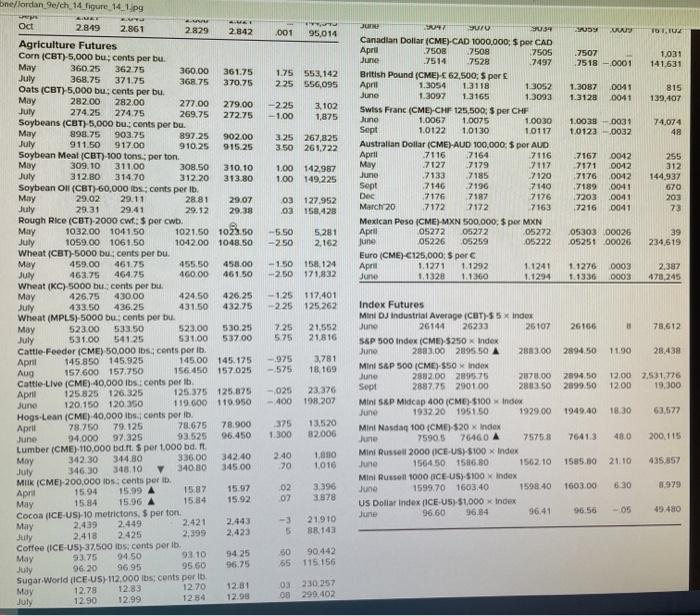

1 Using Figure 14.1 answer the following questions, a. What was the settle price for July 2019 oats futures on this date? What is the total dollar value of this contract at the close of trading for the day? (Input all amounts as positive values. Enter the settle price in dollars rounded to 4 decimal places and round the dollor value to 2 decimal places.) ebook Settle price Dollar value Print ferences b. What was the settle price for October 2019 naturgas futures on this date? If you held 35 contracts, what is the total dollar value of your futures position? (Input all amounts as positive values. Enter the settle price in dollars rounded to 4 decimal places and round the dollar value to the nearest whole number.) Settle price Dollar value 1. Suppose you held an open position of 25 June 2019 S&P 500 index futures on this day. What is the change in the total collar value of your position for this day's trading? (A negative value should be indicated by a minus sign.) DollarValue And 132650 er20 15. 170 1 X AN when edhe 14.1 X Futures Contracts WSJ.com/commodities Metal & Petroleum Futures Contract Open Open High hilo Low Contract Settle 0g | test Open Copper High (CMX)-25,000 lbs.Sporib. Open High hilo Low Settle Chg Interest Apre 2.52250000 Cotton ICE-US) 50.000 sport 2.9325 May 1264 2.0425 29110 May 2.9255 -0.0005 78.18 7836 7730 Gold CMX100 toy or per tray 2 77.62 92.345 Mily 51.151 78.73 7884 78.09 78.46 -01 81.051 Apr 1304,00 1304.00 1301.501309.10 5.60 1300 20131470 Orange Juice CE-US) 5,000 lbs: contes perto 325 1304.70 1313.90 5.60331311 May 108.90 109 80 108.20 108.60 - 00 10,496 Aug 1314.50 1320.70 131100 1319.90 5.60 1145 112.70 112:20 50.760 -195 Doc 7.00 133220 1322 80 1331.90 5.60 36.000 1329.90 1337.00 1329.00 1337.90 550 11.55 Interest Rate Futures April 1317.30 1343.10 1314.30 1043.60 6.005 Palladium (NYM) SO Boy : Sper troy or Treasury Bonds CET) 100.000 ps 32 of 100% April June 147 280 148-170 7.0 0.60 147-230145-070 1366.40 901.582 June 1362.00 1321.50 1355.00 136320 0.60 15,677 Treasury Notes CHT) 3100,000 ps 22nds of 100% Sept 1356.40 136170 June 123-190123295 1349.30 135680 1.40 2.205 123-170123 355 50 520,906 Platinum INYM) 50 toy oz. per troy oz. Sept 123-305124040 123-270 124015 60 2.121 Apr 900.00 900.00 90000 90320 9.30 67 5. Treasury Notes CBT-5100.000pts ands of 100% 896.10 912.90 1050 908.90 9.60 69.49 June 115-160115230 115-147 15-202 35 72.721 Silver (CMX)-5.000 try 02:5 per troy oz. Sept 115220115252 115.202 115-240 40 41.922 April 15.205 15.095 15.201 Do 16 2 Treasury Notes CBT)-5200.000, pans of 100% May 15.10 15.265 15115 15244 0.033 117.796 106123 106-14 106-122 100-136 103.401.265 Crude Oil, Light Sweet NYM-1000 is perto 30 Day Federal Funds CBT) $5.000.000.000 May 64.22 6470 063 280.173 6405 97.1 Apre 57.63 June 970 6420 97.590-002 6471 A 64 65 6400 0.6s 321403 222 880 May 64.12 97600 July 6667 57600 0.75180.217 97.595 07.595 005 63.93 264.95 6440 A 6355 0154191 10 Y Delit Rate Swaps CBT) $100,000 of 100% Dec 6273 June 6257 6347 A 18 6346 104406 104797 694 199.537 10446 104641 19.922 5873 5929 SES 0.56 118,733 Monin LDCMESTO.000 NY Harbor ULSO INYM 42.000 ga 5 peo Apre 97.5225 15 May 20510 2.0897 20488 2017 0427 90825 Euro ICME$1000.000:of June 20575 2.0520 20910 79735 2009 0412 Apre 974275 97.4225 974100574175-0125 226 24 Gasoline NYRBOHINYM) 42.000 $ per al 9740174550 97 440097 4450-0050 1450756 May 20702 2.0105 2.0692 070210354 Se 97400975050 97435094950 305215 June 1.9050 20307 19806 20297 0558103.754 De 97 SOSO 97.5350 97.5060975200 COBO 1,653093 Natural Gas INYM 10.000 MM: Sper MM My 2.706 2729 2700 00117831 2.749 2760 2726 2742 003 167,629 Currency Futures 2005 July 2.76 003 125340 2.101 Japanese Yen ICM 92.500.000 $ por 100 233 Aug 2015 71405 001 2.049 2.813 2490 1990 2016 0010 2.00 144.545 9047 9034 9070 Sopt 9059 0009 1100 2.649 OCT 2.829 15014 2.342 Canadian Dollar (CMECAD 1000.000: 5 per CAD 7500 1500 7507 TO Agriculture Futures 7514 7520 747 7518-0001 14163 Corn (CBT)-5.000 cents portu May British Pound CME-C 500 Sport 360 25 6000 36275 15553142 1310 3002 1.2007 13054 19 368.75 36875 27175 37075 2.25 556.096 13092 1165 13003 13120 41 139407 OCBT) 5.000 bucants per tu 27700 May 3102 279.00 Bwis Franc CME CI 15500:5 per CHF 744 1000 1000031 LOOG 27425 100 274 75 272.75 5461 5469 Sep 6630 DOC 20 20105 2824 2000 2001 001 22.00 - 225 -100 acer bne/lordan 9e/ch 14 figure 141.pg 2.861 . .001 95,014 101, .7507 7518-0001 1,031 141,631 1.75 553 142 2.25 SSG,095 1.3087 1.3128 0041 0041 815 139,407 -2.25 -1.00 3,102 1.875 1.0038-0031 1.0123 .0032 74,074 48 3.25 267,825 3.50 261.722 June 9047 YURU YU Canadian Dollar (CME) CAD 1000,000; Spor CAD April 7508 7508 7505 June 2514 7528 7497 British Pound (CME)- 62,500; Sper April 1.3054 1.3118 1.3052 June 1.3097 1.3165 1.3093 Swiss Franc (CME) CHF 125,500 $ per CHF June 1.0067 1.0075 1.0030 Sept 1.0122 1.0130 1.0117 Australian Dollar (CME) AUD 100,000 $ per AUD April 7116 17164 7116 May 7127 7179 17117 June 7133 .7185 7120 Sept 7146 7196 7140 Dec 7176 7187 7176 March 20 7172 7172 7163 Mexican Peso (CME)-MXN 1500,000, $ por MXN April 05272 05272 05272 June 05226 05259 05222 Euro (CME) C125,000, 5 perc April 1.1271 11292 1.1241 June 1.1328 1.1360 1.1294 255 1.00 142.987 1.00 149.225 7167 7171 7176 7189 7203 7216 0042 0012 0042 0041 0041 0041 312 144,937 670 203 73 03 03 127,952 158,428 -550 -250 5.281 2.162 05303 00026 05251 00026 39 234,619 -150 -2.50 158.124 171,832 1.1276 1.1936 0003 0003 2,387 478.245 -125 117401 -225 125.262 . Oct 2.849 2829 2842 Agriculture Futures Corn (CBT) 5,000 bu, cents per bu May 360.25 362.75 360.00 361.75 July 368.75 371.75 368.75 370.75 Oats (CBT) 5,000 buscents per bu. May 282.00 282.00 277.00 279.00 July 274.25 274.75 269.75 272.75 Soybeans (CBT)-5,000 bu, cents per bu. May 898.75 903.75 89725 902.00 July 911.50 917.00 910.25 915.25 Soybean Meal (CBT)-100 tons; per ton May 309.10 311.00 308.50 310.10 July 312.80 314.70 312.20 313.80 Soybean Oll (CBT) 60,000 IDS: cents per ib. May 29.02 29.11 28.81 29.07 July 29.31 29.41 29.12 29.38 Rough Rice (CBT) 2000 Wt: $ por cwb. May 1032.00 1041.50 1021.50 1025.50 July 1059.00 1061,50 1042.00 1048.50 Wheat (CBT)-5000 bucents per bu. May 459.00 46175 455.50 458.00 July 463.75 464.75 460.00 461.50 Wheat (KC) 5000 bu.: cents per bu. May 426.75 430.00 424.50 426.25 July 433.50 436.25 431.50 432.75 Wheat (MPLS) 5000 bu: cents per bu. May 523.00 533.50 523.00 530.25 July 531.00 541.25 531,00 537.00 Cattle-Feeder (CME) 50,000 lbs. cents per ib. April 145.850 145.925 145.00 145.175 157.600 157.750 156.450 157025 Cattle-Live (CME) 40,000 lbs: cents per ib. April 125.825 126.325 125.375 125.875 June 120.150 120.350 119.600 119.950 Hogs-Lean (CME) 40,000 lbscents per ib. April 78.750 79.125 78.675 78.000 June 94.000 97,325 93.525 96.450 Lumber (CME)-110,000 bd.ft S per 1,000 bd. It 342.30 344.80 336 00 342.40 July 346.30 348 10 345.00 340.30 MIIK (CME 200,000 lbs: cents per ib. April 15.94 15.99 A 15.87 15.97 May 15.84 15.96 A 1584 15.92 Cocoa (ICE-US)-10 metrictons, $ per ton. 2,439 May 2.449 2.443 July 2.418 2,423 2,399 Coffee (ICE-US) 37,500 s, contsporib. 93.75 May 94 50 9 10 94 25 July 96 20 96 95 96.75 95.50 Sugar World (ICE-US)-112.000 lbs, cents per i May 12.79 12.83 12.70 12.31 July 12.90 12.99 1284 12.08 7.25 5.75 78,612 21.552 21,816 11.90 28,438 - 975 -575 3,781 18.169 Aug 12.00 2,531.776 1200 19.300 -025 23.376 198.207 - 400 Index Futures Mini DJ Industrial Average (CBT) 55 x index June 26144 26233 26107 26166 S&P 500 Index (CME) $250 x Index June 2883.00 2895.50 A 2883.00 2894.50 Mini S&P 500 (CME) $50 x Index June 2882.00 2895,75 2878.00 2094.50 Sopi 2887.75 290100 288350 2099,50 Mini S&P Midcap 400 (CMO)-5100 x Index June 193220 1951.50 1929.00 1949.40 Mini Nasdaq 100 (CME) $20 x index June 7590.5 76460 A 75758 7641.3 Mini Russell 2000 (ICE-US-$100 x Index June 1564501586.80 156210 1585.80 Mini Russell 1000 ICE-US)-5100 Index June 1599.70 1603,40 1598.40 1603.00 US Dollar Index [ICE-U5)-51,000 x Index June 96.60 96.84 96.41 96.56 18.30 63,577 375 1.300 13.520 82.006 480 200.115 2:40 70 1.800 1,016 21.10 435.357 8.979 02 07 3.396 3,878 - 05 49.480 2.421 2 1.910 BB 143 5 2.425 50 90.442 65 115 156 03 230.257 00 299.402