Answered step by step

Verified Expert Solution

Question

1 Approved Answer

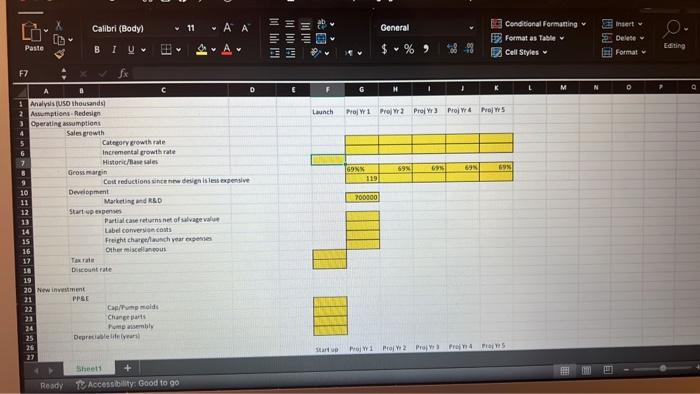

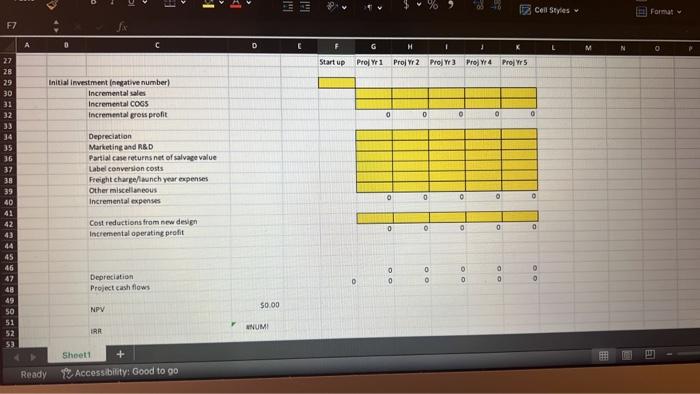

1. Using the 10-4 Excel template, calculate the NPV and IRR. * PROJECT INFORMATION: The redesign calls for cutting SKU's from 79 to 49 .

1. Using the 10-4 Excel template, calculate the NPV and IRR.

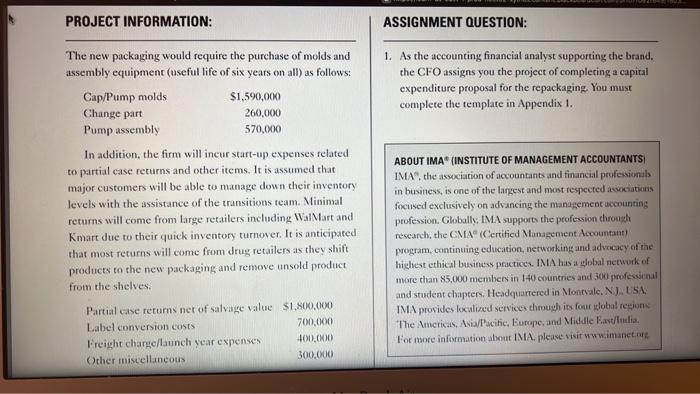

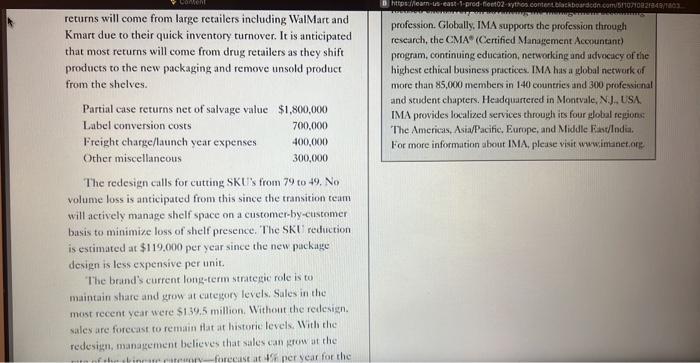

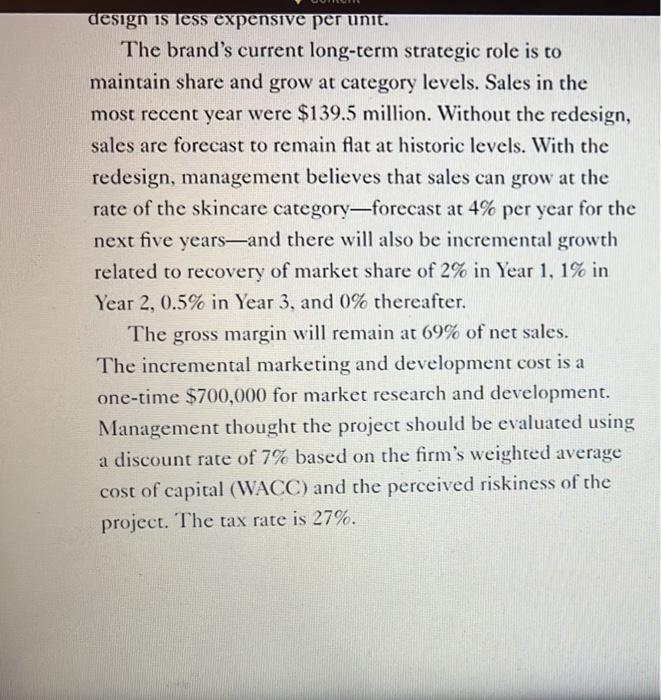

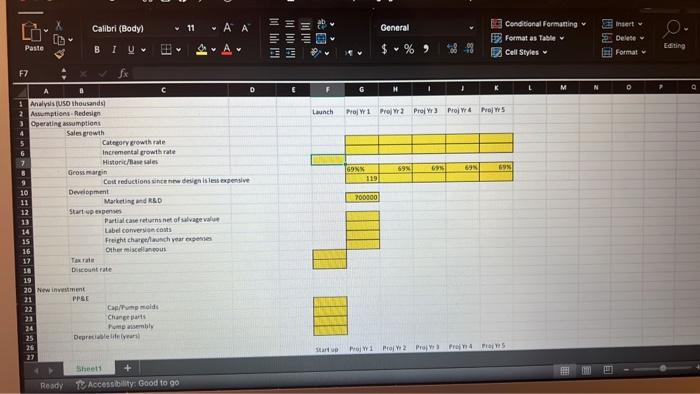

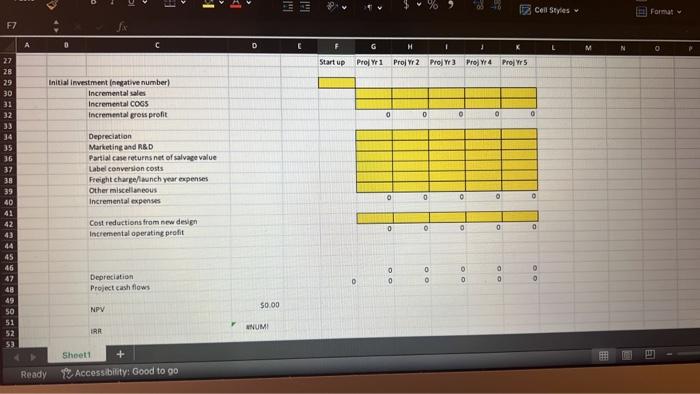

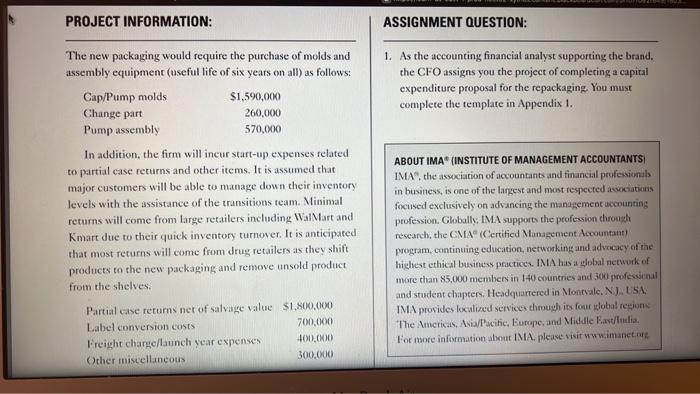

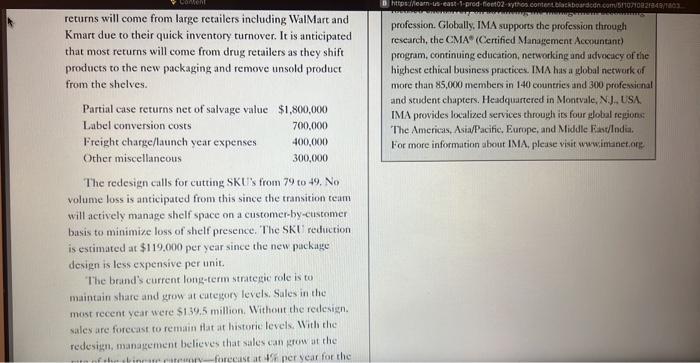

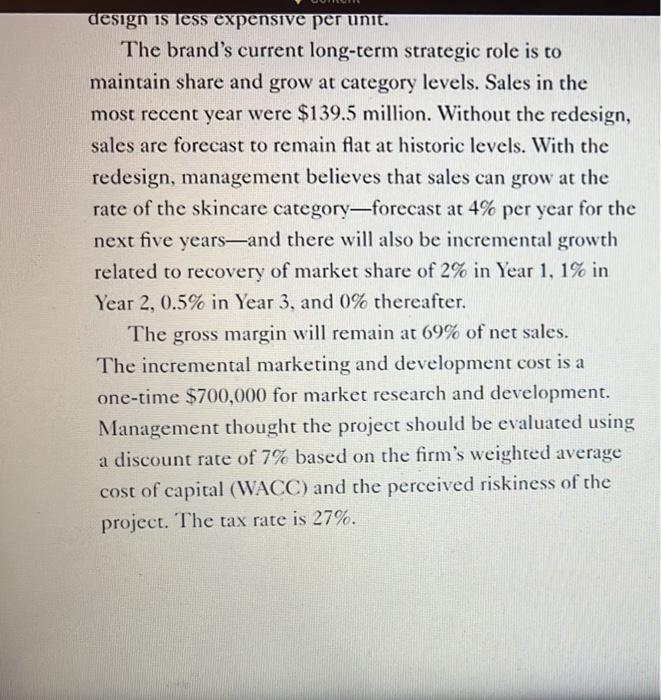

* PROJECT INFORMATION: The redesign calls for cutting SKU's from 79 to 49 . No volume loss is anticipated from this since the transition team will actively manage shelf space on a customer-by-customer basis to minimize loss of shelf presence. The SKL reduction is estimated at $119.000 per year since the new package design is less expensive per unit. 'The brand's current longeterm strategic role is to maintain share and grow at category levels. Sales in the mast recent year wete $1,39.5 million. Without the redesign. sales are forecast to remain flat at historie levels. With the redesign, management believes that sales can grow at the The brand's current long-term strategic role is to maintain share and grow at category levels. Sales in the most recent year were $139.5 million. Without the redesign, sales are forecast to remain flat at historic levels. With the redesign, management believes that sales can grow at the rate of the skincare category-forecast at 4% per year for the next five years-and there will also be incremental growth related to recovery of market share of 2% in Year 1,1% in Year 2, 0.5% in Year 3 , and 0% thereafter. The gross margin will remain at 69% of net sales. The incremental marketing and development cost is a one-time $700,000 for market research and development. Management thought the project should be evaluated using a discount rate of 7% based on the firm's weighted average cost of capital (WACC) and the perceived riskiness of the project. The tax rate is 27%. Tisizate Dicountrate Dices that PPSE Copinmprolet cheretpers treponseribly orrevisielife(inear) \begin{tabular}{|l|} \hline \end{tabular} Cost reductions from new deven incremental operating peofit Depreciatien Project eash flows \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline 0 & 0 & 0 & 0 & 0 \\ \hline \end{tabular} NPV 50.00 RRady 12 Accessibility: Good to 90 * PROJECT INFORMATION: The redesign calls for cutting SKU's from 79 to 49 . No volume loss is anticipated from this since the transition team will actively manage shelf space on a customer-by-customer basis to minimize loss of shelf presence. The SKL reduction is estimated at $119.000 per year since the new package design is less expensive per unit. 'The brand's current longeterm strategic role is to maintain share and grow at category levels. Sales in the mast recent year wete $1,39.5 million. Without the redesign. sales are forecast to remain flat at historie levels. With the redesign, management believes that sales can grow at the The brand's current long-term strategic role is to maintain share and grow at category levels. Sales in the most recent year were $139.5 million. Without the redesign, sales are forecast to remain flat at historic levels. With the redesign, management believes that sales can grow at the rate of the skincare category-forecast at 4% per year for the next five years-and there will also be incremental growth related to recovery of market share of 2% in Year 1,1% in Year 2, 0.5% in Year 3 , and 0% thereafter. The gross margin will remain at 69% of net sales. The incremental marketing and development cost is a one-time $700,000 for market research and development. Management thought the project should be evaluated using a discount rate of 7% based on the firm's weighted average cost of capital (WACC) and the perceived riskiness of the project. The tax rate is 27%. Tisizate Dicountrate Dices that PPSE Copinmprolet cheretpers treponseribly orrevisielife(inear) \begin{tabular}{|l|} \hline \end{tabular} Cost reductions from new deven incremental operating peofit Depreciatien Project eash flows \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline 0 & 0 & 0 & 0 & 0 \\ \hline \end{tabular} NPV 50.00 RRady 12 Accessibility: Good to 90

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started