Answered step by step

Verified Expert Solution

Question

1 Approved Answer

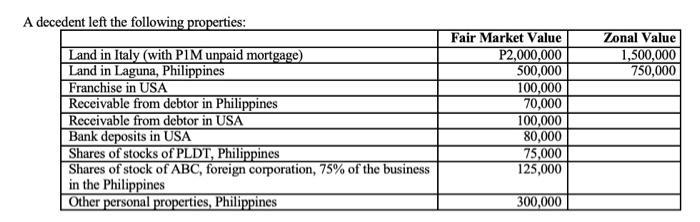

1. Using the above data, if the decedent is a non-resident alien, his gross estate is 2. If the decedent is a Non-Resident Alien and

1. Using the above data, if the decedent is a non-resident alien, his gross estate is

2. If the decedent is a Non-Resident Alien and there is reciprocity, the gross estate is

3. the claims against the estate is P1,500,000, how much is the estate tax due?

A decedent left the following properties: Land in Italy (with PIM unpaid mortgage) Land in Laguna, Philippines Franchise in USA Receivable from debtor in Philippines Receivable from debtor in USA Bank deposits in USA Shares of stocks of PLDT, Philippines Shares of stock of ABC, foreign corporation, 75% of the business in the Philippines Other personal properties, Philippines Fair Market Value P2,000,000 500,000 100,000 70,000 100,000 80,000 75,000 125,000 300,000 Zonal Value 1,500,000 750,000

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

a 4000000 Gross Estate Land in Italy Land in Laguna Philippines Franchise in USA Receivable from deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started