Question

1. Using the accounts and balances above, prepare the closing entries for 2022. For those boxes in which no entry is required, leave the box

1. Using the accounts and balances above, prepare the closing entries for 2022. For those boxes in which no entry is required, leave the box blank.

| Dec. 31 | Depreciation Expense, EquipmentDividends DeclaredIncome SummarySales RevenueUnearned Sales Revenue | - Select - | - Select - |

Depreciation Expense, EquipmentIncome SummaryIncome Tax ExpenseInterest ExpenseInterest Revenue | - Select - | - Select - | |

Accumulated Depreciation, EquipmentIncome SummaryIncome Tax PayablePrepaid RentService Revenue | - Select - | - Select - | |

| (Close revenue account) | |||

| Dec. 31 | EquipmentIncome SummaryUtilities ExpenseWages ExpenseWages Payable | - Select - | - Select - |

Accumulated Depreciation, EquipmentDepreciation Expense, EquipmentEquipmentRetained EarningsUnearned Service Revenue | - Select - | - Select - | |

Accounts PayableIncome SummaryIncome Tax ExpenseIncome Tax PayableService Revenue | - Select - | - Select - | |

Income SummaryInsurance ExpensePrepaid InsuranceRetained EarningsService Revenue | - Select - | - Select - | |

Accounts PayableEquipmentInterest ExpenseInterest PayableInterest Revenue | - Select - | - Select - | |

Income SummaryPrepaid RentRent ExpenseRetained EarningsUnearned Service Revenue | - Select - | - Select - | |

Accounts ReceivableCashCommon SharesSuppliesSupplies Expense | - Select - | - Select - | |

Accounts PayableIncome SummaryRetained EarningsService RevenueUtilities Expense | - Select - | - Select - | |

Income SummaryInterest RevenueService RevenueWages ExpenseWages Payable | - Select - | - Select - | |

| (Close expense accounts) | |||

| Dec. 31 | Depreciation Expense, EquipmentDividends DeclaredIncome SummaryIncome Tax ExpenseUtilities Expense | - Select - | |

Common SharesIncome SummaryInterest ExpenseRetained EarningsService Revenue | - Select - | ||

| (Close Income Summary) | |||

| Dec. 31 | Depreciation Expense, EquipmentDividends DeclaredIncome Tax ExpenseInterest ExpenseRetained Earnings | - Select - | |

CashDividends DeclaredIncome SummaryRetained EarningsService Revenue | - Select - | ||

| (Close Dividends Declared) |

2. Prepare a statement of earnings for Port Austin Boat Repair.

| Revenues: | ||

Retained earningsSales revenueSupplies expenseUnearned sales revenueUtilities expense | $- Select - | |

Depreciation expense, equipmentIncome tax expenseInsurance expenseInterest expenseInterest revenue | - Select - | $- Select - |

| Expenses: | ||

Interest payablePrepaid rentRetained earningsWages expenseWages payable | - Select - | |

Insurance expenseInterest revenuePrepaid insuranceSales revenueUnearned sales revenue | - Select - | |

Accounts receivableCommon sharesSuppliesSupplies expenseWages payable | - Select - | |

Prepaid rentRent expenseRetained earningsSales revenueWages payable | - Select - | |

Accumulated depreciation, equipmentDepreciation expense, equipmentEquipmentIncome summaryWages payable | - Select - | |

Accumulated depreciation, equipmentEquipmentIncome summaryUnearned sales revenueUtilities expense | - Select - | |

Accounts receivableCommon sharesInterest expenseInterest payableInterest revenue | - Select - | |

Accounts payableIncome tax expenseIncome tax payableInterest revenueService revenue | - Select - | - Select - |

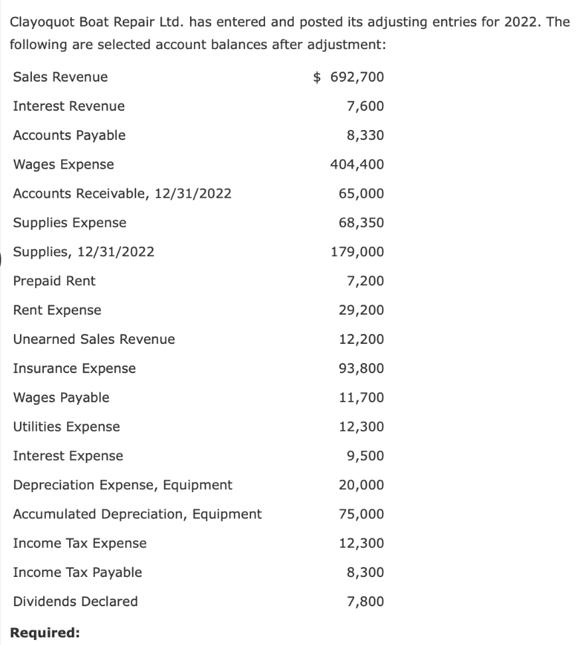

Clayoquot Boat Repair Ltd. has entered and posted its adjusting entries for 2022. The following are selected account balances after adjustment: Sales Revenue $ 692,700 Interest Revenue 7,600 Accounts Payable 8,330 Wages Expense 404,400 Accounts Receivable, 12/31/2022 65,000 Supplies Expense 68,350 Supplies, 12/31/2022 179,000 Prepaid Rent 7,200 Rent Expense 29,200 Unearned Sales Revenue 12,200 Insurance Expense 93,800 Wages Payable 11,700 Utilities Expense 12,300 Interest Expense 9,500 20,000 75,000 12,300 8,300 7,800 Depreciation Expense, Equipment Accumulated Depreciation, Equipment Income Tax Expense Income Tax Payable Dividends Declared Required:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started