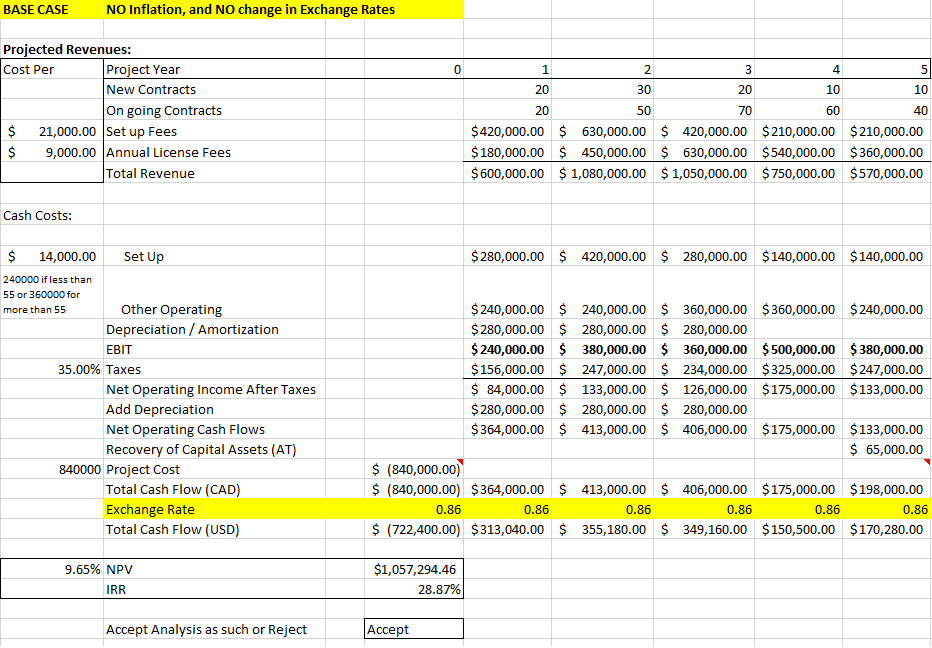

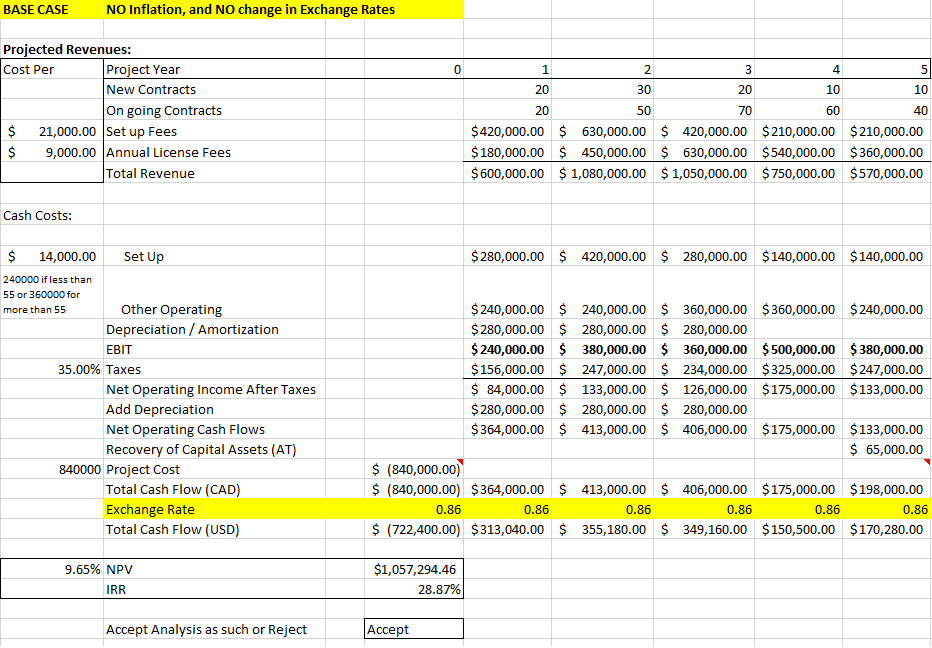

1. Using the Base case below, complete an analysis which considers PPP FX Forecast

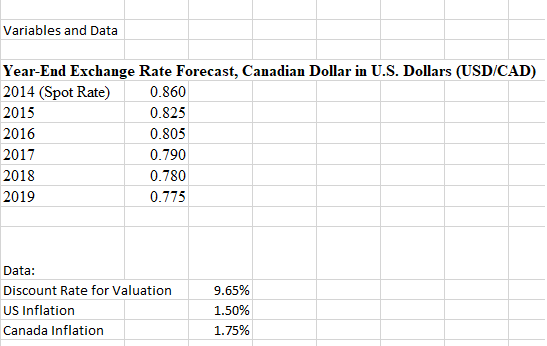

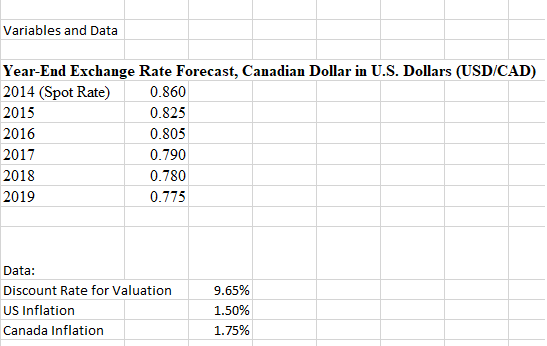

BASE CASE NO Inflation, and NO change in Exchange Rates Projected Revenues: Cost Per Project Year New Contracts On going Contracts 0 4 20 30 20 10 10 20 50 70 $ 21,000.00 Set up Fees $420,000.00 $630,000.00 $ 420,000.00 $210,000.00 $210,000.00 $180,000.00$ 450,000.00 $ 630,000.00 $540,000.00 $360,000.00 $600,000.00 $1,080,000.00 $1,050,000.00 $750,000.00 $570,000.00 $9,000.00 Annual License Fees Total Revenue Cash Costs: $ 14,000.00 240000 if less than 55 or 360000 for more than 55 Set Up $280,000.00$420,000.00 $ 280,000.00 $140,000.00 $140,000.00 $240,000.00 $240,000.00 $ 360,000.00 360,000.00 $240,000.00 Other Operating Depreciation/Amortization EBIT $280,000.00 $ 280,000.00$280,000.00 $240,000.00 $ 380,000.00 $360,000.00 $500,000.00 $380,000.00 $156,000.00 247,000.00$234,000.00 $325,000.00 $247,000.00 $ 84,000.00 133,000.00$126,000.00 $175,000.00 $133,000.00 35.00% Taxes Net Operating Income After Taxes Add Depreciation Net Operating Cash Flows Recovery of Capital Assets (AT) $280,000.00 $ 280,000.00$280,000.00 $364,000.00 413,000.00$406,000.00 $175,000.00 $133,000.00 $ 65,000.00 840000 Project Cost (840,000.00) $ (840,000.00) $364,000.00 S413,000.00 0.86 406,000.00 $175,000.00 $198,000.00 Total Cash Flow (CAD) Exchange Rate Total Cash Flow (USD) 0.86 0.86 0.86 0.86 0.86 $ (722,400.00) $313,040.00 $ 355,180.00 $ 349,160.00 $150,500.00 $170,280.00 $1,057,294.46 28.87% 9.65% NPV IRR Accept Analysis as such or Reject Accept Variables and Data Year-End Exchange Rate Forecast, Canadian Dollar in U.S. Dollars (USD/CAD) 2014 (Spot Rate)0.860 2015 2016 2017 2018 2019 0.825 0.805 0.790 0.780 0.775 Data: Discount Rate for Valuation US Inflation Canada Inflation 9.65% 1.50% 1.75% BASE CASE NO Inflation, and NO change in Exchange Rates Projected Revenues: Cost Per Project Year New Contracts On going Contracts 0 4 20 30 20 10 10 20 50 70 $ 21,000.00 Set up Fees $420,000.00 $630,000.00 $ 420,000.00 $210,000.00 $210,000.00 $180,000.00$ 450,000.00 $ 630,000.00 $540,000.00 $360,000.00 $600,000.00 $1,080,000.00 $1,050,000.00 $750,000.00 $570,000.00 $9,000.00 Annual License Fees Total Revenue Cash Costs: $ 14,000.00 240000 if less than 55 or 360000 for more than 55 Set Up $280,000.00$420,000.00 $ 280,000.00 $140,000.00 $140,000.00 $240,000.00 $240,000.00 $ 360,000.00 360,000.00 $240,000.00 Other Operating Depreciation/Amortization EBIT $280,000.00 $ 280,000.00$280,000.00 $240,000.00 $ 380,000.00 $360,000.00 $500,000.00 $380,000.00 $156,000.00 247,000.00$234,000.00 $325,000.00 $247,000.00 $ 84,000.00 133,000.00$126,000.00 $175,000.00 $133,000.00 35.00% Taxes Net Operating Income After Taxes Add Depreciation Net Operating Cash Flows Recovery of Capital Assets (AT) $280,000.00 $ 280,000.00$280,000.00 $364,000.00 413,000.00$406,000.00 $175,000.00 $133,000.00 $ 65,000.00 840000 Project Cost (840,000.00) $ (840,000.00) $364,000.00 S413,000.00 0.86 406,000.00 $175,000.00 $198,000.00 Total Cash Flow (CAD) Exchange Rate Total Cash Flow (USD) 0.86 0.86 0.86 0.86 0.86 $ (722,400.00) $313,040.00 $ 355,180.00 $ 349,160.00 $150,500.00 $170,280.00 $1,057,294.46 28.87% 9.65% NPV IRR Accept Analysis as such or Reject Accept Variables and Data Year-End Exchange Rate Forecast, Canadian Dollar in U.S. Dollars (USD/CAD) 2014 (Spot Rate)0.860 2015 2016 2017 2018 2019 0.825 0.805 0.790 0.780 0.775 Data: Discount Rate for Valuation US Inflation Canada Inflation 9.65% 1.50% 1.75%