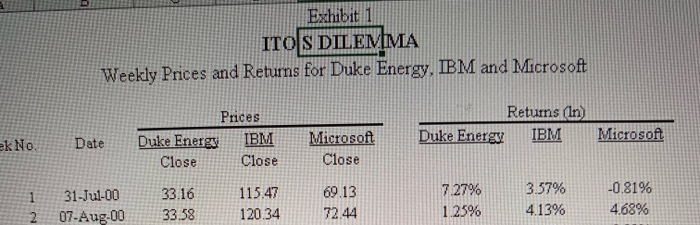

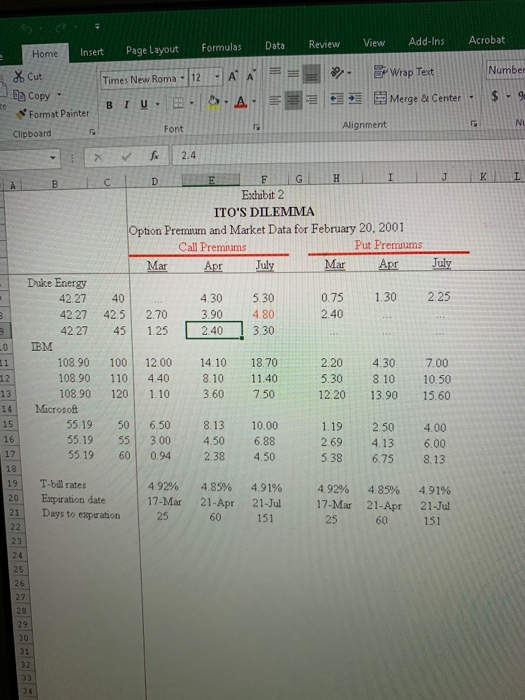

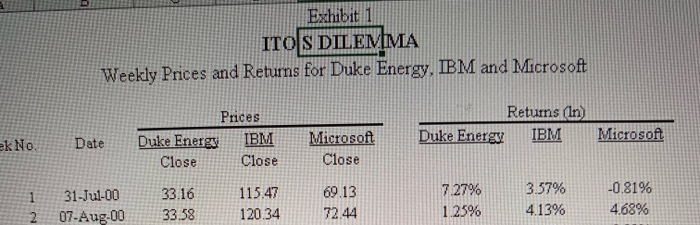

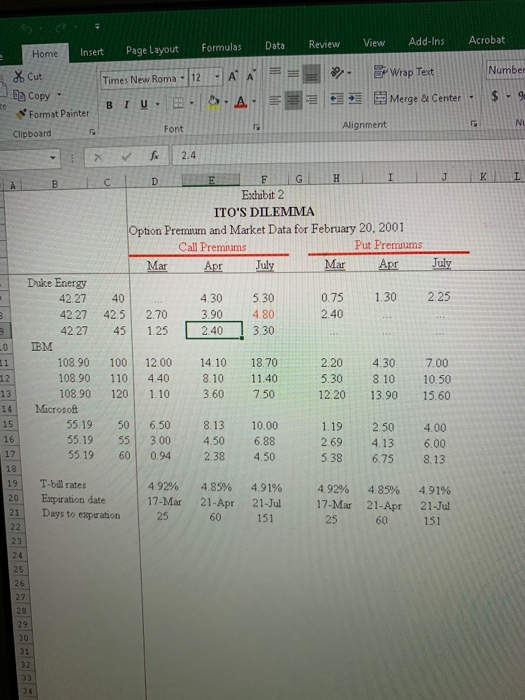

1. Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in case Exhibit 2. For simplicity, assume zero dividend yield. Also, use Louise Ito's volatility estimates, provided in case Exhibit 1. Exhibiti ITO S DILEMMA Weekly Prices and Returns for Duke Energy, IBM and Microsoft Returns (In) Duke Energy IBM Microsoft ek No. Prices Duke Energy IBM Close Close Date Microsoft Close 1 2 31-Jul-00 07-Aug-00 33.16 33.58 115.47 120.34 69.13 72.44 7.27% 1.25% 3.57% 4.13% -0.81% 4.68% Data Review View Add-ins Acrobat Formulas Home Insert Page Layout Number of cut Be Copy " Format Painter Times New Roma - 12 -AA & Wrap Text BIU 5.A. Merge & Center - te Alignment NU Clipboard Font X 2.4 . K I E H G D I J B Exhibit 2 ITO'S DILEMMA Option Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Mar Apr July Mar Apr July Duke Energy 42.27 40 4.30 5.30 0.75 1.30 2.25 42.27 42.5 2.70 3.90 4.80 2.40 42.27 45 1.25 2.40 3.30 20 IBM 108.90 100 12.00 14.10 18.70 2.20 4.30 7.00 12 108.90 110 4.40 8.10 11.40 5.30 8.10 10.50 13 108.90 120 1.10 3.60 7.50 12.20 13.90 15.60 Microsoft 15 55.19 50 6.50 8.13 10.00 1.19 2.50 4.00 16 55.19 55 3.00 4.50 6.88 2.69 4.13 6.00 17 55.19 60 0.94 2.38 4.50 5.38 6.75 8.13 18 19 4.92% 4.85% 4.91% 4.92% 4.85% 4.91% 20 Expiration date 17-Mar 21-Apr 21-Jul 17-Mar 21-Apr 21-Jul 21 Days to expiration 25 60 151 25 60 151 22 23 24 25 26 27 28 29 30 31 32 33 34 T-bil rates 1. Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in case Exhibit 2. For simplicity, assume zero dividend yield. Also, use Louise Ito's volatility estimates, provided in case Exhibit 1. Exhibiti ITO S DILEMMA Weekly Prices and Returns for Duke Energy, IBM and Microsoft Returns (In) Duke Energy IBM Microsoft ek No. Prices Duke Energy IBM Close Close Date Microsoft Close 1 2 31-Jul-00 07-Aug-00 33.16 33.58 115.47 120.34 69.13 72.44 7.27% 1.25% 3.57% 4.13% -0.81% 4.68% Data Review View Add-ins Acrobat Formulas Home Insert Page Layout Number of cut Be Copy " Format Painter Times New Roma - 12 -AA & Wrap Text BIU 5.A. Merge & Center - te Alignment NU Clipboard Font X 2.4 . K I E H G D I J B Exhibit 2 ITO'S DILEMMA Option Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Mar Apr July Mar Apr July Duke Energy 42.27 40 4.30 5.30 0.75 1.30 2.25 42.27 42.5 2.70 3.90 4.80 2.40 42.27 45 1.25 2.40 3.30 20 IBM 108.90 100 12.00 14.10 18.70 2.20 4.30 7.00 12 108.90 110 4.40 8.10 11.40 5.30 8.10 10.50 13 108.90 120 1.10 3.60 7.50 12.20 13.90 15.60 Microsoft 15 55.19 50 6.50 8.13 10.00 1.19 2.50 4.00 16 55.19 55 3.00 4.50 6.88 2.69 4.13 6.00 17 55.19 60 0.94 2.38 4.50 5.38 6.75 8.13 18 19 4.92% 4.85% 4.91% 4.92% 4.85% 4.91% 20 Expiration date 17-Mar 21-Apr 21-Jul 17-Mar 21-Apr 21-Jul 21 Days to expiration 25 60 151 25 60 151 22 23 24 25 26 27 28 29 30 31 32 33 34 T-bil rates