Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using the data in the exhibit below, please calculate the following ratios for BMW. Has performance improved since the start of the pandemic, as

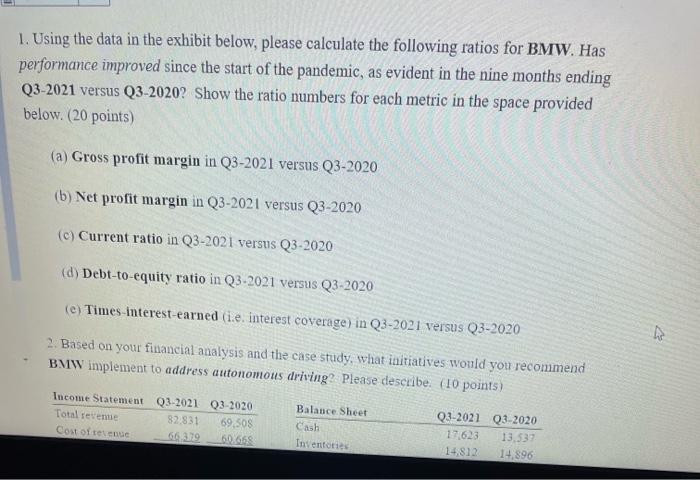

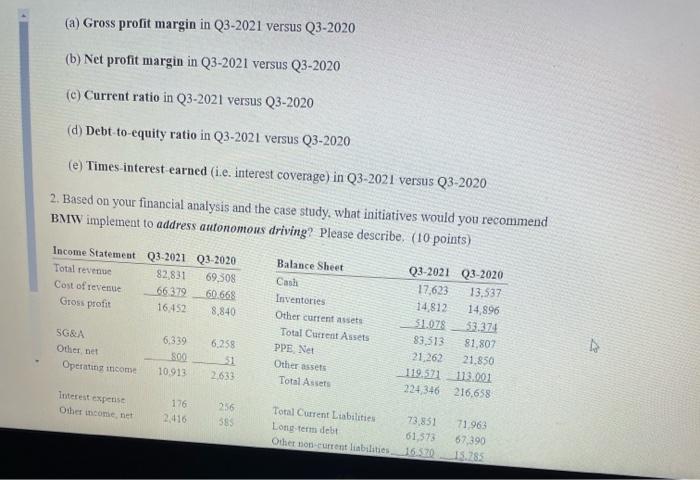

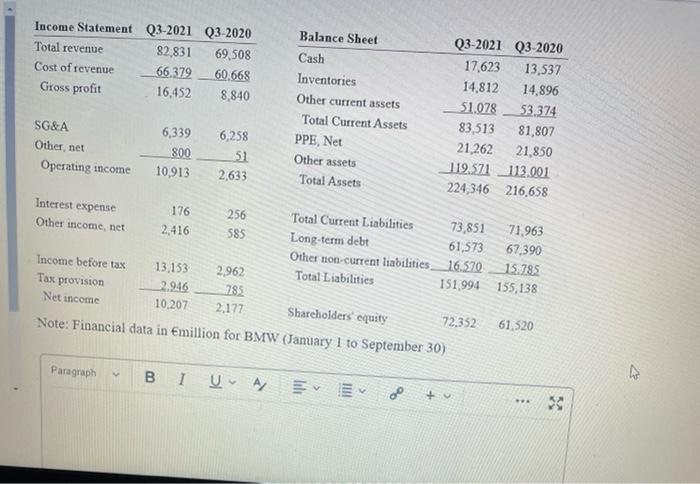

1. Using the data in the exhibit below, please calculate the following ratios for BMW. Has performance improved since the start of the pandemic, as evident in the nine months ending Q3-2021 versus Q3-2020? Show the ratio numbers for each metric in the space provided below. (20 points) (a) Gross profit margin in Q3-2021 versus Q3-2020 (b) Net profit margin in Q3-2021 versus Q3-2020 (c) Current ratio in Q3-2021 versus Q3-2020 (d) Debt-to-equity ratio in Q3-2021 versus Q3-2020 (e) Times-interest-earned (i.e. interest coverage) in Q3-2021 versus Q3-2020

2. Based on your financial analysis and the case study, what initiatives would you recommend BMW implement to address autonomous driving? Please describe. (10 points) Income Statement Total revenue Cost of revenue Gross profit SG&A Other, net Operating income Interest expense Other income, net Q3-2021 Q3-2020 82.831 69,508 60.668 8,840 66.379 16.452 6.339 800 10.913 176 2.416 6.258 51 2.633 256 585 Balance Sheet Cash Inventories Other current assets Total Current Assets PPE Net Other assets Total Assets Total Current Liabilities Long-term debt Other non-current liabilities Q3-2021 Q3-2020 17.623 13.537 14.812 14,896 51.078 53.374 83,513 81.807 21,262 21.850 119.571 113.001 224.346 216.658 73.851 61.573 16.570 71.963 67.390 15.785

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started