Question

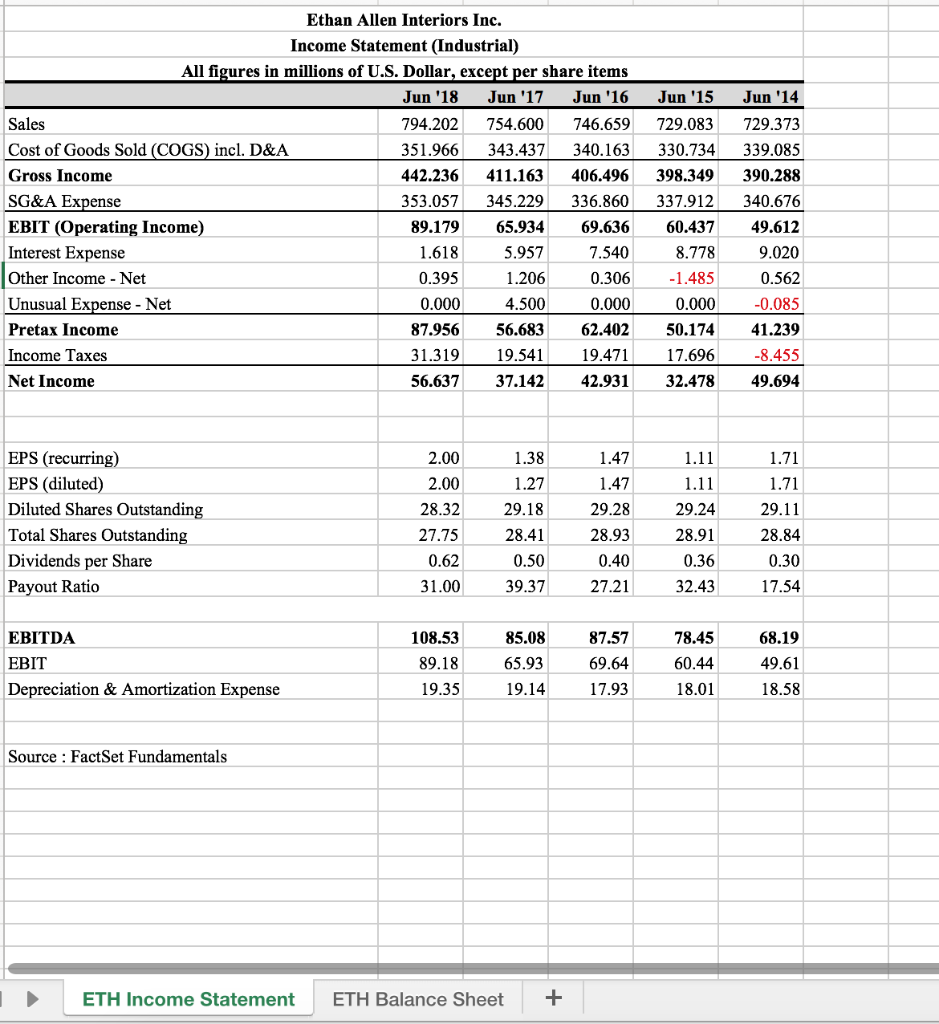

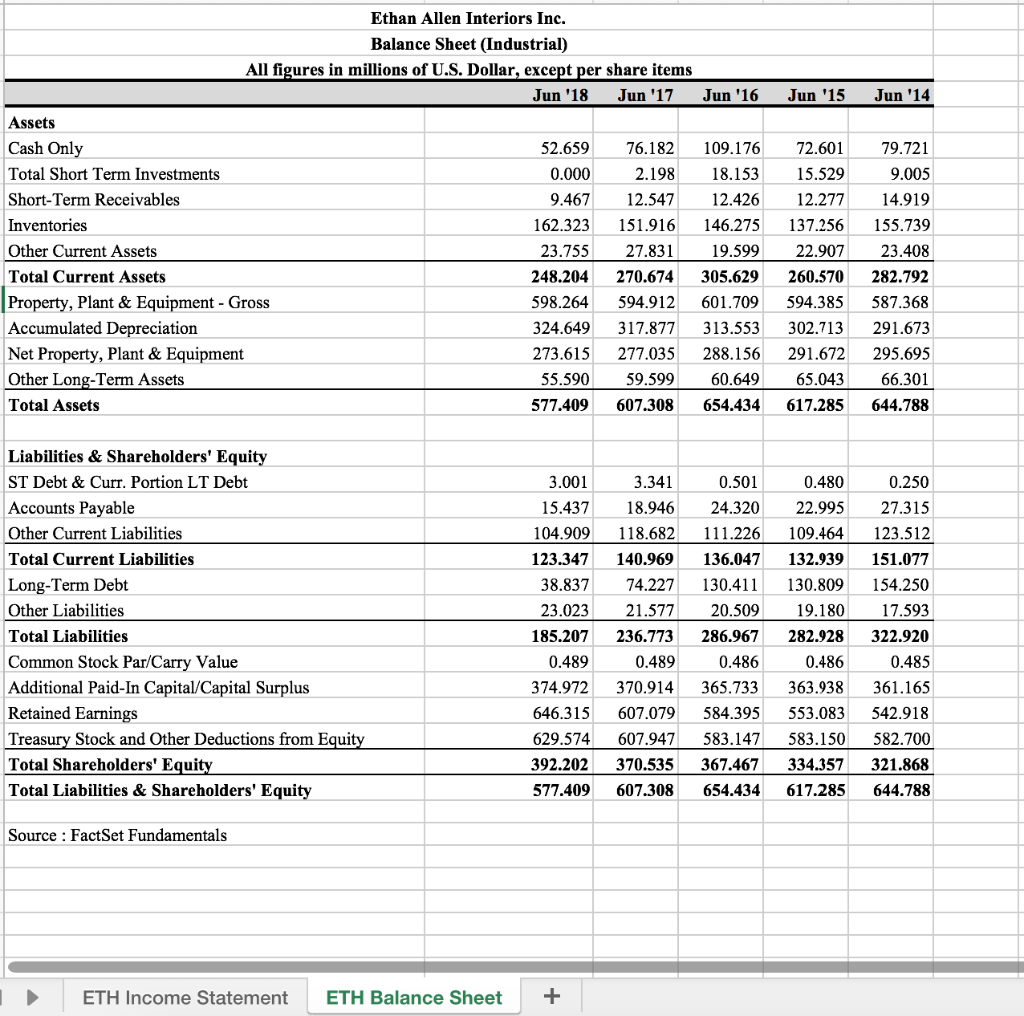

1. Using the data in the student spreadsheet file Ethan Allen Financials.xlsx forecast the June 30, 2019 income statement and balance sheet for Ethan Allen.

1. Using the data in the student spreadsheet file Ethan Allen Financials.xlsx forecast the June 30, 2019 income statement and balance sheet for Ethan Allen. Use the percent of sales method and the following assumptions: (1) sales in FY 2019 will be $797.3359; (2) the tax rate will be 35%; (3) each item that changes with sales will be the five-year average percentage of sales; (4) net fixed assets will increase to $300; and (5) the common dividend will be $0.75 per share. Use your judgment on all other items.

a. What is the discretionary financing needed in 2019? Is this a surplus or deficit?

b. Assume that the DFN will be absorbed by long-term debt and that the interest rate is 4% of LTD. Set up an iterative worksheet to eliminate it.

Ethan Allen Interiors Inc. Income Statement (Industrial) All figures in millions of U.S. Dollar, except per share items Sales Cost of Goods Sold (COGS) incl. D&A Gross Income SG&A Expense EBIT (Operating Income) Interest Expense Other Income Net Unusual Expense - Net Pretax Income Income Taxes Net Income Jun '18 Jun '17 Jun '16 Jun'15 Jun '14 794.202 754.600 746.659729.083729.373 351.966 343.437 340.163 330.734 339.085 442.236 411.163 406.496398.349 390.288 353.057 345.229336.860 337.912340.676 89.17965.934 69.636 60.437 49.612 9.020 0.562 0.000 0.085 87.95656.68362.40250.174 41.239 17.696-8.455 56.63737.142 42.93132.47849.694 8.778 1.618 0.395 0.000 5.957 1.206 4.500 7.540 0.306-1.485 0.000 31.31919.541 19.471 EPS (recurring) EPS (diluted) Diluted Shares Outstanding Total Shares Outstanding Dividends per Share Payout Ratio 2.00 2.00 28.32 27.75 0.62 31.00 1.38 1.27 29.18 28.41 0.50 39.37 1.47 1.47 29.28 28.93 0.40 27.21 1.11 1.11 29.24 28.91 0.36 32.43 1.71 1.71 29.11 28.84 0.30 17.54 EBITDA EBIT Depreciation & Amortization Expense 108.53 89.18 19.35 85.08 65.93 19.14 87.57 69.64 17.93 78.45 60.44 18.01 68.19 49.61 18.58 Source : FactSet Fundamentals ETH Income Statement ETH Balance Sheet Ethan Allen Interiors Inc. Balance Sheet (Industrial) All figures in millions of U.S. Dollar, except per share items Jun '18 Jun '17 Jun '16 Jun '15 Jun '14 Assets Cash Only Total Short Term Investments Short-Term Receivables Inventories Other Current Assets Total Current Assets Property, Plant & Equipment - Gross Accumulated Depreciation Net Property, Plant & Equipment Other Long-Term Assets Total Assets 52.65976.182 109.17672.60179.721 9.005 9.4672.547 12.42612.27714.919 162.323151.916 146.275137.256155.739 19.59922.907 23.408 248.204 270.674 305.629260.570 282.792 598.264594.912601.709594.385587.368 324.649 317.877313.553302.713 291.673 273.615 277.035 288.156291.672 295.695 55.59059.59960.649 65.04366.301 577.409 607.308654.434617.285 644.788 0.000 2.198 18.153 15.529 23.75527.831 Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Total Liabilities Common Stock Par/Carry Value Additional Paid-In Capital/Capital Surplus Retained Earnings Treasury Stock and Other Deductions from Equit Total Shareholders' Equit Total Liabilities & Shareholders' Equity 0.480 0.250 15.437 18.946 24.32022.995 27.315 104.909 118.682111.226 109.464 123.512 123.347 140.969 136.047 132.939151.077 38.837 74.227 130.411 130.809 154.250 23.02321.577 20.509 19.180 17.593 185.207 236.773 286.967 282.928322.920 0.485 374.972370.914 365.733363.938 361.165 646.315 607.079584.395553.083542.918 629.574 607.947 583.147583.150 582.700 392.202370.535 367.467334.357 321.868 577.409 607.308654.434617.285644.788 3.001 3.341 0.501 0.489 0.489 0.486 0.486 Source : FactSet Fundamentals ETH Income Statement ETH Balance Sheet Ethan Allen Interiors Inc. Income Statement (Industrial) All figures in millions of U.S. Dollar, except per share items Sales Cost of Goods Sold (COGS) incl. D&A Gross Income SG&A Expense EBIT (Operating Income) Interest Expense Other Income Net Unusual Expense - Net Pretax Income Income Taxes Net Income Jun '18 Jun '17 Jun '16 Jun'15 Jun '14 794.202 754.600 746.659729.083729.373 351.966 343.437 340.163 330.734 339.085 442.236 411.163 406.496398.349 390.288 353.057 345.229336.860 337.912340.676 89.17965.934 69.636 60.437 49.612 9.020 0.562 0.000 0.085 87.95656.68362.40250.174 41.239 17.696-8.455 56.63737.142 42.93132.47849.694 8.778 1.618 0.395 0.000 5.957 1.206 4.500 7.540 0.306-1.485 0.000 31.31919.541 19.471 EPS (recurring) EPS (diluted) Diluted Shares Outstanding Total Shares Outstanding Dividends per Share Payout Ratio 2.00 2.00 28.32 27.75 0.62 31.00 1.38 1.27 29.18 28.41 0.50 39.37 1.47 1.47 29.28 28.93 0.40 27.21 1.11 1.11 29.24 28.91 0.36 32.43 1.71 1.71 29.11 28.84 0.30 17.54 EBITDA EBIT Depreciation & Amortization Expense 108.53 89.18 19.35 85.08 65.93 19.14 87.57 69.64 17.93 78.45 60.44 18.01 68.19 49.61 18.58 Source : FactSet Fundamentals ETH Income Statement ETH Balance Sheet Ethan Allen Interiors Inc. Balance Sheet (Industrial) All figures in millions of U.S. Dollar, except per share items Jun '18 Jun '17 Jun '16 Jun '15 Jun '14 Assets Cash Only Total Short Term Investments Short-Term Receivables Inventories Other Current Assets Total Current Assets Property, Plant & Equipment - Gross Accumulated Depreciation Net Property, Plant & Equipment Other Long-Term Assets Total Assets 52.65976.182 109.17672.60179.721 9.005 9.4672.547 12.42612.27714.919 162.323151.916 146.275137.256155.739 19.59922.907 23.408 248.204 270.674 305.629260.570 282.792 598.264594.912601.709594.385587.368 324.649 317.877313.553302.713 291.673 273.615 277.035 288.156291.672 295.695 55.59059.59960.649 65.04366.301 577.409 607.308654.434617.285 644.788 0.000 2.198 18.153 15.529 23.75527.831 Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Total Liabilities Common Stock Par/Carry Value Additional Paid-In Capital/Capital Surplus Retained Earnings Treasury Stock and Other Deductions from Equit Total Shareholders' Equit Total Liabilities & Shareholders' Equity 0.480 0.250 15.437 18.946 24.32022.995 27.315 104.909 118.682111.226 109.464 123.512 123.347 140.969 136.047 132.939151.077 38.837 74.227 130.411 130.809 154.250 23.02321.577 20.509 19.180 17.593 185.207 236.773 286.967 282.928322.920 0.485 374.972370.914 365.733363.938 361.165 646.315 607.079584.395553.083542.918 629.574 607.947 583.147583.150 582.700 392.202370.535 367.467334.357 321.868 577.409 607.308654.434617.285644.788 3.001 3.341 0.501 0.489 0.489 0.486 0.486 Source : FactSet Fundamentals ETH Income Statement ETH Balance SheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started