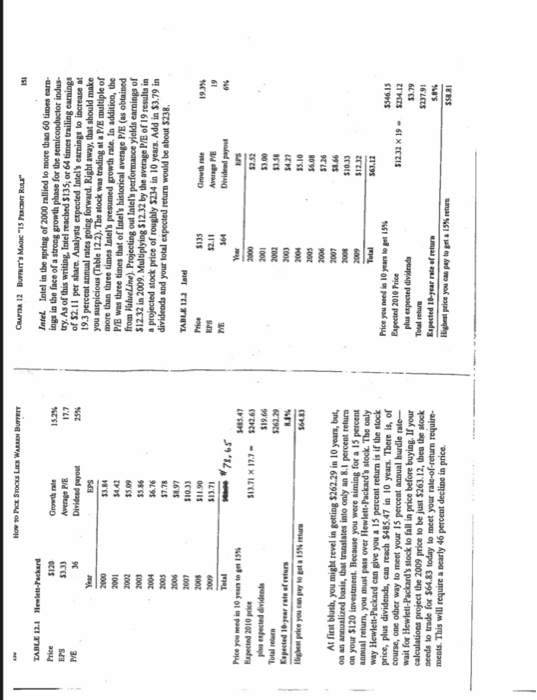

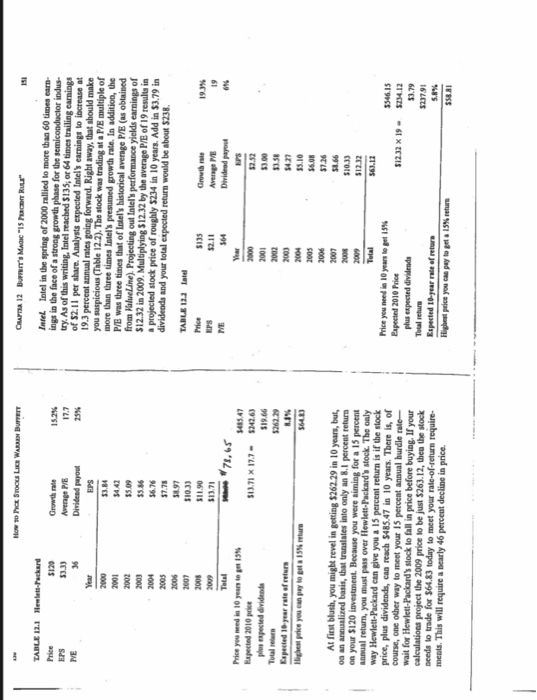

1. Using the financial statement information for Ford (F) evaluate the company using Warren Buffet's 15 percent rule 2. Is Ford an attractive investment? Why or why not? ings in the face of a strong growth phase for the semiconducior indus- try. As of this writing, Intel reached S$135, or 64 times trailing earnings of $2.11 per share. Analysts expected Intel's earnings to increase at 19.3 percent annual rates going forward. Right away, that should make you suspicious (Table 12.2). The stock was trading at a P/E multiple of more than three times Intel's presumed growth rate. In addition, the -aea sac 09 e asoa o pa000 joSuds a uli from alueLine) Projecting out Intels performance yields earnings of $12.32 in 2009. Multiplying $12.32 by the average P/E of 19 results in a projected stock price of roughly $234 in 10 years. Add in $3.79 in dividends and your total expected return would be about $238. ng oog a 61 %9 Growth rate molnd paapa aled peapd Sd SCIS 00 Sd 0002 3 000 too $6.76 or'SE LLS 100 Z002 809S E002 c00 $7.26 00 99 crors s00 0611 9000 SI996 S x teis 6 L000 L0OL 002 99615 800 16LC5 600 Expected 2010 price plus expected dividends Price you need in 10 years to get 15% Expected 2010 Price plus expected dividends At first blush, you might revel in getting $262.29 in 10 yean, but, oa an annualized basis, that translates into only an 8.1 percent return on your $120 investment. Because you were aiming for a 15 percent annual return, you must pass over Hewlett-Packard's stock. The oaly uma je aa-91 pasadr uma61 nd es nok aad ama pa Expected 10-year rate of returs jo s aa eak oI LS8S ea spuapiap snjd aoud Highest price you can pay to get a 15% retur wait for Hewlett-Packard's stock to fall in price before buying. If your calculations project the 2009 price to be just $263.12, then the stock needs to trade for $64.83 today to meet your rale-of-return require- ings in the face of a strong growth phase for the semiconducior indus- try. As of this writing, Intel reached S$135, or 64 times trailing earnings of $2.11 per share. Analysts expected Intel's earnings to increase at 19.3 percent annual rates going forward. Right away, that should make you suspicious (Table 12.2). The stock was trading at a P/E multiple of more than three times Intel's presumed growth rate. In addition, the -aea sac 09 e asoa o pa000 joSuds a uli from alueLine) Projecting out Intels performance yields earnings of $12.32 in 2009. Multiplying $12.32 by the average P/E of 19 results in a projected stock price of roughly $234 in 10 years. Add in $3.79 in dividends and your total expected return would be about $238. ng oog a 61 %9 Growth rate molnd paapa aled peapd Sd SCIS 00 Sd 0002 3 000 too $6.76 or'SE LLS 100 Z002 809S E002 c00 $7.26 00 99 crors s00 0611 9000 SI996 S x teis 6 L000 L0OL 002 99615 800 16LC5 600 Expected 2010 price plus expected dividends Price you need in 10 years to get 15% Expected 2010 Price plus expected dividends At first blush, you might revel in getting $262.29 in 10 yean, but, oa an annualized basis, that translates into only an 8.1 percent return on your $120 investment. Because you were aiming for a 15 percent annual return, you must pass over Hewlett-Packard's stock. The oaly uma je aa-91 pasadr uma61 nd es nok aad ama pa Expected 10-year rate of returs jo s aa eak oI LS8S ea spuapiap snjd aoud Highest price you can pay to get a 15% retur wait for Hewlett-Packard's stock to fall in price before buying. If your calculations project the 2009 price to be just $263.12, then the stock needs to trade for $64.83 today to meet your rale-of-return require- 1. Using the financial statement information for Ford (F) evaluate the company using Warren Buffet's 15 percent rule 2. Is Ford an attractive investment? Why or why not? ings in the face of a strong growth phase for the semiconducior indus- try. As of this writing, Intel reached S$135, or 64 times trailing earnings of $2.11 per share. Analysts expected Intel's earnings to increase at 19.3 percent annual rates going forward. Right away, that should make you suspicious (Table 12.2). The stock was trading at a P/E multiple of more than three times Intel's presumed growth rate. In addition, the -aea sac 09 e asoa o pa000 joSuds a uli from alueLine) Projecting out Intels performance yields earnings of $12.32 in 2009. Multiplying $12.32 by the average P/E of 19 results in a projected stock price of roughly $234 in 10 years. Add in $3.79 in dividends and your total expected return would be about $238. ng oog a 61 %9 Growth rate molnd paapa aled peapd Sd SCIS 00 Sd 0002 3 000 too $6.76 or'SE LLS 100 Z002 809S E002 c00 $7.26 00 99 crors s00 0611 9000 SI996 S x teis 6 L000 L0OL 002 99615 800 16LC5 600 Expected 2010 price plus expected dividends Price you need in 10 years to get 15% Expected 2010 Price plus expected dividends At first blush, you might revel in getting $262.29 in 10 yean, but, oa an annualized basis, that translates into only an 8.1 percent return on your $120 investment. Because you were aiming for a 15 percent annual return, you must pass over Hewlett-Packard's stock. The oaly uma je aa-91 pasadr uma61 nd es nok aad ama pa Expected 10-year rate of returs jo s aa eak oI LS8S ea spuapiap snjd aoud Highest price you can pay to get a 15% retur wait for Hewlett-Packard's stock to fall in price before buying. If your calculations project the 2009 price to be just $263.12, then the stock needs to trade for $64.83 today to meet your rale-of-return require- ings in the face of a strong growth phase for the semiconducior indus- try. As of this writing, Intel reached S$135, or 64 times trailing earnings of $2.11 per share. Analysts expected Intel's earnings to increase at 19.3 percent annual rates going forward. Right away, that should make you suspicious (Table 12.2). The stock was trading at a P/E multiple of more than three times Intel's presumed growth rate. In addition, the -aea sac 09 e asoa o pa000 joSuds a uli from alueLine) Projecting out Intels performance yields earnings of $12.32 in 2009. Multiplying $12.32 by the average P/E of 19 results in a projected stock price of roughly $234 in 10 years. Add in $3.79 in dividends and your total expected return would be about $238. ng oog a 61 %9 Growth rate molnd paapa aled peapd Sd SCIS 00 Sd 0002 3 000 too $6.76 or'SE LLS 100 Z002 809S E002 c00 $7.26 00 99 crors s00 0611 9000 SI996 S x teis 6 L000 L0OL 002 99615 800 16LC5 600 Expected 2010 price plus expected dividends Price you need in 10 years to get 15% Expected 2010 Price plus expected dividends At first blush, you might revel in getting $262.29 in 10 yean, but, oa an annualized basis, that translates into only an 8.1 percent return on your $120 investment. Because you were aiming for a 15 percent annual return, you must pass over Hewlett-Packard's stock. The oaly uma je aa-91 pasadr uma61 nd es nok aad ama pa Expected 10-year rate of returs jo s aa eak oI LS8S ea spuapiap snjd aoud Highest price you can pay to get a 15% retur wait for Hewlett-Packard's stock to fall in price before buying. If your calculations project the 2009 price to be just $263.12, then the stock needs to trade for $64.83 today to meet your rale-of-return require