Question

1/ Using the information presented in Question 1 above, determine the Historical Cost of the building after taking into consideration the capitalization of interest. 2/

1/ Using the information presented in Question 1 above, determine the Historical Cost of the building after taking into consideration the capitalization of interest.

2/ Using the information presented in Question 1 above, determine the Interest Expense that Desert would report on their Income Statement for the year ended December 31, 2019.

3/ Using the information in Question 1 above, assume instead that Desert's only other outstanding debt during 2019 was a $450,000, 9%, three-year note (i.e. all other information remains unchanged but Desert no longer has $3,000,000 of other non-specific borrowings; only $450,000 of non-specific debt). Determine the Avoidable Interest from this construction project under this scenario.

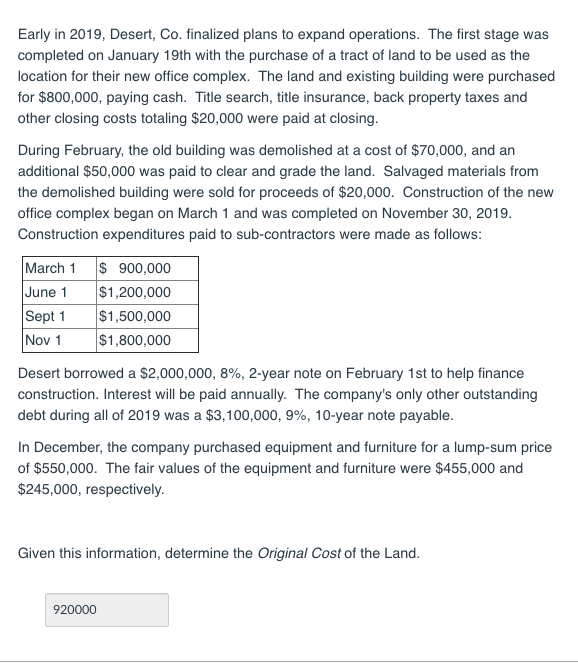

Early in 2019, Desert, Co. finalized plans to expand operations. The first stage was completed on January 19th with the purchase of a tract of land to be used as the location for their new office complex. The land and existing building were purchased for $800,000, paying cash. Title search, title insurance, back property taxes and other closing costs totaling $20,000 were paid at closing. During February, the old building was demolished at a cost of $70,000, and an additional $50,000 was paid to clear and grade the land. Salvaged materials from the demolished building were sold for proceeds of $20,000. Construction of the new office complex began on March 1 and was completed on November 30, 2019 Construction expenditures paid to sub-contractors were made as follows: March 1 June 1 Sept 1 Nov 1 $ 900,000 $1,200,000 $1,500,000 $1,800,000 Desert borrowed a $2,000,000, 8%, 2-year note on February 1st to help finance construction. Interest will be paid annually. The company's only other outstanding debt during all of 2019 was a $3,100,000, 9%, 10-year note payable. In December, the company purchased equipment and furniture for a lump-sum price of $550,000. The fair values of the equipment and furniture were $455,000 and $245,000, respectively. Given this information, determine the Original Cost of the Land. 920000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started