Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Variable Ltd operates under ideal conditions of uncertainty, with a fiscal year end of December 31st. Its cash flows depend crucially on the

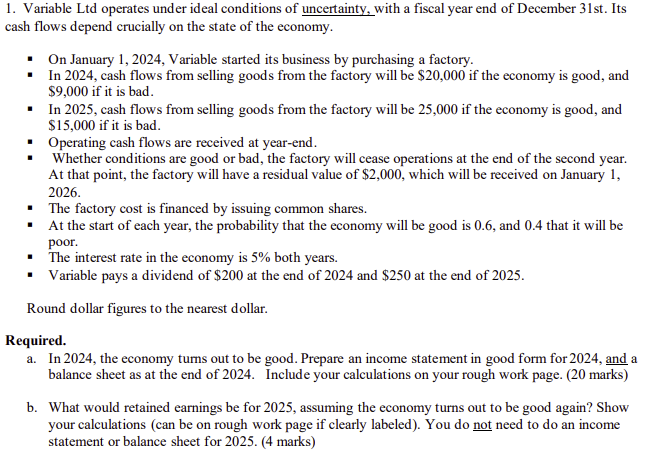

1. Variable Ltd operates under ideal conditions of uncertainty, with a fiscal year end of December 31st. Its cash flows depend crucially on the state of the economy. On January 1, 2024, Variable started its business by purchasing a factory. In 2024, cash flows from selling goods from the factory will be $20,000 if the economy is good, and $9,000 if it is bad. In 2025, cash flows from selling goods from the factory will be 25,000 if the economy is good, and $15,000 if it is bad. Operating cash flows are received at year-end. Whether conditions are good or bad, the factory will cease operations at the end of the second year. At that point, the factory will have a residual value of $2,000, which will be received on January 1, 2026. The factory cost is financed by issuing common shares. At the start of each year, the probability that the economy will be good is 0.6, and 0.4 that it will be poor. The interest rate in the economy is 5% both years. Variable pays a dividend of $200 at the end of 2024 and $250 at the end of 2025. Round dollar figures to the nearest dollar. Required. a. In 2024, the economy tums out to be good. Prepare an income statement in good form for 2024, and a balance sheet as at the end of 2024. Include your calculations on your rough work page. (20 marks) b. What would retained earnings be for 2025, assuming the economy turns out to be good again? Show your calculations (can be on rough work page if clearly labeled). You do not need to do an income statement or balance sheet for 2025. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Variable Ltd Financial Statements Good Economy in 2024 a Income Statement for 2024 Good Economy Reve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started