Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, Diamond Company agreed to lease some equipment from Norton Machinery. Relevant information is as follows: Inception of Lease: January 1,

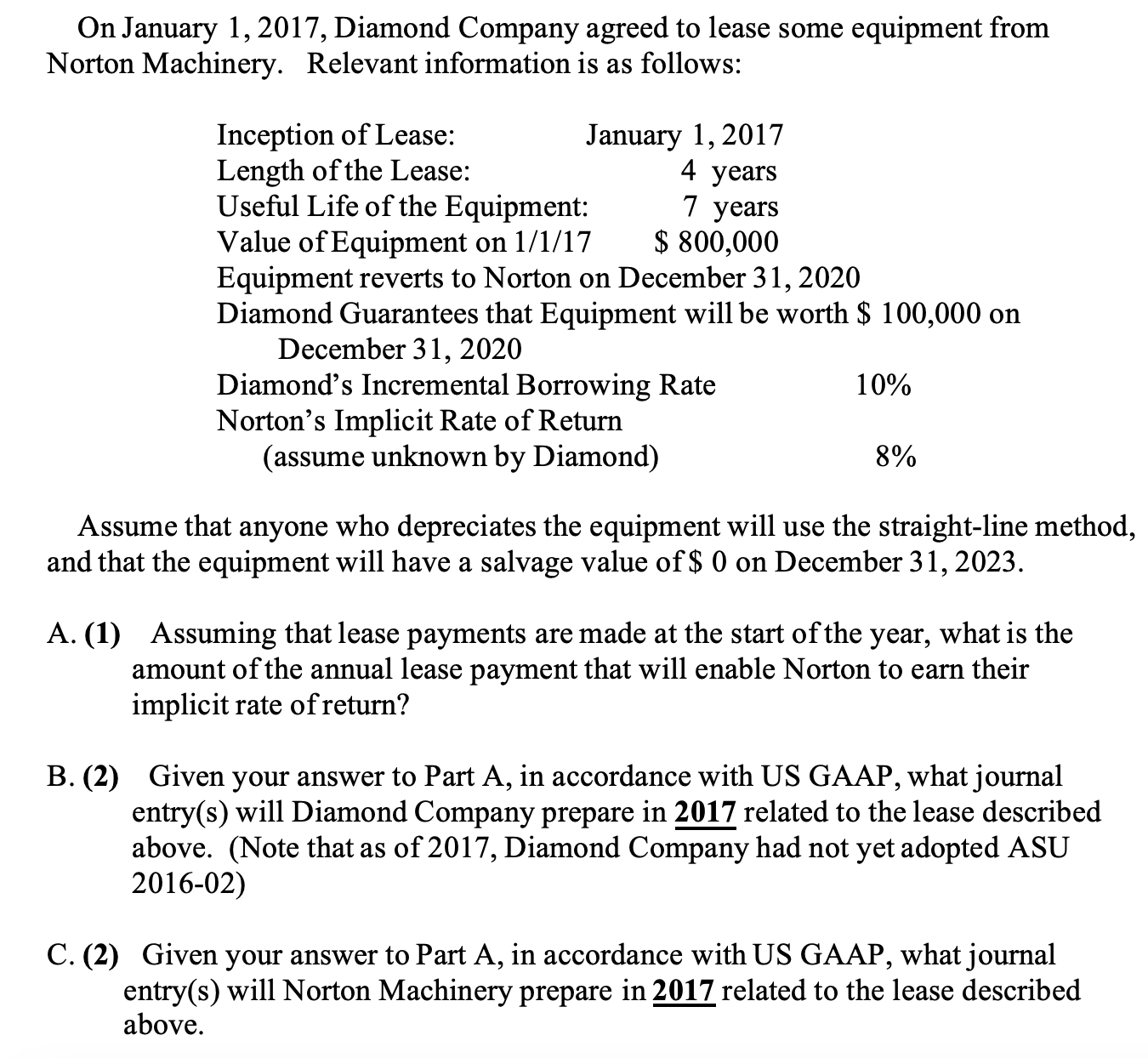

On January 1, 2017, Diamond Company agreed to lease some equipment from Norton Machinery. Relevant information is as follows: Inception of Lease: January 1, 2017 Length of the Lease: 4 years Useful Life of the Equipment: 7 years Value of Equipment on 1/1/17 $ 800,000 Equipment reverts to Norton on December 31, 2020 Diamond Guarantees that Equipment will be worth $ 100,000 on December 31, 2020 Diamond's Incremental Borrowing Rate Norton's Implicit Rate of Return (assume unknown by Diamond) 10% 8% Assume that anyone who depreciates the equipment will use the straight-line method, and that the equipment will have a salvage value of $ 0 on December 31, 2023. A. (1) Assuming that lease payments are made at the start of the year, what is the amount of the annual lease payment that will enable Norton to earn their implicit rate of return? B. (2) Given your answer to Part A, in accordance with US GAAP, what journal entry(s) will Diamond Company prepare in 2017 related to the lease described above. (Note that as of 2017, Diamond Company had not yet adopted ASU 2016-02) C. (2) Given your answer to Part A, in accordance with US GAAP, what journal entry(s) will Norton Machinery prepare in 2017 related to the lease described above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started