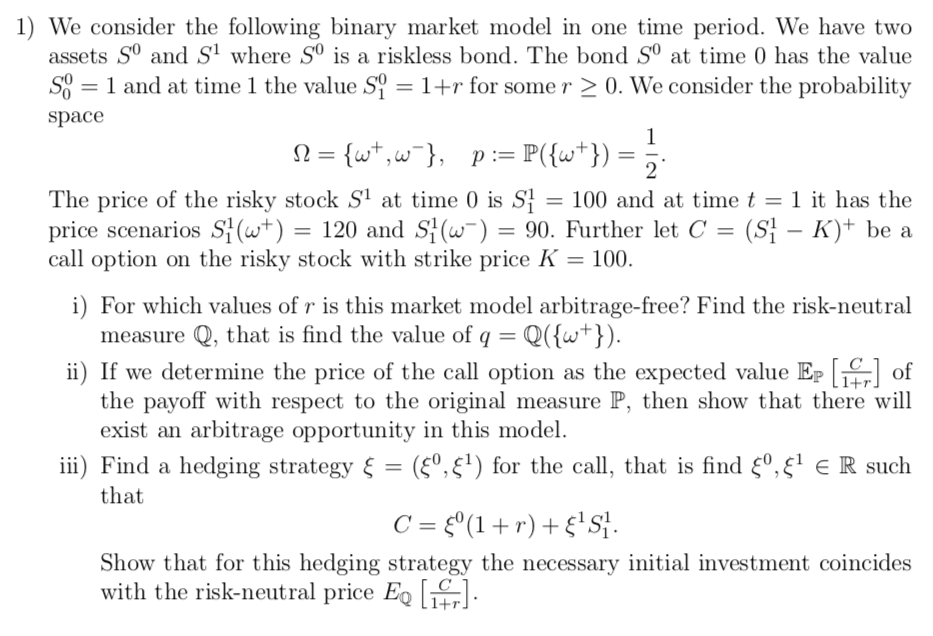

1) We consider the following binary market model in one time period. We have two assets S and Sl where S is a riskless bond. The bond S at time 0 has the value So = 1 and at time 1 the value Si = 1+r for some r > 0. We consider the probability space N = {wt,w }, p:= P({w+}) = 5 The price of the risky stock S1 at time 0 is S1 = 100 and at time t = 1 it has the price scenarios S/(w+) = 120 and Sl(w) = 90. Further let C = (S] - K)+ be a call option on the risky stock with strike price K = 100. i) For which values of r is this market model arbitrage-free? Find the risk-neutral measure Q, that is find the value of q = Q({w+}). ii) If we determine the price of the call option as the expected value Ep [14] of the payoff with respect to the original measure P, then show that there will exist an arbitrage opportunity in this model. iii) Find a hedging strategy = ($, $!) for the call, that is find &,&T E R such that C = 8(1+r) +&+51 Show that for this hedging strategy the necessary initial investment coincides with the risk-neutral price E 1) We consider the following binary market model in one time period. We have two assets S and Sl where S is a riskless bond. The bond S at time 0 has the value So = 1 and at time 1 the value Si = 1+r for some r > 0. We consider the probability space N = {wt,w }, p:= P({w+}) = 5 The price of the risky stock S1 at time 0 is S1 = 100 and at time t = 1 it has the price scenarios S/(w+) = 120 and Sl(w) = 90. Further let C = (S] - K)+ be a call option on the risky stock with strike price K = 100. i) For which values of r is this market model arbitrage-free? Find the risk-neutral measure Q, that is find the value of q = Q({w+}). ii) If we determine the price of the call option as the expected value Ep [14] of the payoff with respect to the original measure P, then show that there will exist an arbitrage opportunity in this model. iii) Find a hedging strategy = ($, $!) for the call, that is find &,&T E R such that C = 8(1+r) +&+51 Show that for this hedging strategy the necessary initial investment coincides with the risk-neutral price E