1. What are Doziers cash flows from its new sales contract on January 13, 1976? on april 13? (Assume the $812,111 cost of the project is incurred on April 13) i have provided necessary i formation below. thank you

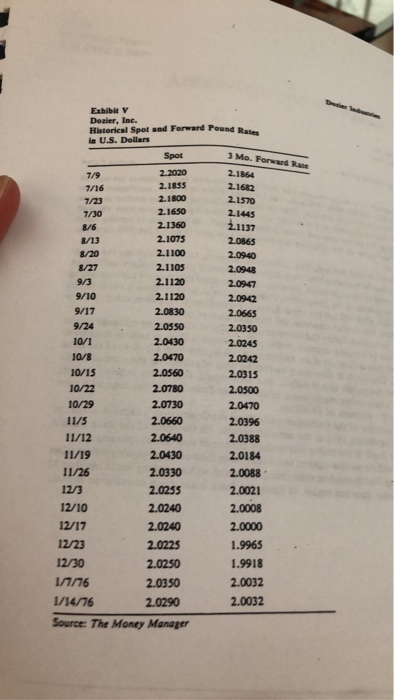

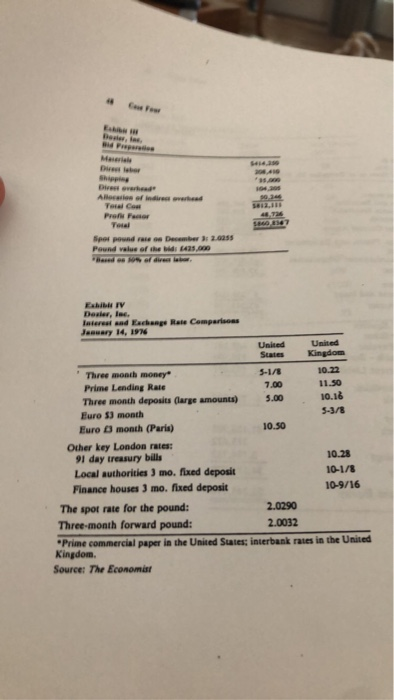

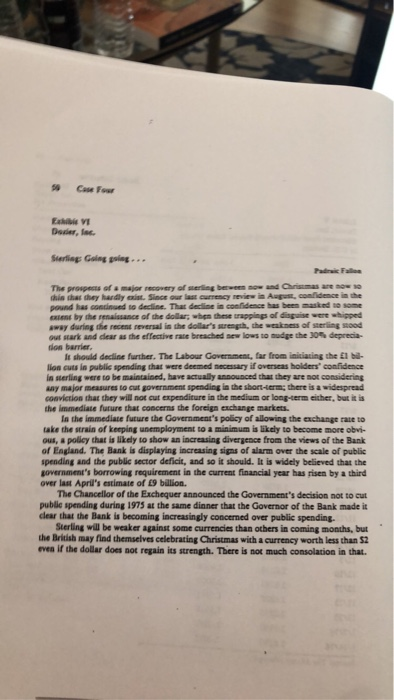

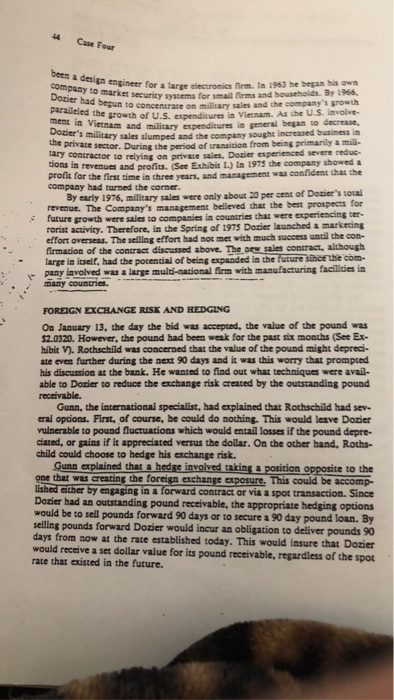

EVE Derfor Sterling Going poing... The prospects of a major recovery of wring been and Crimes are this has they hardlys . Since our last currency review in August, confidence in the pound has continued to decline. The decise is confidence has been asked me test by the f a ce of the dollar; when these trapping of disguise were whipped away during the recent reveral in the dollar's strength, the weakness of sterling wood Our stark and dear as the effective rate breached new low to budge the 30% deprecia dos barrier. It should decline further. The Labour Government, far from initiating the Elba- lion cuts in public spending that were deemed necessary if overseas holders' confidence is sterling were to be maintained, have actually announced that they are not considering any major measures to cut government spending in the short-term, there is a widespread conviction that they will not cut expenditure in the medium or long-term either, but it is the immediate future that concerns the foreign exchange markets. In the immediate future the Government's policy of allowing the exchange rate to take the strain of keeping unemployment to a minimum is likely to become more obvi- ous, a policy that is likely to show an increasing divergence from the views of the Bank of England. The Bank is displaying increasing signs of alarm over the scale of public spending and the public sector deficit, and so it should. It is widely believed that the government's borrowing requirement in the current financial year has risen by a third over last April's estimate of 9 billion. The Chancellor of the Exchequer announced the Government's decision not to cut public spending during 1975 at the same dinner that the Governor of the Bank made it clear that the Bank is becoming increasingly concerned over public spending. Sterling will be weaker against some currencies than others in coming months, but the British may find themselves celebrating Christmas with a currency worth less than 52 even if the dollar does not regain its strength. There is not much consolation in that. EVE Derfor Sterling Going poing... The prospects of a major recovery of wring been and Crimes are this has they hardlys . Since our last currency review in August, confidence in the pound has continued to decline. The decise is confidence has been asked me test by the f a ce of the dollar; when these trapping of disguise were whipped away during the recent reveral in the dollar's strength, the weakness of sterling wood Our stark and dear as the effective rate breached new low to budge the 30% deprecia dos barrier. It should decline further. The Labour Government, far from initiating the Elba- lion cuts in public spending that were deemed necessary if overseas holders' confidence is sterling were to be maintained, have actually announced that they are not considering any major measures to cut government spending in the short-term, there is a widespread conviction that they will not cut expenditure in the medium or long-term either, but it is the immediate future that concerns the foreign exchange markets. In the immediate future the Government's policy of allowing the exchange rate to take the strain of keeping unemployment to a minimum is likely to become more obvi- ous, a policy that is likely to show an increasing divergence from the views of the Bank of England. The Bank is displaying increasing signs of alarm over the scale of public spending and the public sector deficit, and so it should. It is widely believed that the government's borrowing requirement in the current financial year has risen by a third over last April's estimate of 9 billion. The Chancellor of the Exchequer announced the Government's decision not to cut public spending during 1975 at the same dinner that the Governor of the Bank made it clear that the Bank is becoming increasingly concerned over public spending. Sterling will be weaker against some currencies than others in coming months, but the British may find themselves celebrating Christmas with a currency worth less than 52 even if the dollar does not regain its strength. There is not much consolation in that. 3 Me. Forward Rate Exhibit V Dozier, Inc. Historical Spot sed Forward Pound Rai in U.S. Dollars Spot 3 More 7/9 2.2020 2.1864 7/16 2.1855 2.1682 7/23 2.1800 2.1570 7/30 2.1650 2.1445 8/6 2.1360 2.1137 8/13 2.1075 2.0865 2.1100 2.0940 8/27 2.1105 2.0948 9/3 2.1120 2.0947 9/10 2.1120 2.0942 9/17 2.0830 2.0665 9/24 2.0550 2.0350 10/1 2.0430 2.0245 10/8 2.0470 2.0242 10/15 2.0560 2.0315 10/22 2.0780 2.0500 10/29 2.0730 2.0470 2.0660 2.0396 11/12 2.0640 2.0388 11/19 2.0430 2.0184 11/26 2.0330 2.0088 12/3 2.0255 2.0021 12/10 2.0240 2.0008 12/17 2.0240 2.0000 12/23 2.0225 1.9965 12/30 2.0250 1.9918 1/7/76 2.0350 2.0032 1/14/76 2.0290 2.0032 Source: The Money Manager 11/5 Tec por pondre December 2005 Paudwal of the 4.60 EX TV Destler, der lateral and Echange Rate Comparis Jeewery 14, IN United United Kingdom States 3.00 Three month one 5-17 10.22 Prime Landing Rate 7.00 11.50 Three month deposit (large amounts) 10.16 Euro 53 month 5-3/8 Euro month (Paris) 10.50 Other key London rates: 91 day treasury bills 10.28 Local authorities mo. fixed deposit 10-1/8 Finance houses 3 mo. fed deposit 10-9/16 The spot rate for the pound: Three-month forward pound: 2.0032 "Prime commercial paper in the United States: Interbank rates in the United Kingdom Source: The Economie 2.0290 EVE Derfor Sterling Going poing... The prospects of a major recovery of wring been and Crimes are this has they hardlys . Since our last currency review in August, confidence in the pound has continued to decline. The decise is confidence has been asked me test by the f a ce of the dollar; when these trapping of disguise were whipped away during the recent reveral in the dollar's strength, the weakness of sterling wood Our stark and dear as the effective rate breached new low to budge the 30% deprecia dos barrier. It should decline further. The Labour Government, far from initiating the Elba- lion cuts in public spending that were deemed necessary if overseas holders' confidence is sterling were to be maintained, have actually announced that they are not considering any major measures to cut government spending in the short-term, there is a widespread conviction that they will not cut expenditure in the medium or long-term either, but it is the immediate future that concerns the foreign exchange markets. In the immediate future the Government's policy of allowing the exchange rate to take the strain of keeping unemployment to a minimum is likely to become more obvi- ous, a policy that is likely to show an increasing divergence from the views of the Bank of England. The Bank is displaying increasing signs of alarm over the scale of public spending and the public sector deficit, and so it should. It is widely believed that the government's borrowing requirement in the current financial year has risen by a third over last April's estimate of 9 billion. The Chancellor of the Exchequer announced the Government's decision not to cut public spending during 1975 at the same dinner that the Governor of the Bank made it clear that the Bank is becoming increasingly concerned over public spending. Sterling will be weaker against some currencies than others in coming months, but the British may find themselves celebrating Christmas with a currency worth less than 52 even if the dollar does not regain its strength. There is not much consolation in that. 4 Case Four been a design engineer for a lars company to make surity systems for engineer for a large electronics rm. In 1953 he began his own market Security systems for small rms and households. By 1966. had begun to concentrate on miliary sales and the company's growth ed the growth of US expenditures in Vietnam. As the US involve Vietnam and military expenditures in general began to decrease, Dozier's milli er i military sales slumped and the company sought increased business in e private sector. During the period of transition from being primarily a mili- cary contractor to relying on private sales. Dozier experienced severe reduc- bons in revenues and pronu. (See Exhibit 1.) In 1975 the company showed a prorit for the first time in three years, and management was confident that the company has turned the core. By early 1976, military sales were only about 20 per cent of Dozier's total revenue. The Company's management believed that the best prospects for future growth were sales to companies in countries that were experiencing ter- rorist activity. Therefore, in the Spring of 1975 Derier launched a marketing effort overseas. The selling effort had not met with much success until the con- firmation of the contract discussed above. The new sales contract, although large in itself, had the potential of being expanded in the future since the com- pany involved was a large multi-national firm with manufacturing facilities in many countries. FOREIGN EXCHANGE RISK AND HEDGING On January 13, the day the bid was accepted, the value of the pound was $2.0320. However, the pound had been weak for the past six months (See Ex- hibit 7). Rothschild was concerned that the value of the pound might depreci- ate even further during the next 90 days and it was this worry that prompted his discussion at the bank. He wanted to find out what techniques were avail- able to Dozier to reduce the exchange risk created by the outstanding pound receivable. Gunn, the international specialist, had explained that Rothschild had sev- cral options. First, of course, he could do nothing. This would leave Dozier vulnerable to pound fluctuations which would entail losses if the pound depre- ciated, or gains if it appreciated versus the dollar. On the other hand, Roths- child could choose to hedge his exchange risk. . Gunn explained that a hedge involved taking a position opposite to the one that was creating the foreign exchange exposure. This could be accomp- lished cither by engaging in a forward contract or via a spot transaction. Since Dozier had an outstanding pound receivable, the appropriate hedging options would be to sell pounds forward 90 days or to secure a 90 day pound loan. By selling pounds forward Dozier would incur an obligation to deliver pounds 90 days from now at the rate established today. This would insure that Dozier would receive a ser dollar value for its pound receivable, regardless of the spot rate that existed in the future. Larsenal. Luter At Gul SAWAN : G . CASE FOUR DOZIER INDUSTRIES 01976 Leland Stanford Junior University Richard Rothschild, the chief financial officer of Dozier Industries, returned to his office after the completion of his meeting with two officers of Southeas. tern National Bank. He had requested the meeting in order to discuss financial issues related to Dozier's first major international sales contract, which had been confirmed the previous day, January 13, 1976. Initially. Rothschild had contacted Robert Leigh, a vice president at the bank who had primary respon sibilities for Dozier's business with Southeastern National. Leigh had in turn suggested that John Gunn of the bank's international division be included in the meeting since Leigh felt that he, himself, lacked the international expertise to answer all the questions Rothschild might raise. The meeting had focused on the exchange risk related to the new sales contract. Dozier's bid of 425,000 for the installation of an internal security system for a large manufacturing firm in the United Kingdom had been ac- cepted. In accordance with the contract, the British firm had transferred by ca- ble 42.500 (i... 10 per cent of the contract amount) as deposit on the contract with the balance due at the time the system was completed. Dozier's produc- tion Vice-President, Mike Miles, had assured Rothschild that there would be no difficulty in completing the project within the 90-day period stipulated in the bid. As a result, Rothschild was planning on receiving 382.500 on April 13, 1976. the difficulty in co, Mike Miles, the system wa HISTORY OF THE COMPANY Dozier Inc. was a relatively young firm specializing in electronic security sys- tems. It had been established in 1963 by Charles L. Dozier who was still Presi- dent and the owner of 78 per cent of the stock. The remaining 22 per cent of the stock was held by other members of management. Dosier had formerly Copyright 1976 by the Board of Trouens of the Leand Stanford Junior University, Reprinted with permission EVE Derfor Sterling Going poing... The prospects of a major recovery of wring been and Crimes are this has they hardlys . Since our last currency review in August, confidence in the pound has continued to decline. The decise is confidence has been asked me test by the f a ce of the dollar; when these trapping of disguise were whipped away during the recent reveral in the dollar's strength, the weakness of sterling wood Our stark and dear as the effective rate breached new low to budge the 30% deprecia dos barrier. It should decline further. The Labour Government, far from initiating the Elba- lion cuts in public spending that were deemed necessary if overseas holders' confidence is sterling were to be maintained, have actually announced that they are not considering any major measures to cut government spending in the short-term, there is a widespread conviction that they will not cut expenditure in the medium or long-term either, but it is the immediate future that concerns the foreign exchange markets. In the immediate future the Government's policy of allowing the exchange rate to take the strain of keeping unemployment to a minimum is likely to become more obvi- ous, a policy that is likely to show an increasing divergence from the views of the Bank of England. The Bank is displaying increasing signs of alarm over the scale of public spending and the public sector deficit, and so it should. It is widely believed that the government's borrowing requirement in the current financial year has risen by a third over last April's estimate of 9 billion. The Chancellor of the Exchequer announced the Government's decision not to cut public spending during 1975 at the same dinner that the Governor of the Bank made it clear that the Bank is becoming increasingly concerned over public spending. Sterling will be weaker against some currencies than others in coming months, but the British may find themselves celebrating Christmas with a currency worth less than 52 even if the dollar does not regain its strength. There is not much consolation in that. EVE Derfor Sterling Going poing... The prospects of a major recovery of wring been and Crimes are this has they hardlys . Since our last currency review in August, confidence in the pound has continued to decline. The decise is confidence has been asked me test by the f a ce of the dollar; when these trapping of disguise were whipped away during the recent reveral in the dollar's strength, the weakness of sterling wood Our stark and dear as the effective rate breached new low to budge the 30% deprecia dos barrier. It should decline further. The Labour Government, far from initiating the Elba- lion cuts in public spending that were deemed necessary if overseas holders' confidence is sterling were to be maintained, have actually announced that they are not considering any major measures to cut government spending in the short-term, there is a widespread conviction that they will not cut expenditure in the medium or long-term either, but it is the immediate future that concerns the foreign exchange markets. In the immediate future the Government's policy of allowing the exchange rate to take the strain of keeping unemployment to a minimum is likely to become more obvi- ous, a policy that is likely to show an increasing divergence from the views of the Bank of England. The Bank is displaying increasing signs of alarm over the scale of public spending and the public sector deficit, and so it should. It is widely believed that the government's borrowing requirement in the current financial year has risen by a third over last April's estimate of 9 billion. The Chancellor of the Exchequer announced the Government's decision not to cut public spending during 1975 at the same dinner that the Governor of the Bank made it clear that the Bank is becoming increasingly concerned over public spending. Sterling will be weaker against some currencies than others in coming months, but the British may find themselves celebrating Christmas with a currency worth less than 52 even if the dollar does not regain its strength. There is not much consolation in that. 3 Me. Forward Rate Exhibit V Dozier, Inc. Historical Spot sed Forward Pound Rai in U.S. Dollars Spot 3 More 7/9 2.2020 2.1864 7/16 2.1855 2.1682 7/23 2.1800 2.1570 7/30 2.1650 2.1445 8/6 2.1360 2.1137 8/13 2.1075 2.0865 2.1100 2.0940 8/27 2.1105 2.0948 9/3 2.1120 2.0947 9/10 2.1120 2.0942 9/17 2.0830 2.0665 9/24 2.0550 2.0350 10/1 2.0430 2.0245 10/8 2.0470 2.0242 10/15 2.0560 2.0315 10/22 2.0780 2.0500 10/29 2.0730 2.0470 2.0660 2.0396 11/12 2.0640 2.0388 11/19 2.0430 2.0184 11/26 2.0330 2.0088 12/3 2.0255 2.0021 12/10 2.0240 2.0008 12/17 2.0240 2.0000 12/23 2.0225 1.9965 12/30 2.0250 1.9918 1/7/76 2.0350 2.0032 1/14/76 2.0290 2.0032 Source: The Money Manager 11/5 Tec por pondre December 2005 Paudwal of the 4.60 EX TV Destler, der lateral and Echange Rate Comparis Jeewery 14, IN United United Kingdom States 3.00 Three month one 5-17 10.22 Prime Landing Rate 7.00 11.50 Three month deposit (large amounts) 10.16 Euro 53 month 5-3/8 Euro month (Paris) 10.50 Other key London rates: 91 day treasury bills 10.28 Local authorities mo. fixed deposit 10-1/8 Finance houses 3 mo. fed deposit 10-9/16 The spot rate for the pound: Three-month forward pound: 2.0032 "Prime commercial paper in the United States: Interbank rates in the United Kingdom Source: The Economie 2.0290 EVE Derfor Sterling Going poing... The prospects of a major recovery of wring been and Crimes are this has they hardlys . Since our last currency review in August, confidence in the pound has continued to decline. The decise is confidence has been asked me test by the f a ce of the dollar; when these trapping of disguise were whipped away during the recent reveral in the dollar's strength, the weakness of sterling wood Our stark and dear as the effective rate breached new low to budge the 30% deprecia dos barrier. It should decline further. The Labour Government, far from initiating the Elba- lion cuts in public spending that were deemed necessary if overseas holders' confidence is sterling were to be maintained, have actually announced that they are not considering any major measures to cut government spending in the short-term, there is a widespread conviction that they will not cut expenditure in the medium or long-term either, but it is the immediate future that concerns the foreign exchange markets. In the immediate future the Government's policy of allowing the exchange rate to take the strain of keeping unemployment to a minimum is likely to become more obvi- ous, a policy that is likely to show an increasing divergence from the views of the Bank of England. The Bank is displaying increasing signs of alarm over the scale of public spending and the public sector deficit, and so it should. It is widely believed that the government's borrowing requirement in the current financial year has risen by a third over last April's estimate of 9 billion. The Chancellor of the Exchequer announced the Government's decision not to cut public spending during 1975 at the same dinner that the Governor of the Bank made it clear that the Bank is becoming increasingly concerned over public spending. Sterling will be weaker against some currencies than others in coming months, but the British may find themselves celebrating Christmas with a currency worth less than 52 even if the dollar does not regain its strength. There is not much consolation in that. 4 Case Four been a design engineer for a lars company to make surity systems for engineer for a large electronics rm. In 1953 he began his own market Security systems for small rms and households. By 1966. had begun to concentrate on miliary sales and the company's growth ed the growth of US expenditures in Vietnam. As the US involve Vietnam and military expenditures in general began to decrease, Dozier's milli er i military sales slumped and the company sought increased business in e private sector. During the period of transition from being primarily a mili- cary contractor to relying on private sales. Dozier experienced severe reduc- bons in revenues and pronu. (See Exhibit 1.) In 1975 the company showed a prorit for the first time in three years, and management was confident that the company has turned the core. By early 1976, military sales were only about 20 per cent of Dozier's total revenue. The Company's management believed that the best prospects for future growth were sales to companies in countries that were experiencing ter- rorist activity. Therefore, in the Spring of 1975 Derier launched a marketing effort overseas. The selling effort had not met with much success until the con- firmation of the contract discussed above. The new sales contract, although large in itself, had the potential of being expanded in the future since the com- pany involved was a large multi-national firm with manufacturing facilities in many countries. FOREIGN EXCHANGE RISK AND HEDGING On January 13, the day the bid was accepted, the value of the pound was $2.0320. However, the pound had been weak for the past six months (See Ex- hibit 7). Rothschild was concerned that the value of the pound might depreci- ate even further during the next 90 days and it was this worry that prompted his discussion at the bank. He wanted to find out what techniques were avail- able to Dozier to reduce the exchange risk created by the outstanding pound receivable. Gunn, the international specialist, had explained that Rothschild had sev- cral options. First, of course, he could do nothing. This would leave Dozier vulnerable to pound fluctuations which would entail losses if the pound depre- ciated, or gains if it appreciated versus the dollar. On the other hand, Roths- child could choose to hedge his exchange risk. . Gunn explained that a hedge involved taking a position opposite to the one that was creating the foreign exchange exposure. This could be accomp- lished cither by engaging in a forward contract or via a spot transaction. Since Dozier had an outstanding pound receivable, the appropriate hedging options would be to sell pounds forward 90 days or to secure a 90 day pound loan. By selling pounds forward Dozier would incur an obligation to deliver pounds 90 days from now at the rate established today. This would insure that Dozier would receive a ser dollar value for its pound receivable, regardless of the spot rate that existed in the future. Larsenal. Luter At Gul SAWAN : G . CASE FOUR DOZIER INDUSTRIES 01976 Leland Stanford Junior University Richard Rothschild, the chief financial officer of Dozier Industries, returned to his office after the completion of his meeting with two officers of Southeas. tern National Bank. He had requested the meeting in order to discuss financial issues related to Dozier's first major international sales contract, which had been confirmed the previous day, January 13, 1976. Initially. Rothschild had contacted Robert Leigh, a vice president at the bank who had primary respon sibilities for Dozier's business with Southeastern National. Leigh had in turn suggested that John Gunn of the bank's international division be included in the meeting since Leigh felt that he, himself, lacked the international expertise to answer all the questions Rothschild might raise. The meeting had focused on the exchange risk related to the new sales contract. Dozier's bid of 425,000 for the installation of an internal security system for a large manufacturing firm in the United Kingdom had been ac- cepted. In accordance with the contract, the British firm had transferred by ca- ble 42.500 (i... 10 per cent of the contract amount) as deposit on the contract with the balance due at the time the system was completed. Dozier's produc- tion Vice-President, Mike Miles, had assured Rothschild that there would be no difficulty in completing the project within the 90-day period stipulated in the bid. As a result, Rothschild was planning on receiving 382.500 on April 13, 1976. the difficulty in co, Mike Miles, the system wa HISTORY OF THE COMPANY Dozier Inc. was a relatively young firm specializing in electronic security sys- tems. It had been established in 1963 by Charles L. Dozier who was still Presi- dent and the owner of 78 per cent of the stock. The remaining 22 per cent of the stock was held by other members of management. Dosier had formerly Copyright 1976 by the Board of Trouens of the Leand Stanford Junior University, Reprinted with permission