Answered step by step

Verified Expert Solution

Question

1 Approved Answer

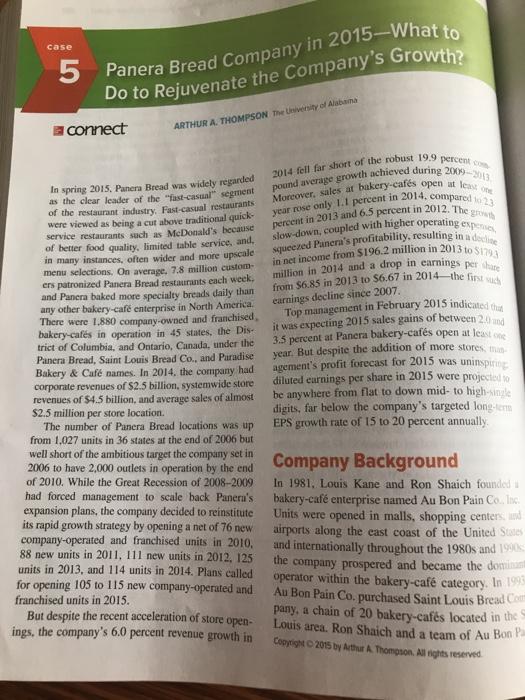

1. What are the chief elements of Panera Bread's strategy? 2. Perform a SWOT analysis for Panera Bread. Does the company has any core competencies

1. What are the chief elements of Panera Bread's strategy?

2. Perform a SWOT analysis for Panera Bread. Does the company has any core competencies or distinctive competencies?

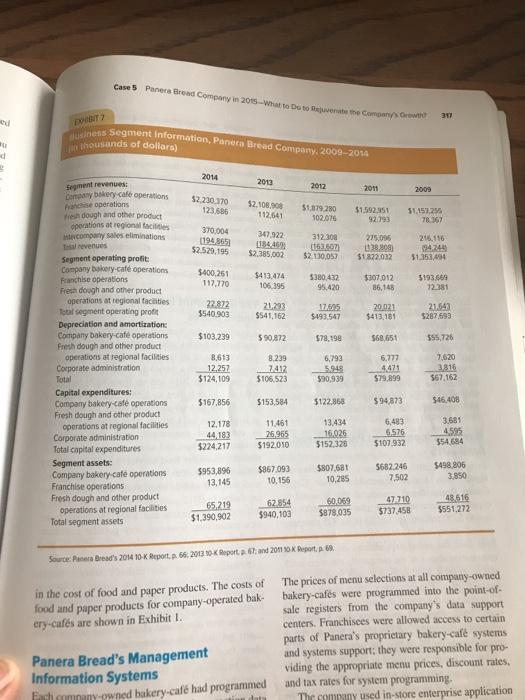

3. Perform financial/performance analysis of the company based on the data in the case for 2009-2014 period.

4. What strategic issues or problems does Panera Bread management need to address? ? What are your recommendations to address those issues/problems to top management?

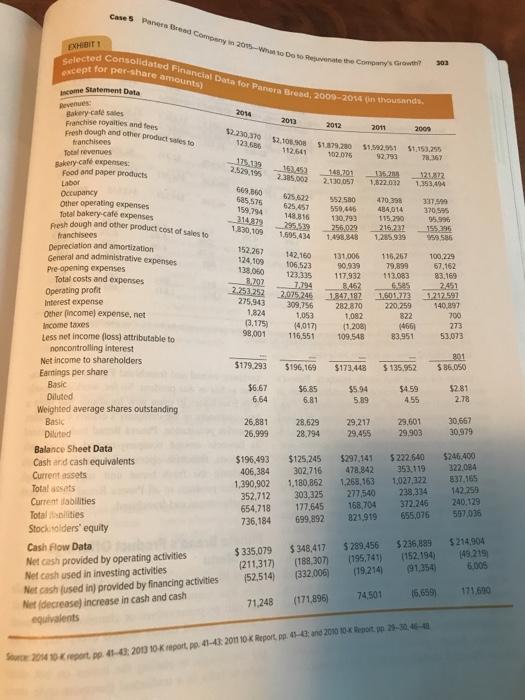

Case 5 Paners Bread Company in 2015-wu to Do to Rejuvenate the Company's Growth? EXHIBIT 1 Selected Consolidated Financial Data for Panera Bread, 2009-2014 (in thousands. except for per-share amounts) Income Statement Data Revenues Bakery-caf sales Franchise royalties and fees Fresh dough and other product sales to franchisees Total revenues Bakery-caf expenses: Food and paper products Labor Occupancy Other operating expenses Total bakery-caf expenses Fresh dough and other product cost of sales to franchisees Depreciation and amortization General and administrative expenses Pre-opening expenses Total costs and expenses Operating profit Interest expense Other (income) expense, net Income taxes Less net income (loss) attributable to noncontrolling interest Net income to shareholders Earnings per share Basic Diluted Weighted average shares outstanding Basic Diluted Balance Sheet Data Cash and cash equivalents Current assets Total assets Current abilities Total nilities Stockholders' equity Cash Flow Data Net cash provided by operating activities Net cash used in investing activities Net cash (used in) provided by financing activities Net (decrease) increase in cash and cash equivalents 2014 $2.230.370 123,686 175.339 2,529,195 609,060 685,575 159,794 314879 1.830,109 152.267 124,109 138,060 8,707 2.253.252 275,943 1,824 (3,175) 98,001 $179,293 $6.67 6.64 26,881 26,999 2013 $2,108,908 112641 163,453 2.385,002 625,622 625,457 148.816 295.539 1,695,434 2012 2011 $1.879.280 $1.592.951 102,076 92,793 142,160 106,523 123.335 7,794 2,075 246 309,756 1,053 (4,017) 116,551 148.201 2.130.057 28.629 28,794 552,500 550,446 130.793 256,029 216.237 1.498,848 1.285.939 177,645 736,184 699,892 131,006 90,939 117,932 8.462 1.847.187 282,870 1,082 (1,208) 109.548 136,288 1,822.032 $335,079 $348,417 (211,317) (188,307) (52,514) (332.006) 71,248 (171,896) $5.94 5.89 470,398 484,014 115,290 29,217 29,455 $196,493 $125,245 $297,141 406,384 478,842 302.716 1,180,862 1,268,163 1,390,902 352,712 303,325 277,540 654,718 168,704 821,919 $196,169 $173,448 $135,952 $6.85 6.81 116,267 79,899 113.083 6.585 1.601.773 220.259 $289,456 (195,741) (19,214) 2009 $1,153,255 78.367 74,501 822 (466) 83,951 121,872 1,353,494 $4.59 4.55 303 337,500 370,595 95.996 155.396 959.586 29,601 29,903 $222.640 353,119 1,027,322 238,334 372.246 655,076 100,229 67,162 83.169 2451 1.212.597 140,897 $236,889 (152.194) (91,354) (6,659) Source 2014 10 Kreport, pp. 41-43, 2013 10-K report, pp. 41-43: 2011 10-K Report, pp. 43-43 and 2010 10-k Report pp 29-30 46-48 700 273 53,073 801 $86,050 $2.81 2.78 30,667 30,979 $246,400 322.084 837,165 142.259 240,129 597,036 $214,904 (49,219) 6.005 171,690

Step by Step Solution

There are 3 Steps involved in it

Step: 1

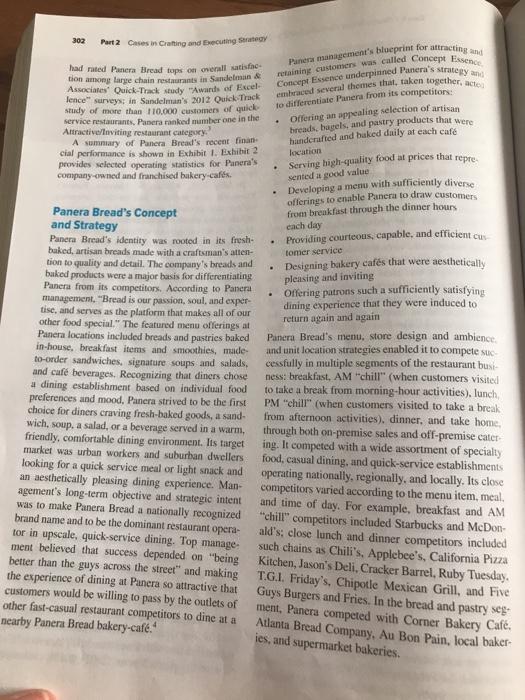

1 What are the chief elements of Panera Breads strategy The chief elements of Panera Breads strategy are The first element of Panera Breads strategy is to focus on fresh madetoorder food The company e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started