Answered step by step

Verified Expert Solution

Question

1 Approved Answer

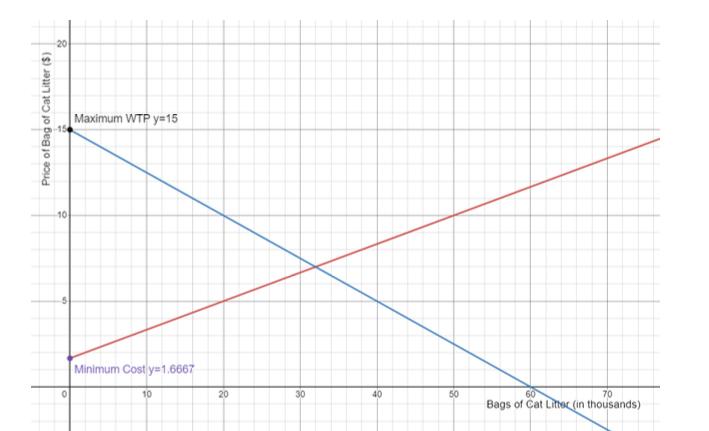

1. What are the equilibrium price PE and quantity QE in this market? Identify them in the graph. 2. Calculate consumer surplus and producer

1. What are the equilibrium price PE and quantity QE in this market? Identify them in the graph. 2. Calculate consumer surplus and producer surplus for the equilibrium. Include your formula and show your work. 3. Suppose there is a $5.00 tax imposed on this market. Draw in the tax and label the quantity produced as QT. (You can estimate where the tax will go. We don't have exact measures with this graph.) 4. What is the price that buyers pay when there is a tax? Label it Ps in your graph. 5. What is the price that sellers receive when there is a tax? Label it Ps in your graph. 6. "Incidence or the burden of the tax": a. What portion of the tax is paid by the buyers (in $)? Show your work. b. What is the portion of the tax that is paid by the sellers (in $)? Show your work. 7. Suppose policy makers are imposing the tax to generate money to trap, neuter and release feral cats to control the number of homeless cats in your community. There is a similar privately funded program called Community Cats at the Animal Humane Society. Follow the link to read about it. Regarding the policy makers' choice to provide a program in your community, answer the following questions. a. How much tax revenue will this tax generate? Show your work. b. Do you think this would be a good way to help alleviate the problem of homeless cats? Explain how you would decide. (Things to think about: who are you taxing? Will it be enough money? Too much money? Who receives the benefits? Etc. Who is hurt by the choice to tax to solve this problem?) Price of Bag of Cat Litter ($) 10 Maximum WTP y 15 Minimum Cost y 1.6667 10 20 30 40 50 70 Bags of Cat Litter (in thousands) 1. What are the equilibrium price PE and quantity QE in this market? Identify them in the graph. 2. Calculate consumer surplus and producer surplus for the equilibrium. Include your formula and show your work. 3. Suppose there is a $5.00 tax imposed on this market. Draw in the tax and label the quantity produced as QT. (You can estimate where the tax will go. We don't have exact measures with this graph.) 4. What is the price that buyers pay when there is a tax? Label it Ps in your graph. 5. What is the price that sellers receive when there is a tax? Label it Ps in your graph. 6. "Incidence or the burden of the tax": a. What portion of the tax is paid by the buyers (in $)? Show your work. b. What is the portion of the tax that is paid by the sellers (in $)? Show your work. 7. Suppose policy makers are imposing the tax to generate money to trap, neuter and release feral cats to control the number of homeless cats in your community. There is a similar privately funded program called Community Cats at the Animal Humane Society. Follow the link to read about it. Regarding the policy makers' choice to provide a program in your community, answer the following questions. a. How much tax revenue will this tax generate? Show your work. b. Do you think this would be a good way to help alleviate the problem of homeless cats? Explain how you would decide. (Things to think about: who are you taxing? Will it be enough money? Too much money? Who receives the benefits? Etc. Who is hurt by the choice to tax to solve this problem?) Price of Bag of Cat Litter ($) 10 Maximum WTP y 15 Minimum Cost y 1.6667 10 20 30 40 50 70 Bags of Cat Litter (in thousands)

Step by Step Solution

★★★★★

3.55 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Here are my answers to the questions 1 The equilibrium price is 4 and the equilibrium quantity is 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started